GBP/EUR Week Ahead Forecast: Nerves into Bank of England

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling is forecast to trade with a heavy tone into a potential interest rate cut on Thursday.

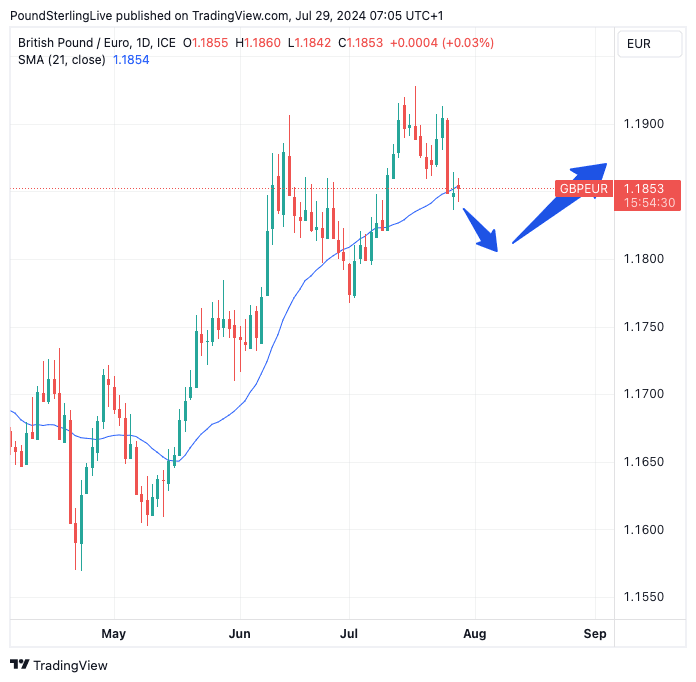

The Pound to Euro exchange rate fell last week, as predicted by our previous Week Ahead Forecast, and we expect the pressure to remain into Thursday's all-important decision from the Bank of England.

We have, in fact, seen two weekly declines for GBP/EUR as it comes off its 2024 highs. However, we continue to regard weakness as pullbacks in a broader uptrend and the overall setup remains constructive.

The exchange rate remains well above its 50-, 100- and 200-day moving averages. Only when these are encountered would we start signalling a belief that the uptrend is at risk of dying.

We think a test of 1.20 is on the cards in the coming weeks (see what more than 30 investment banks are forecasting for Q3 and year-end). But, short term, we can give more room for weakness and think 1.18 can be tested before any restart to the rally.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The exchange rate fell below the 21-day moving average last week, and this is now capping intra-day advances (it's currently at 1.1854), which encourages our expectation for pre-Bank of England nerves to be directed to the downside.

"Positioning implies that the pound may become more sensitive to disappointing news or to dovish takeaways from the BoE which indicates scope for more volatility," says Jane Foley, Senior FX Strategist at Rabobank.

Positioning in the Pound is crowded, with a significant number of positions taken out by investors in recent weeks that would profit from further advances. The risk of such heavy one-way positioning is that any disappointments in the data or events cause a 'washout' of these positions, resulting in a deeper pullback.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Recent CFTC positioning data indicates "a stunning surge in the number of speculators’ net GBP longs," explains Foley.

Rabobank thinks that the Bank of England is likely to cut rates by 25 basis points this week. "Such a move could prompt some profit-taking in long GBP positions," says Foley.

Markets are currently seeing little more than 50% chance of a rate cut on Thursday. To be sure, last week's weakness in the Pound reflects a rebuilding of these expectations, as the odds of a cut were closer to 40%.

Kamal Sharma, analyst at Bank of America, says, "headed into the rate meeting we think the risks are skewed asymmetrically to GBP weakness if the BoE cuts. Two factors suggest this: positioning as IMM GBP longs are crowded; and the rise in market volatility which historically has been bearish for the high beta currencies."

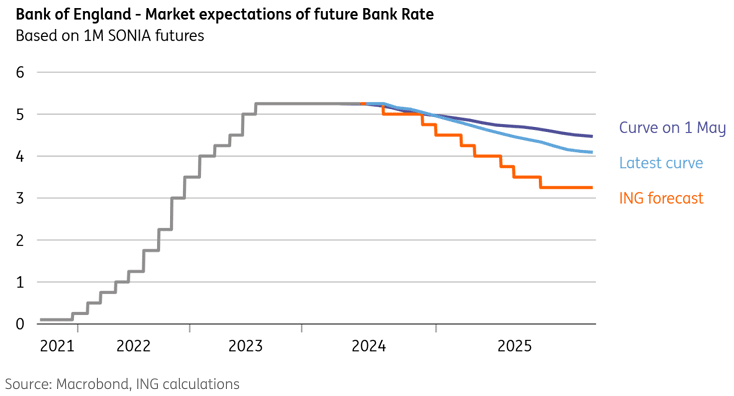

Above: The Bank might cut more than the market expects in the coming months says ING. If correct, this could weigh on the Pound.

"Even in the case of a hawkish cut, we are inclined to think that markets will continue to sell GBP on the cut as positions are pared back," he adds. A 'hawkish cut' is when the Bank cuts rates but signals to markets that further cuts are not guaranteed and are dependent on upcoming data.

What if the Bank doesn't cut interest rates? This might offer some upside relief to the Pound which can rebound into the end of the week.

However, upside will likely be limited as the Bank would almost certainly 'nail on' a September rate hike. "The conditions are in place for the MPC to cut, but we think they will wait until September to avoid surprising markets," says Andrew Goodwin, Chief UK Economist, Oxford Economics.

A firm commitment to a September rate cut would make this a 'dovish' hold, which is not entirely consistent with a rebound in the Pound.

Beyond the prospect for near-term weakness, Bank of America thinks the structural backdrop remains supportive of the Pound:

"With event risk out of the way, and the new Government seemingly in a hurry to announce policy, we look for further GBP upside in the months ahead. Carry remains supportive but near-term positioning is crowded," he explains.

This fits with the broader theme of near-term weakness ahead of a resumption of the rally at some point in the coming weeks.