Time To Buy the Euro and Sell Pound Sterling Says HSBC Following Wage Data Release

- Written by: Gary Howes

Image © Adobe Images

The Euro is going higher against Pound Sterling say strategists at HSBC.

"We open a buy EUR-GBP trade idea," says Dominic Bunning, Head of European FX Research at HSBC, following the release of data on Tuesday that showed an ongoing loosening in labour conditions.

"Today’s labour market data showed some softness versus expectations, with a rise in the unemployment rate, a decline in total employment, and slower than expected wage gains," says Bunning.

The odds of a June interest rate cut at the Bank of England rose and the Pound fell after the ONS said average earnings, with bonuses included, rose 5.6% in January, which was softer than the 5.7% expected and below December's 5.8%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The unemployment rate ticked higher to rose to 3.9% in January from December's 3.8%, as employment fell 21k in the three months to January compared to the three months to November.

The official labour market figures follow Monday's REC/KPMG Report on Jobs, which revealed UK salary inflation fell to a three-year low in January.

HSBC says the Bank of England has been clearly focused on labour market tightness as a upside risk to inflation and a reason to maintain a modestly hawkish tone.

"With that source of concern potentially fading, there may be room for some dovish developments at the 21 March meeting. An example of this would be if one of the prior two votes for a hike switched to an unchanged vote, for example," says Bunning.

HSBC strategists say they "favour playing GBP weakness against the EUR as the cross has been finding a base around a long-term support level at 0.8500".

From a tactical perspective, this provides "a clear exit point if the pair moves lower."

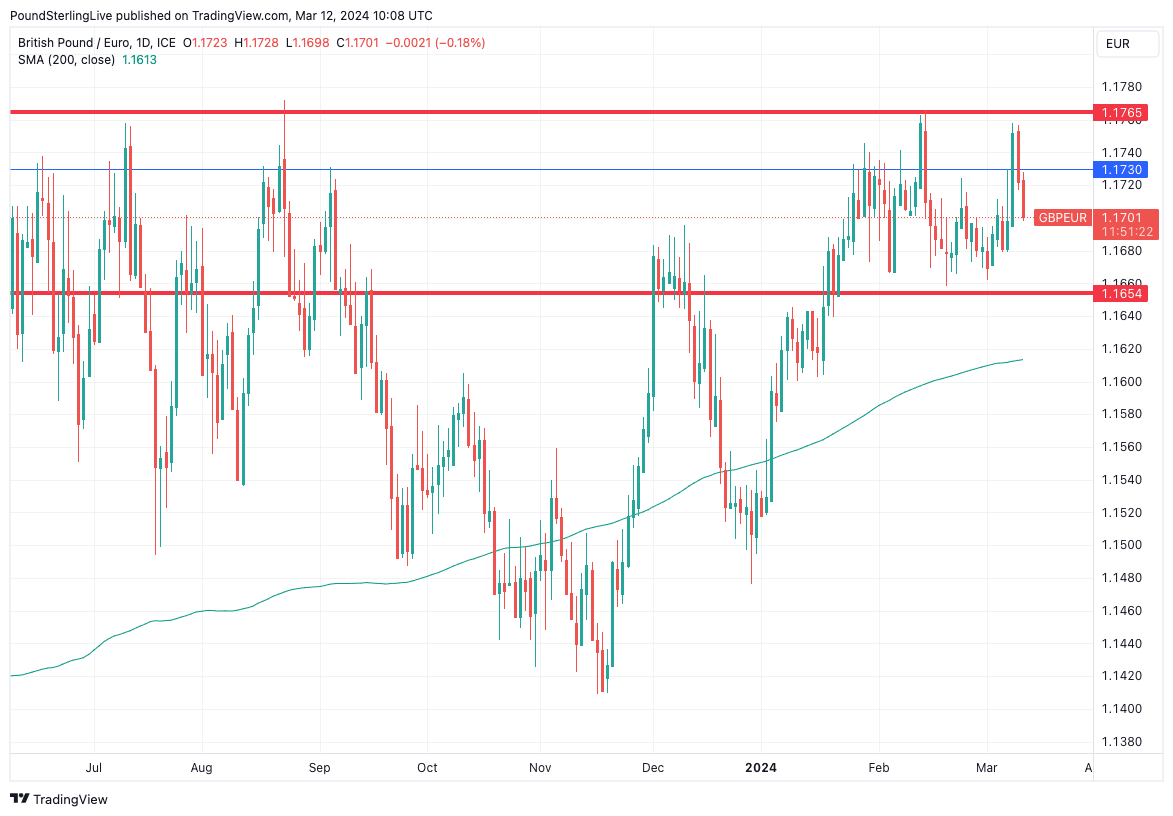

0.85 equals the 1.1765 peak in the Pound to Euro exchange rate, a level the pair has been unable to crack since 2022.

Above: A history of failure. GBP/EUR looks set to retreat back into a well-worn range following yet another failed rally into the mid-1.17s. Track GBP and EUR with your own custom rate alerts. Set Up Here

Pound Sterling Live has long noted the Pound's inability to move beyond this level, and we view any forays above 1.17 as likely to be short-lived.

Regarding the Euro side of the equation, Bunning says the European Central Bank (ECB) appears to be setting its stall out for a June cut at the earliest, which limits downside risks to the EUR from rates dynamics in the upcoming weeks.

The trade targets a move in the Euro to Pound exchange rate back to 0.8680, which gives a Pound to Euro rate target at 1.1520.