ECB Signals Final Rate Hike Has Been Delivered

- Written by: Gary Howes

Above: File image of ECB President Christine Lagarde. Image: Andreas Reeg/ECB.

The Euro fell against the British Pound, U.S. Dollar and the majority of major currencies after the European Central Bank (ECB) raised interest rates but signalled it had reached the end of the hiking cycle.

The ECB said in a statement that it considers that "the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target."

"The Governing Council’s past interest rate increases continue to be transmitted forcefully," said the statement.

Economists at the central bank raised inflation forecasts for 2023 and 2024, a development that was telegraphed in a leak to the media mid-week and raised the level of the Euro.

But what was not telegraphed was that inflation forecasts for 2025 were lowered, a 'dovish' development for the Euro.

Above: GBP/EUR (top) and EUR/USD at 15 minute intervals showing the post-ECB decision price action.

The ECB now projects inflation at 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025.

Financing conditions are said to have tightened further and are "increasingly dampening demand, which is an important factor in bringing inflation back to target".

In another 'dovish' development for the Euro, ECB economists lowered their economic growth projections "significantly".

They now expect the euro area economy to expand by 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025.

The Euro to Dollar exchange rate dropped half a per cent in the half-hour window following the announcement to 1.0668. The Euro to Pound fell 0.20% in the same window to 0.8585.

This left the Pound to Euro rate up at 1.1647.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ECB also confirmed that it would continue to keep a watchful eye on the data when considering the potential for further hikes: "the Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction."

But by communicating it would enter a holding pattern at current levels confirms it would take a notable deterioration in Eurozone growth data dynamics to convince it to hike again.

"The ECB's communication is clear: today was the last hike in the current cycle," says Carsten Brzeski, Global Head of Macro at ING Bank. "Looking ahead, a further weakening of the economy and more traction in a disinflationary trend will make it very hard to find arguments for yet another rate hike before the end of the year."

The ECB will be particularly keen to ensure the market does not get ahead of itself and take today's communication as a signal to bring forward expectations for interest rate cuts as this has the effect of lowering interest rate expectations, which brings down the cost of lending.

In short, it eases financial conditions and could work against the ECB's goal of bringing inflation down.

Should the market bring forward interest rate cut expectations then Euro exchange rates can come under further pressure. But the ECB will likely continue to emphasise that rates will stay at elevated levels for a protracted period to limit rate cut expectations.

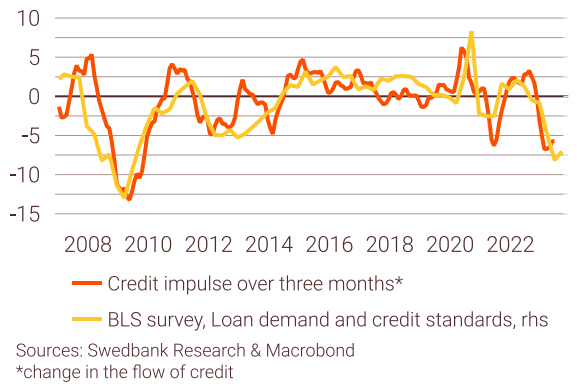

Above: Euro area financial conditions and lending, % of GDP, index, 3maa (rhs). Image courtesy of Swedbank.

But Analyst Nerijus Maciulis at Swedbank thinks the ECB will be in a position to cut rates in relatively short time given the slowdown in the Eurozone.

"Monetary policy will become increasingly more restrictive through two channels – real rates will continue climbing rapidly as inflation recedes, while credit conditions will be restrictive and credit impulse will remain negative. PMIs and leading indicators point to continued weakness in demand which will significantly reduce business pricing power and may even lead to shrinking profit margins, which will accelerate the disinflation process," says Maciulis.

Thus, Swedbank maintains a forecast that the ECB will start cutting rates as soon as April 2024, sooner than currently expected by the markets.