GBP/EUR Week Ahead Forecast: Pullback Needs Room

- Written by: Gary Howes

Image © Bank of England

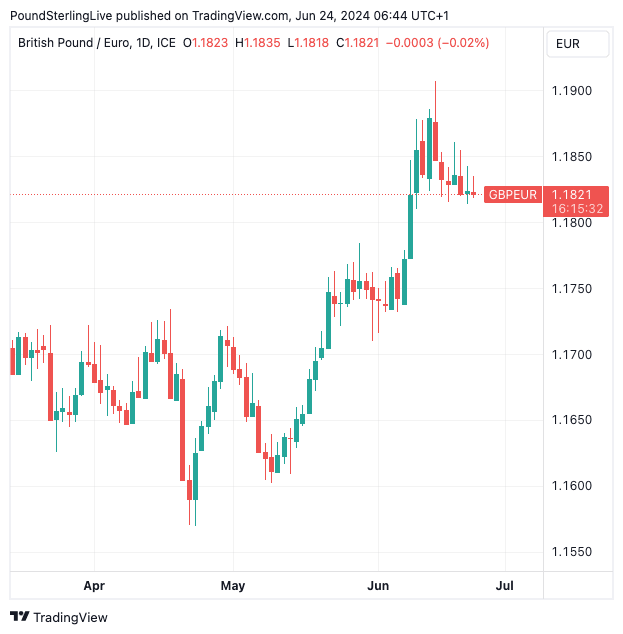

What is the forecast for the Pound to Euro exchange rate in the coming week? We think the Pound can pull back from recent highs as it consolidates the strong gains of the May to June period. We think losses will be shallow.

Pound Sterling reached a 22-month high against the Euro on June 14, but price action since then has been soft and the GBP/EUR exchange rate has faded to levels around 1.1820, where we find it at the start of the new week.

There are no major data events due from the UK or Eurozone this week, and we think a gentle pullback and consolidation are on the cards. We would not be surprised to see 1.18 tested.

Track GBP/EUR with your own alerts, find out more here.

This means those with payment requirements will likely receive at levels around 1.1750 in the coming days.

A return to the 1.19 highs now looks out of reach as last week's Bank of England policy update revealed the Bank of England is readying for an August rate cut. Markets are now 65% fully priced for such an outcome, which means there is further room for a hike to be fully priced. As this occurs, the Pound will likely lose value.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

That said, the Pound remains in a broader uptrend, with all the key technical indicators we monitor being supportive, and we would anticipate weakness to be limited.

In fact, anything below 1.18 would look like a decent buying opportunity for speculators.

This is because there is a significant degree of political-inspired risk being accommodated by Euro exchange rates owing to the French legislative and forward-looking financial products showing there could be decent volatility during the election period.

This will keep Euro strength limited and the Pound-Euro exchange rate supported. "A cautious stance on the EUR ahead of the French election is warranted," says Valentin Marinov, head of FX strategy at Crédit Agricole. "Political developments will remain an important driver of the EUR ahead of the French general election on 30 June and 7 July."

Crédit Agricole says near term focus will remain on the polls ahead of the French election as investors try to position for different potential outcomes.

Thus far, all polling data points to a 'hung' parliament, which means no single party will be able to command a majority and exact decisive reform. This is not the worst-case scenario, but it is hardly ideal for a country that faces a significant debt pile and has lead investors to fret about the outlook for French debt.

"While some negatives seem to be in the EUR price by now, any indications that the French political turmoil is starting to hit the Eurozone real economy could fuel ECB rate cut expectations and thus erode the EUR’s relative rate appeal as well," says Marinov.

"That being said, in the absence of growing contagion from the OAT selloff to other EGB markets, chances are that the EUR could stabilise," says Marinov.

In short, nervousness can keep the Euro under pressure into the month-end vote and limit GBP/EUR weakness to above 1.18.