GBP/EUR in Tug of War Over 1.14

- Written by: James Skinner

- GBP/EUR in tug-of-war over 1.14 as BoE & ECB loom

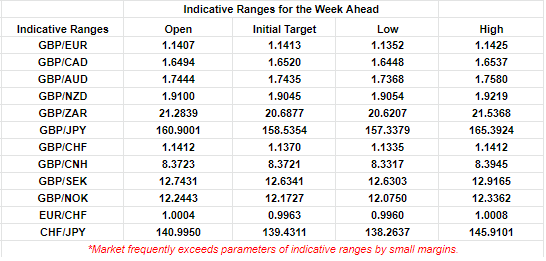

- Rough 1.1352 to 1.1425 range possible in week ahead

- Risk of hawkish bent in BoE's latest Bank Rate outlook

- After a resilient economy & stubborn inflation lift wages

- But ECB's hawkish policy stance a possible constraint

Image © Adobe Images

The Pound to Euro exchange rate has retained an upward bias in recent trade but the outlook for it will be decided in a tug-of-war over 1.14 this week and Sterling would risk coming off worse if the market finds the Bank of England's (BoE) short of hawkish resolve on Thursday.

Sterling fell close to its January low against the Euro early last week after S&P Global PMI surveys warned of a deepening recession in the UK economy's most important sector just days after official figures told of grim December for high street retailers.

But there were buyers of the Pound near 1.13 on Tuesday and Wednesday while demand appeared to be bolstered by the mid-week release of official data suggesting falling prices for materials and output from the manufacturing sector in November and December.

"The good news should keep coming, as many leading indicators suggest the drop in core goods CPI inflation will speed up this year," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics, in reference to the producer prices data out on Wednesday.

"We continue to think that the pace of core price rises will slow markedly over the coming months, convincing the MPC that it can stop its hiking cycle after increasing Bank Rate by 50bp to 4.0% next month," he adds.

Above: Pound to Euro rate shown at hourly intervals. Click image for closer inspection.

Above: Pound to Euro rate shown at hourly intervals. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The author's model suggests a 1.1352 to 1.1425 range is likely for the Pound to Euro rate this week, although Sterling would potentially have scope to rise out of this range if the Bank of England retains a hawkish policy stance following this Thursday's interest rate decision.

There are reasons for why the BoE might too after rising prices in the services sector kept the core inflation rate from falling further in December and the official measure of average wage growth accelerated again in November, potentially alarming some members of the Monetary Policy Committee.

This is after minutes of December's BoE meeting, which saw Bank Rate lifted to 3.5%, suggested that wage growth and services sector inflation were both key motivators of all seven members of the Monetary Policy Committee who voted for last month's increase.

"Concerns about pressure from pay rises on core inflation will probably have been reinforced by recent data and the BoE's own survey of pay deals. And the economy has been less weak than expected," says Andrew Goodwin, chief UK economist at Oxford Economics.

"But with a recession likely, inflation trending down, and the lagged effect of previous rate rises building, the case for further rate hikes beyond February is diminishing," Goodwin writes in a Friday research briefing.

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

The BoE is widely expected to raise Bank Rate to 4% this week while many economists have suggested it might also warn that it does not intend to raise rates much further, although the above-referenced economic data may mean the latter is less likely now.

"We suspect it’s more likely to keep its options open," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

"Given that a 50bp hike is not fully priced for Thursday, sterling could enjoy some limited and temporary strength should the BoE indeed hike 50bp. Depending on the post-FOMC state of the dollar, that could briefly send GBP/USD back into the 1.24/25 range and EUR/GBP back to the low 0.87s," Turner writes in a Friday research briefing.

The Pound could benefit if the BoE's guidance about the interest rate outlook comes across as hawkish on Thursday and ING suggests this would potentially lead GBP/EUR to approach 1.15, although much will also depend on how the Euro receives the ECB's policy decision.

The potential rub for the single currency, however is that ECB rate setters have already prepped the market well over recent weeks for a half percentage point increase in interest rates as part of both January and March policy decisions.

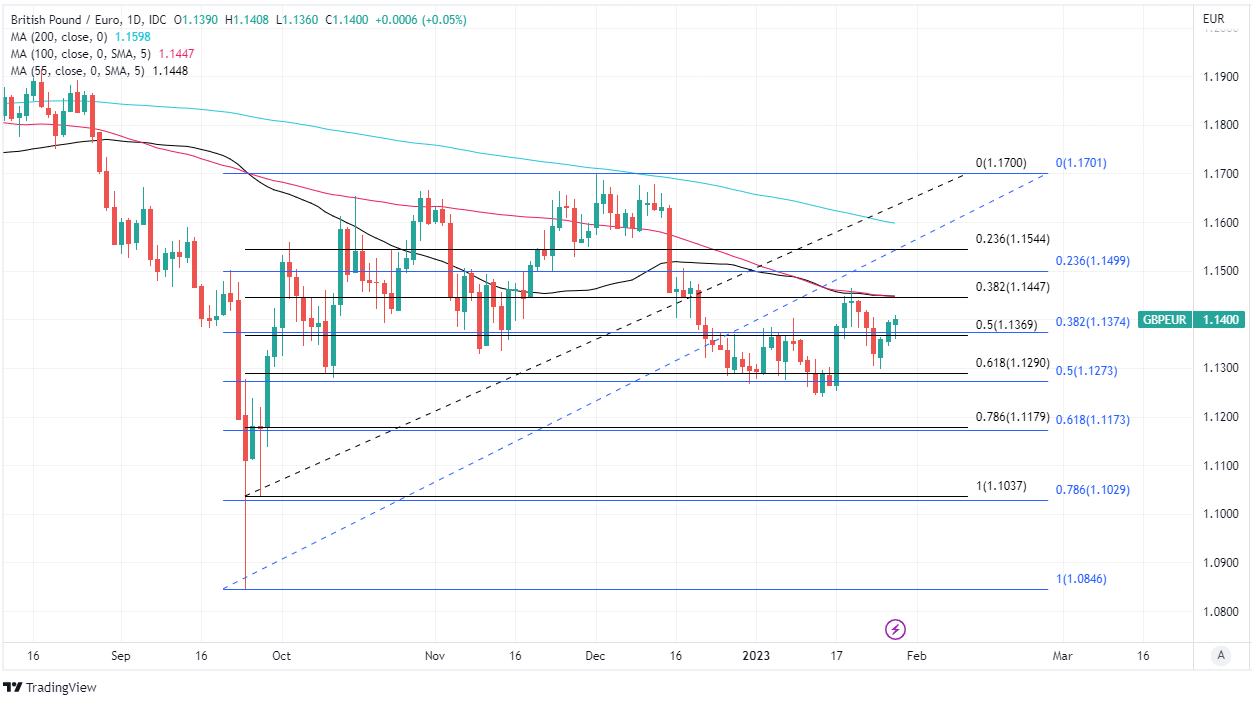

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of late September and early October rallies indicating possible areas of technical support while selected moving-averages denote potential resistance. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of late September and early October rallies indicating possible areas of technical support while selected moving-averages denote potential resistance. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.