The GBP/EUR Rate's Turning Point is Coming

- Written by: Gary Howes

Above: File image of Megan Greene. Image © Informa Connect Global Finance.

The British Pound stays under pressure against the Euro as markets bet the UK will see interest rates fall sooner and further than those in the Eurozone in 2024, an assumption that is increasingly at odds with what the Bank of England is telling us.

There are concerns financial markets are now 'pricing in' more rate cuts than are likely, with Bank of England policy setter Megan Greene saying investors were not buying the Bank's message that rates need to stay elevated for a long period.

"The notion that the long-run neutral rate might be a bit higher and the natural rate of unemployment might be a bit higher isn't something everyone's grappling with," said Greene in an interview.

Greene's comments warn markets that rising expectations for UK rate cuts could amount to a misstep as rates won't fall as far as currently assumed.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

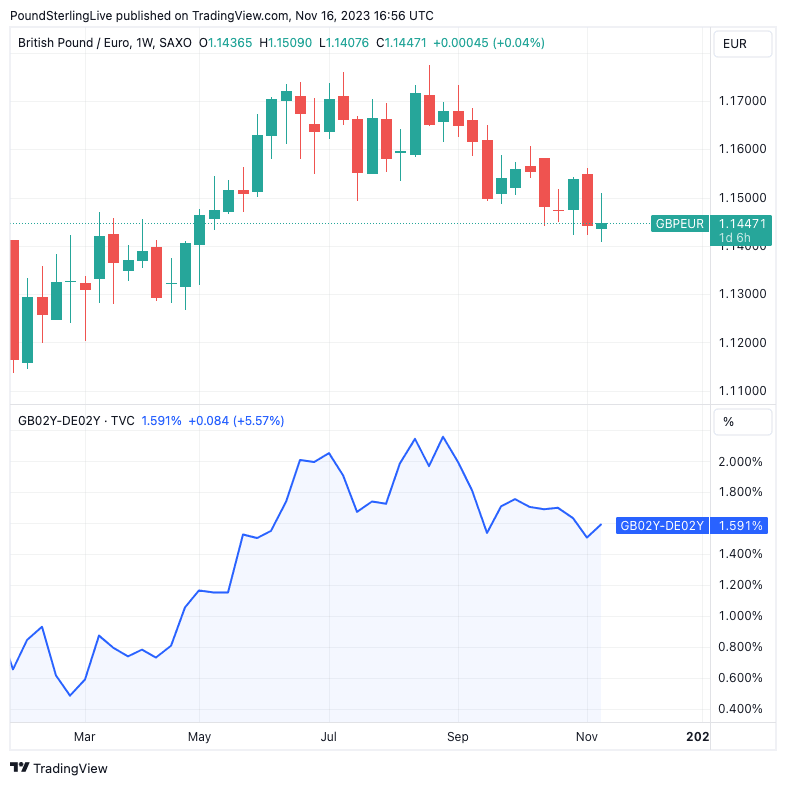

Since August, financial markets have materially lowered expectations for the elevation of UK interest rates over the coming year, pulling UK bond yields down from highs and pressuring the Pound.

The market now sees about three 25 basis point rate cuts in 2024, with the first being delivered as early as May.

The drop in inflation reported midweek prompted money markets to raise bets and pencil in up to 80 basis points worth of rate cuts next year.

"We expect the BOE's MPC to cut rates by 1% more than the ECB, whereas the market prices the gap between the two to remain constant. GBP will weaken, though everyone is so bearish already that the rise in EUR/GBP will be slow," says Kit Juckes, Senior FX Strategist at Société Générale.

Above: GBPEUR (top) and the UK 2-year bond yield minus the German equivalent (bottom). Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

As long as markets continue raising UK rate cut bets relative to the Eurozone, the Pound can continue to fall.

But with up to 80 basis points of rate cuts already 'priced in', currency watchers are asking where the limit lies.

Elevated wage increases in the UK will keep core inflation and services inflation well above levels consistent with the Bank of England's objective of bringing inflation back down to 2.0%, say some economists.

Core inflation rose 5.7% y/y in October, while services rose 6.6% y/y, suggesting that inflation is set to remain high and could be reluctant to fall back to the Bank of England's 2.0% target until at least 2025.

Greene said she is particularly worried about services inflation as wage growth is still "incredibly high."

The message from Greene is that the economic evidence will prevent the Bank of England from cutting rates as early as rates markets suggest (first cut in May), which we would expect to boost the Pound relative to the Euro.

Above: "We expect the BoE to be on hold for longer than the market does" - HSBC.

Rising rate cut expectations are reflected in lower bond yields and swaps on money markets, which are used to price real-world lending products. Therefore, expecting future rate cuts brings down the cost of finance in the present and works against the Bank's efforts to keep conditions tight to bring down inflation.

"Expectations that the BoE will cut interest rates by 80bp next year look overcooked. Strong arguments can still be made for UK interest rates to go higher," says David Croy, a foreign exchange strategist at ANZ Bank.

Economists at HSBC say the Bank of England won't be able to consider rate cuts at all in 2024, and the first cut will only fall in 2025.

"With wage growth high and an absence of rapid productivity growth, services companies in particular may need to continue to pass on increased costs to consumers," says Simon Wells, Chief European Economist at HSBC in London.

If HSBC's economists are correct, then money markets face a considerable rerating in a direction that is consistent with Pound Sterling strength, allowing some of the recent Pound-Euro weakness to be pared.

Bank of England Governor Andrew Bailey said last week at a conference hosted by the Central Bank of Ireland that it was too soon to start talking about rate cuts.

Bailey said there was a need to "maintain rates policy to curb inflation... it's really too early to be talking about cutting rates."

But the Bank of England's unity was undermined somewhat by the Bank's Chief Economist, Huw Pill, who also spoke last week.

He earned the dubious distinction of being the first major central banker to openly court rate cut expectations when he said the market was not "totally unreasonable" in predicting rate cuts from mid-year 2024.

Pill rowed back on these comments just two days later in another appearance, confirming the Bank of England's unease with growing rate cut expectations that followed Pill's earlier comments.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes