GBP/EUR Rate Rises to Multi-month Highs In Wake of ECB

- Written by: Gary Howes

Above: President Lagarde. Photo: Martin Lamberts/ECB.

Pound Sterling looked set to complete its fifth consecutive weekly advance against the Euro, with the European Central Bank's latest interest rate guidance providing fresh tailwinds.

The Pound to Euro exchange rate rallied to a new 20-week high after the European Central Bank's (ECB) President, Christine Lagarde, did not entirely rule out an April rate cut.

The Euro was steady after the ECB kept interest rates unchanged and opted to release a statement that was similar to that of December's meeting, the subtext being that it was no closer to raising interest rates than it was a month ago.

But Lagarde's press conference was more telling: she said a summer rate cut was possible while seemingly not willing to discount an April cut entirely, resulting in a universally weaker euro.

"It was particularly interesting that Lagarde, while not endorsing an April cut, did not appear to push back strongly against that possibility," says Hann-Ju Ho, Senior Economist at Lloyds Bank.

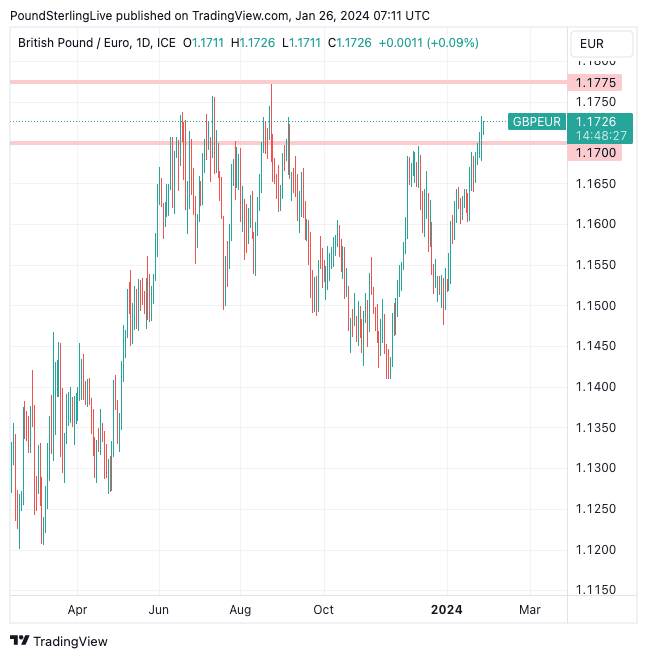

Above: GBP/EUR at daily intervals. The exchange rate is now in an intense area of resistance that it has been unable to hold since 2022.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

In response to Lagarde's press conference, markets raised their conviction levels for an April rate cut to about an 80% probability and 50bps of cuts are priced in by June.

"The euro fell to around 1.0850 against the US dollar, which also partly reflected stronger-than-expected US GDP data. Sterling moved up through 1.17 against the euro," says Ho.

Lloyds Bank's economists see "a reasonable chance" that Eurozone CPI inflation will return to the 2% target by the spring.

"That could open the door for a rate cut before the summer despite recent comments from ECB officials," says Ho.

Image courtesy of Lloyds Bank.

The Pound to Euro exchange rate now enters an area of tough resistance that it has been unable to hold for any sustained period since 2022.

The chances of a pullback below 1.17 are, therefore, high. Indeed, we reported on Thursday that strategists at Macro Hive, an independent research and strategy firm, say now is the time to buy the Euro and sell the Pound in anticipation of such a move.

But currency strategists at Westpac say they are buying the Pound and selling the Euro as the exchange rate's break of the range will hold.

Westpac reckons the Bank of England will hold out longer than the ECB when cutting interest rates, thereby offering Sterling support.

Track GBP/EUR with your own custom rate alerts. Set Up Here

This brings us to the next major event risk for Pound-Euro: next Thursday's Bank of England policy decision and economic forecast update.

Some economists say the Bank will prepare the market for a 'pivot', i.e. it will introduce the idea of cutting interest rate cuts.

How far that pivot goes will be crucial in determining whether the Pound can hold recent gains against the Euro and the majority of G10 peers.

Should inflation forecasts show a sharp drop in inflation on the horizon, and one or two Committee members vote for an immediate rate cut, the Pound could come under pressure.

Any softening in guidance on the 'higher for longer' narrative could also send the Pound back down.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes