British Pound's Conservative-Inspired Rally Takes GBP Into New Ranges

- Written by: Gary Howes

The pound sterling exchange rate complex has reacted positively to news of an impending Conservative majority.

The UK currency has powered higher from recent lows on news of a pro-business outcome to the 2015 General Election.

Defying expectations the Conservatives won the majority clearing the way for a more confident economic path for the UK to follow.

The response of the markets has been one of relief. However, the UK currency has been unable to break above the best levels of 2015:

Latest Live Rates

Pound to Euro Exchange Rate Conversion Exchange Rate: 1.1519

Pound to Euro Exchange Rate Conversion Exchange Rate: 1.1519

Pound to Dollar Conversion Exchange Rate: 1.3612

Pound to Dollar Conversion Exchange Rate: 1.3612

Pound to Australian Dollar Conversion Exchange Rate: 1.9405

Pound to Australian Dollar Conversion Exchange Rate: 1.9405

Pound to Canadian Dollar Conversion Exchange Rate: 1.8616

Pound to Canadian Dollar Conversion Exchange Rate: 1.8616

Pound to New Zealand Dollar Conversion Exchange Rate: 2.2624

Pound to New Zealand Dollar Conversion Exchange Rate: 2.2624

Pound to South African Rand Conversion Rate: 21.8354

Pound to South African Rand Conversion Rate: 21.8354

* The above rates are wholesale, those with international payment could achieve up to 5% more FX than on a traditional bank transfer by getting closer to the market rate with an independent payment specialist. Learn more.

- CAD Could Fall Against GBP

Shaun Osborne at TD Securities says the scope for further gains in GBP/CAD are on the cards:

"GBPCAD gapped higher yesterday and despite easing quite sharply off the intraday peak earlier in the session, the cross may still close out the week in constructive fashion. The surge higher in the GBP took out both the 28– and 40-day MA signals in one fell swoop and the cross is set to form a bullish outside range week against the 40-week (200-day equivalent) MA."

- Carving Out the Platform for a Fresh Rally v Euro?

Sterling appears to have made the 1.37 the new level of support, defining a new higher range in which it could well form the base for a fresh push higher.

- GBP/USD Fails at 2015 Maximum

It looks like sterling has also reached its maximum against the US dollar.

GBP-USD has halted just below the best levels of 2015, around the 1.5530 level.

- GBP-EUR Resistance Halts Gains

The British pound has rallied to a key resistance zone. We are by no means near the best levels of 2015 despite the strong moves seen over recent hours. This tells us that markets are just getting back to where the economic fundamentals would naturally price sterling now that politics will be moved aside.

Above: Sterling gains just taking us back above 1.35 support.

- Markets Were Not Expecting This

Alan Wilde, Head of Fixed Income at Baring Asset Management:

“The result is something of a surprise given the pre-election polls had predicted a hung-Parliament. No single party was forecast to emerge with a majority but as the last votes are tallied the Conservative Party will have the chance to govern with what looks like a slim overall majority. As this was not priced in by markets, sterling has rallied sharply overnight up more than 1.5% versus the US dollar and just over 2% from the 5pm close versus the €uro. Gilts will open stronger but in the context of global bond markets rallying after several days in free-fall."

- Another Surge for Pound to Euro Conversion Forecast

Richard Kelly, Head of Global Strategy at TD Securities gives us a currency forecast:

“The take away message here is that we have a chance for a much stronger Conservative showing than expected and perhaps a chance that by around 3am Lond time, we have a good idea if we are really moving in that direction with the actual results.

“If confirmed, we would expect sterling can have yet another surge, as EURGBP could break through the 55dma at 0.7255 and open up scope for a move down to at least 0.7160, as worries of uncertainty would greatly diminish.

“But given the margin of error in these early exit polls, and while those in the last elections have been fairly accurate they do not always live up to expectations, we would be quite wary of a head fake here as this sets a very high hurdle now for the results to live up to.”

Above: Sterling surges against the euro.

- Clarity Needed

"The GBP gapped higher this morning on exit polls suggesting the Tories have won close to 300 seats, with further weakness in the cross looking likely. However, it is only early days and it may be another 24 hours before any clarity can be found." - ANZ Research.

- Conservatives Tipped to Have Won, Pound Higher

At 10:00 the BBC exit poll is released. The Conservatives are believed to have won 316 seats and will in all form the next Government.

The GBP-USD is a pct higher, GBP-EUR 0.8% higher.

Above: GBP-USD makes its feelings known on the release of an exit poll that suggests a Conservative victory.

- Dollar and Pound Sterling Power Ahead

Elections, what elections? The GBP is strong across the board with gains coming against the Australian, New Zealand and Canadian dollars.

Strength is maintained against the euro.

The GBP is moving in tandem with the USD it seems which has benefited from strong data today which has boosted US Treasury prices and pushed down yields.

- Pound Euro Powers Higher

A strong comeback by sterling over the euro. The decline in the euro comes as the dollar shoots up confirming that, for now, drivers remain resolutely external for GBP.

