GBP/EUR Higher After PMIs Show UK/Eurozone Economic Divergence

- Written by: Sam Coventry

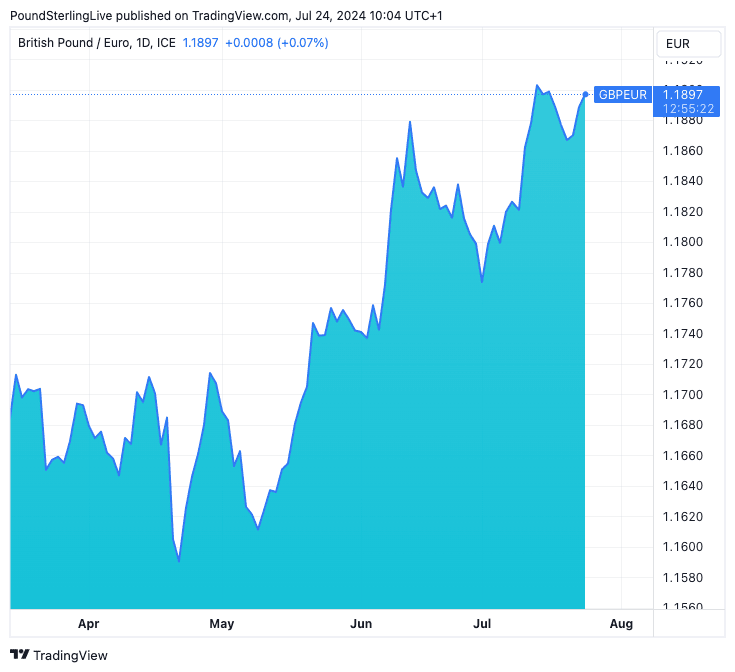

Above: GBP/EUR at daily intervals.

Pound Sterling holds an uptrend against the Euro as the UK economy looks to be outperforming that of the Eurozone this July.

This is according to a leading survey of economic activity, which revealed new business growth across the UK private sector jumped to a 15-month high.

The Pound to Euro exchange rate rose back to 1.19 after the S&P Global UK Composite PMI rose to 52.7 in July from 52.3 in June, beating expectations for 52.6.

By way of contrast, the Eurozone equivalent fell to 50.1 from 50.9, defying expectations for a rise to 51.1. A reading below 50 indicates contraction, suggesting the Eurozone's headline PMI figure headed in the wrong direction in July.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

UK businesses reported a strengthening of employment growth at the start of the third quarter, as staffing numbers rose at a solid rate that was the fastest observed in just over a year.

This can maintain upward pressure on wages and will ensure the Bank of England retains a cautious approach to cutting interest rates.

If the Bank opts to cut next week, it will likely be a 'hawkish' cut, in which it warns further reductions in Bank Rate are highly uncertain.

Some members of the Bank's Monetary Policy Committee will have been encouraged by the revelation that prices charged inflation slowed to their weakest since February 2021 in July, driven by a softer increase in output charges at services companies.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Elevated services inflation is chief among the MPC's concerns. Members judge that headline inflation will rise over the coming months owing to the UK's elevated service inflation (5.7% y/y in June).

An initial cut could weigh on Pound Sterling, but weakness could be limited by ambiguity over further cuts.

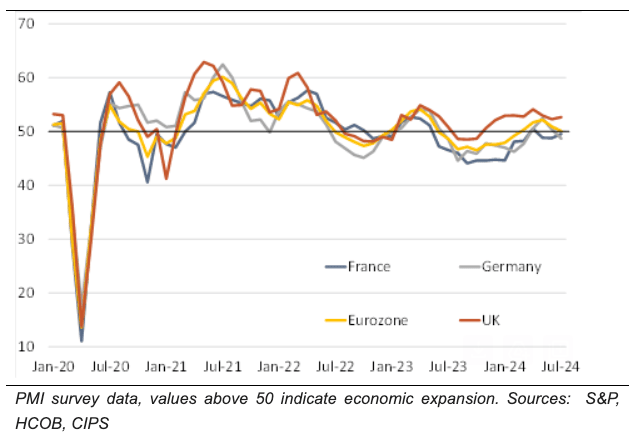

Across the English Channel, the Eurozone economy is held back by an ongoing contraction in manufacturing activity (45.6 vs. 51.8 in the UK). This is largely centred on the region's biggest economy, Germany, where a manufacturing slump continues.

Image courtesy of Berenberg.

"The UK is well ahead of the Eurozone," says Salomon Fiedler, an economist at Berenberg Bank. "Even the manufacturing sector seems to be participating in the upswing, with the index in expansion territory for the third consecutive month."

However, the Eurozone Services OMI (51.9) also disappointed, falling from 52.8 and undershooting estimates of 53.

"The eurozone manufacturing sector was again a key source of weakness. Production was down markedly in July, and to the largest extent in the year-to-date. As such, a rise in services activity stopped the overall private sector from falling into contraction. That said, the expansion in the service sector was only modest and the weakest since March," said S&P Global.

These data suggest a divergence in economic fortunes between the Eurozone and UK, which can continue to support the Pound relative to the Euro.

"EUR-GBP has room to fall, we believe," says Clyde Wardle, Senior EM FX Strategist at HSBC.