French Vote: The Tailrisk That Would Tip GBP/EUR Above 1.22

- Written by: Gary Howes

Above: RN's Bardella is set to become France's next Prime Minister. Image: Pound Sterling Live / CNews Direct.

The Pound to Euro exchange rate could be on course to easily clear 1.20 in the coming weeks, but only if the French vote delivers a surprise.

Next week's French and UK elections will be significant for Pound Sterling and the Euro. Markets have a good idea of what will happen, and if they are correct, we could well see the Pound-Euro exchange rate hanging around current levels when all is said and done.

However, elections are about people, and we don't always do what financial analysts expect. This means certain tail-risk outcomes exist that could really shake the market and deliver the volatility many currency buyers desire.

With the Conservatives and Labour offering up the status quo, the UK offers limited tail-risk outcomes, even in the event of a miraculous win by Rishi Sunak's Conservatives. Instead, France's legislative vote will be more interesting with some clear tail-risk outcomes that could really move the market.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Base-case: Pound-Euro Slides Below 1.18

The first round of voting happens on Sunday, and the initial results will be known at 7PM UK time. The market expects Marine Le Pen's RN Party to make a strong showing and become the biggest party in the French legislature after the second round vote a week later.

This will mean a 'cohabitation' between the French President and Prime Minister, who are from different parties, resulting in lawmaking gridlock, but it is not necessarily an adverse outcome to the Euro, which has already factored in such an outcome.

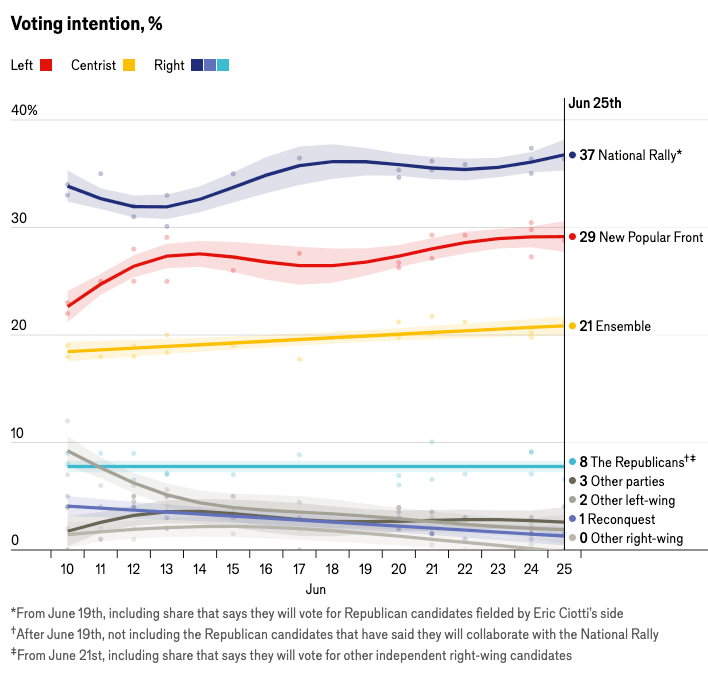

Above: The Economist's poll tracker

In fact, the single currency could even continue to recover over the coming days and weeks, with Pound-Euro eventually slipping below 1.18, bringing it closer to the median investment bank forecast for end-2024.

"If the French election results in a cohabitation with a hung parliament, our base case economic outlook for the eurozone remains on track. That should see French equities recover," says Dr. Nannette Hechler-Fayd’herbe, an economist at Lombard Odiear.

Fat Tail-risks: 1.22 and Above

The remaining scenarios are unfavourable to the Euro.

These are 1) RN secures an outright majority, as opposed to a simple win, which gives them a greater say in parliament, and 2) the left-wing alliance New Popular Front wins the vote as voters shift allegiances in the second round.

"We would expect French equities to continue selling off, especially in the case of a left-wing majority French government," says Hechler-Fayd’herbe. "This would create the greatest risks for other European assets such as eurozone sovereign bonds and the euro."

The New Popular Front is trailing RN in second place, but the gap is not insurmountable.

Analysis from Goldman Sachs says the latest polls suggest that participation in the election is likely to be high compared to the 2022 vote, which is expected to increase the chances of having three-party candidates making round two across many constituencies.

Goldman Sachs views this "as a favourable scenario for the extremes (left and right) into round 2."

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, says GBP/EUR would shoot higher if the New Popular Front (NFP) wins.

"The EUR/GBP 3M-6M outlook would depend on the outcome of the French rather than the UK election. Key in that would be the FX impact of wider government credit spreads to Bund yields after the French vote. Our simulation results suggest that EUR/GBP could dip towards 0.82 or even lower in response to a Left-wing alliance victory."

EUR/GBP dipping to 0.82 "or even lower" equates to a rise in the Pound to Euro exchange rate above 1.22.

The NFP has revealed spending plans are significant and would require a sizeable increase in borrowing, something bond markets would struggle to accommodate.

The NFP is a coalition of left-wing parties that includes Jean-Luc Mélenchon’s France Unbowed, the Socialist Party, the French Communist Party and the Greens. It plans to raise the monthly minimum wage to €1,600, impose price ceilings on essential foods, electricity, gas and petrol, repeal Macron’s deeply unpopular decision to raise the retirement age to 64 and invest massively in the green transition and public services.

Prime Minister Gabriel Attal said their agenda would present France with a "fiscal drubbing".

Crédit Agricole's base-case assumption is that some negatives related to the French and UK votes are in the price of EUR/GBP so that the pair may not drop significantly below recent lows in the event of an RN victory and/or a hung parliament in France.

However, in the long term, Marinov expects that a slightly less dovish Bank of England relative to the European Central Bank could sustainably push EUR/GBP towards 0.83 or lower in 2025 (GBP/EUR above 1.2050).

It is ever thus: central bank policy will ultimately determine the longer-term moves for exchange rates.

Those with payment requirements should view any big knee-jerk politically-inspired moves as being potentially shortlived and stay nimble.