The culprit was some strong US data - Initial Jobless Claims came in below the expected 280K at 265K. Markets are buying dollars as they fear they may have over-estimated the slowdown in the US economy.

- Western Union Warn on Prolonged Instability for GBP

“The outlook for sterling remains about as muddied as the prospects for a timely verdict on who will occupy 10 Downing Street over the coming 5 years. Sterling is likely to adhere to its unpredictable path at least until the next administration can form a stable government which could potentially take days, maybe weeks. The longer political uncertainty flares, the more vulnerable the pound is seen.” Joe Manimbo, Senior Market Analyst at Western Union.

- Euro Primed to Advance Beyond Three Month Best

“The uncertainty is weighing on the GBP as traders clean their books and brace for the impact. GBP/USD is slightly lower this morning after a quiet session in Tokyo. On the downside, a support stands at 1.5120 and further at 1.4922 (Fib 61.8% on April rally). EUR/GBP is on the rise and is printed a 3-month high at 0.7465. The next resistance can be found at 0.7592 (high from February 3rd).” - Arnaud Masset at Swissquote Bank.

- A Strategy for GBP-USD

Kathy Lien at BK Asset Management believes that one strategy for trading any volatility would be to buy declines of 3-4%:

“Election uncertainty always passes and if you believe that the victor in tomorrow's election will assert himself as Prime Minister quickly and take steps to form a coalition government, then buying GBPUSD 3% to 4% lower than tomorrow's pre-election levels may be a smart technique.”

- Pound v Dollar Itching to Rally

The GBP-USD exchange rate is in the red as traders reduce exposure to the UK currency.

However, analysts Ipek Ozkardeskaya at London Capital Group, reckons the pair is itching to push higher:

“Further rally on Cable may well be on the agenda following the UK general election. The latest GBPUSD rally has been the result of an aggressive USD unwind on poor ADP release.

"There is little enthusiasm in UK stocks (FTSE closed flat in London yesterday) and bonds (10-year UK sovereign yields test 2%), as the pre-election uncertainties anchor the GBP on the downside verse EUR and JPY.

"Against the USD, it is a different story. The aggressive USD weakness sent Cable relentlessly higher over the past month and the pullback in hawkish Fed expectations has become sufficiently overwhelming that the UK’s idiosyncratic risks fail to offset the erratic USD sentiment before Friday’s NFPs.”

- When Will Volatility Pick Up?

The pound sterling has thus far managed to avoid any serious negativity surrounding the elections.

Voters head to the polls today, but for GBP the real test will only come when results start being released.

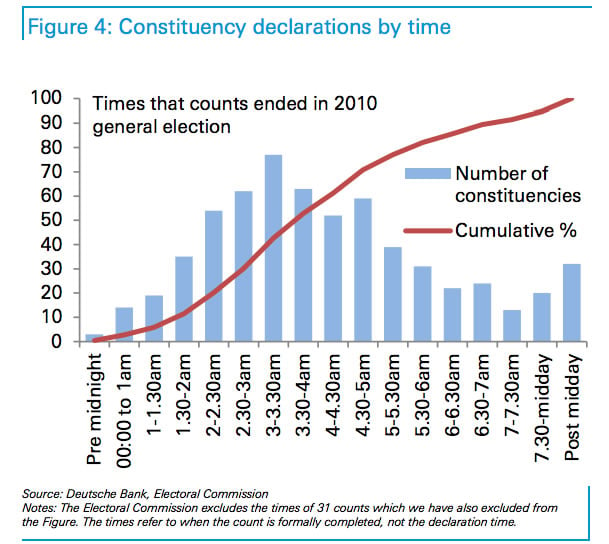

With the majority of results being released around 3 AM as this graph from Deutsche Bank shows.

It therefore falls to Asian markets to drive the currency response to the results.

- The Worst and Best Outcomes for Sterling

What do we expect the various outcomes to hold for the GBP?

- Conservative majority is a pound positive

- Labour majority is a pound positive

- Conservative / Lib Dem coalition is a positive.

The above three scenarios would be immediately obvious should either of the main parties muster the number of seats required.

We know the Conservatives and Lib Dems are open to another coalition so if together they can cross the line we would expect GBP to rally as uncertainty is vanquished.

The problems come if neither of the three aforementioned scenarios are realised as this opens the political landscape to unprecedented uncertainty.

And currencies hate uncertainty.

- Euro Stronger, Dollar Weaker

A strong euro is the key driver of currency markets at the present time with the rise in German Bund yields being the main source of new-found buying interest.

The US dollar, by contrast, continues its run of weakness courtesy of under-par economic reports out of the US.

The weaker-than-expected ADP number yesterday has seen the US markets come under pressure across the board, with Oil and commodities also performing well.

This has allowed the pound to dollar conversion rate to remain above 1.52. The pound to euro exchange rate (GBP-EUR) has broken a key support zone and is looking heavy at 1.3389.

“With the EUR performing well against most of its trading partners again yesterday, another positive set of European data today would push the move further and probably more so than a weaker set of data causing a pullback,” say Lloyds Bank Research in a note to clients.