GBP/EUR Falls to 2-Month Lows Amidst Sharp Drop in European Gas Prices

- Written by: Gary Howes

Image © Adobe Images

The Euro remains on the front foot against the Pound and Dollar amidst further declines in European gas prices.

European benchmark prices fell as much as 30% last week and were a further 3.5% lower on December 27 as weather forecasts show northern Europe would experience above-average temperatures in the first part of January 2023.

Russia also said is ready to resume gas supplies to Europe through the Yamal-Europe Pipeline, Russian Deputy Prime Minister Alexander Novak told state TASS news agency.

"The European market remains relevant, as the gas shortage persists, and we have every opportunity to resume supplies," TASS cited Novak as saying in remarks published by the agency on Sunday.

TTF benchmark gas for January delivery dropped a further 0.6% to €82.50 a megawatt-hour in Tuesday trade.

The Euro rose 0.10% against both the Dollar and Pound as a month-long period of strength looked to extend into the new year amidst the further easing in energy price concerns.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Euro's rise reflects reduced concerns about the region's economic outlook after Russia's invasion of Ukraine sent energy prices surging through the summer months and threatened a deep and protracted recession.

"We are neutral-to-mild-constructive on EUR's outlook. Recession fears in Euro-area, energy woes and geopolitical concerns remain. Further deterioration would warrant a downward revision in forecasts but, for now we believe the bulk of the risks have been baked into the price," says Christopher Wong, an analyst at OCBC Bank.

The continued easing in European gas prices, therefore, provides further impetus to the Euro recovery trade.

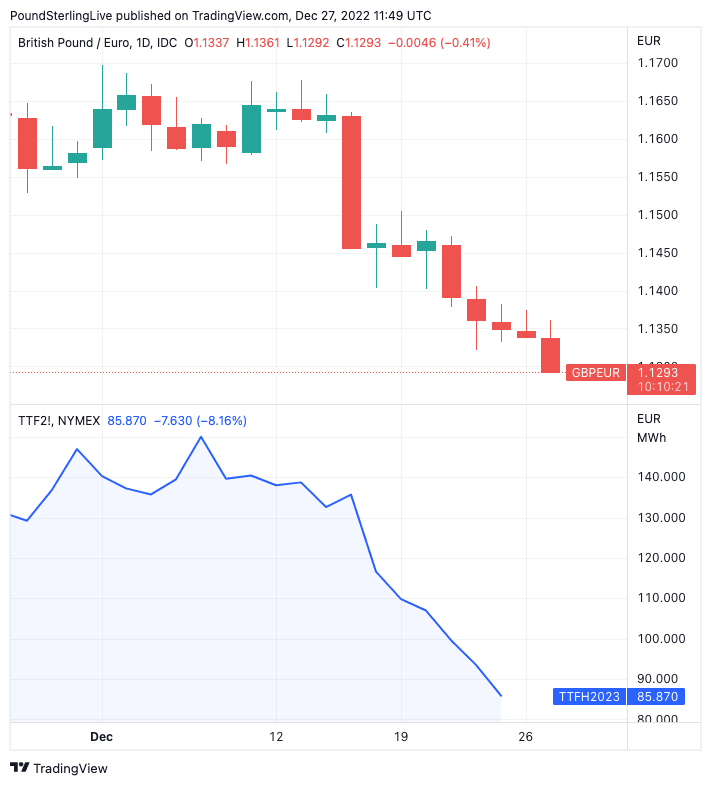

Above: GBP/EUR (top) and TTF gas prices for the next month's delivery. Shown at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

The Pound to Euro exchange rate has now retreated to 1.13, its lowest level since October.

Liquefied natural gas shipments into Europe remain strong, allowing for storage levels to be at higher-than-typical levels for this time of year.

Lower demand amongst consumers and industry are also contributing to the lower prices.

The stronger Euro takes GBP/EUR rates on offer at a typical high-street bank to approximately 1.1130, at competitive cash and holiday money providers the rate moves to around 1.1255 and for competitive money transfer providers, the rate is nearer to 1.1323.

Further impetus for the Euro comes as Eurozone interest rates are set to rise further than previously expected as the European Central Bank pursues a policy of interest rate increases to bring inflation under control.

"Hawkish ECB rhetoric mitigates against further worsening in EU-UST yield differentials and should continue to provide some support for EUR," says Wong.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ECB said at its December policy update that further interest rate hikes of 50 basis points were required to bring inflation lower.

The tone and guidance proved more assertive than the market was expecting, resulting in higher Eurozone bond yields which in turn aided the single-currency higher.

Analysts at ING Bank said recently the ECB appears willing to promote a stronger Euro, which acts as a deflationary force.

"The ECB would clearly like a stronger euro to help out with its battle against inflation and it was telling at last week's ECB press conference that President Christine Lagarde was keen to highlight that the ECB would be tightening longer than the Fed," writes Chris Turner, global head of markets and regional head of research for UK & CEE at ING, in a recent research briefing

"If the ECB is to be successful in getting the euro higher, then the euro will need to rally against those currencies with major weights in the trade-weighted euro index. The biggest weights in this index are the US dollar (16%), the Chinese renminbi (14%) and then the British pound (12%)," he adds.

Looking ahead, Pound Sterling will lose "notable" value against the Euro says a new analysis from global investment bank MUFG, although other analysts say the UK currency can advance in value later in 2023.

The call by MUFG's currency strategists comes in the wake of December's round of central bank policy decisions that included the 'hawkish' ECB policy update which contrasted with a more cautious message from the Bank of England.

"Gains for the euro versus the higher key further higher beta G10 currencies seems more likely," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

Global stocks were lower across the board after the ECB raised interest rates by 50 basis points but President Christine Lagarde warned numerous 50bp hikes were still required to bring inflation back down to the 2.0% target.

"That would be consistent with market conditions turning more volatile which could be the consequence of some of these central bank meetings this week," says Halpenny. "Higher EUR/GBP is also consistent with worsening risk sentiment and higher volatility when EUR tends to outperform GBP."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes