GBP/EUR Week Ahead Forecast: Downside Risks Gather on Horizon

- Written by: James Skinner

- GBP/EUR rally stalled & veering into consolidation

- Path higher obstructed at 1.1675, 1.1744 on chart

- Supports underpin at 1.1609 & 1.1612 short-term

- UK CPI a risk but retail sales & EU CPI may offset

Image © Adobe Images

The Pound to Euro rate has veered into a consolidation on the charts and could be most likely to trade within a relatively narrow range in the week ahead, one spanning the gap between roughly 1.1609 and 1.1679, though with some risk of a break higher.

Sterling opened as the third worst performing major currency for the week to Monday after falling from fresh one year highs near 1.1750 when declining U.S. inflation rates led many assets to rally through the second half including stocks, commodities and government bonds.

GBP/EUR entered the new week trading back near 1.1650 but could struggle to recover much ahead of Wednesday and the release of a make-or-break set of UK inflation numbers for June owing to uncertainty over the likely outcome and currency market response in different scenarios.

“We think the headline rate of CPI inflation fell to 8.1% in June, from 8.7% in May, below the 8.2% consensus,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“What’s more, we see a greater risk of an 8.0% print than an upside surprise to our forecast,” he adds.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of February rally and selected moving averages indicating possible areas of technical support for Sterling.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Wednesday’s data will decide whether the Bank of England (BoE) raises Bank Rate from 5% in August and by how much but with market expectations already very high, this week’s data might be more of a downside risk for Sterling than anything else.

UK inflation surprised significantly on the upside of economist expectations in recent months, leading the market to wager on further increases lifting Bank Rate from 5% to 6.25% by early next year, so it might take a significant upside surprise on Wednesday to raise these expectations further.

That sort of a surprise would have grim implications for the economic outlook, however, so it’s far from certain that this kind of outcome would benefit Sterling while elevated market pricing for Bank Rate could be especially susceptible to any undershoot of the consensus on Wednesday.

“GBP surely faces some clearer downside risks than the euro given the greater room for a dovish repricing of Bank of England rate expectations compared to the ECB’s,” writes Francesco Pesole, an FX strategist at ING, in a Friday market commentary.

“The latest wage data pointed at another 50bp hike in August, but next week’s CPI release is still an important risk event,” he adds.

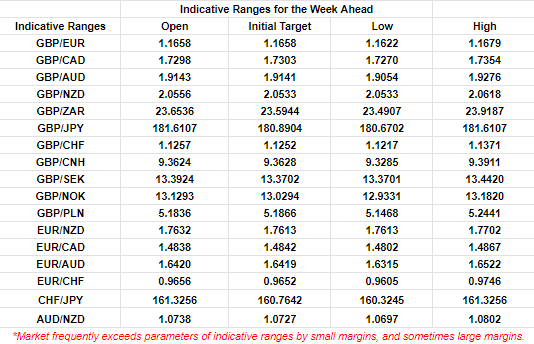

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

BoE forecasts suggested in May that inflation would likely fall to around 7% by July but with economists and market expectations being where they are, any meaningful progress toward this level for June on Wednesday would potentially act as a catalyst for further Pound to Euro losses.

Any sell-off could peter out or otherwise lose momentum somewhere around 1.1609 1.1612 later in the week, however, if the 50-day moving average and initial Fibonacci retracement of 2023's uptrend offer technical support for the Pound.

Mid-week losses could also be countered on Thursday if there is any downward revision to Eurostat's estimate of European inflation for last month, or should UK retail sales figures suggest a continuation of a recently positive trend on Friday.

“Retail sales have recently displayed a surprising degree of resilience, and we think growth probably continued in June, aided by the return to a normal complement of working days after May's extra public holiday,” says Andrew Goodwin, chief UK economist at Oxford Economics.

“Retailers' performance should have been aided by evidence of a further rebound in consumer confidence, which reached an 18-month high on the GfK measure, and the unseasonably warm weather. We think retail sales volumes rose 0.2% m/m in June,” he adds in a Friday research briefing.

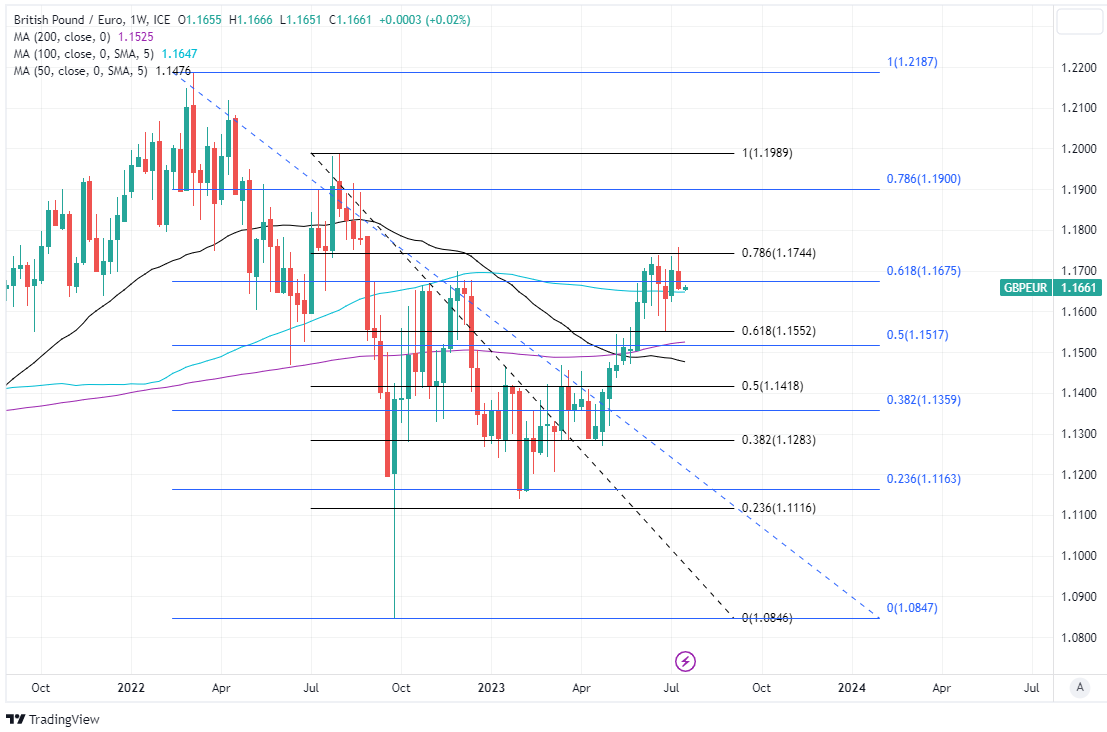

Above: Pound to Euro rate shown at weekly intervals with Fibonacci retracements of selected downtrends indicating possible areas of technical resistance for Sterling while moving averages denote prospective support and/or resistance.