GBP/EUR Rate on Inevitable Journey to Parity says Société Générale

- Written by: Gary Howes

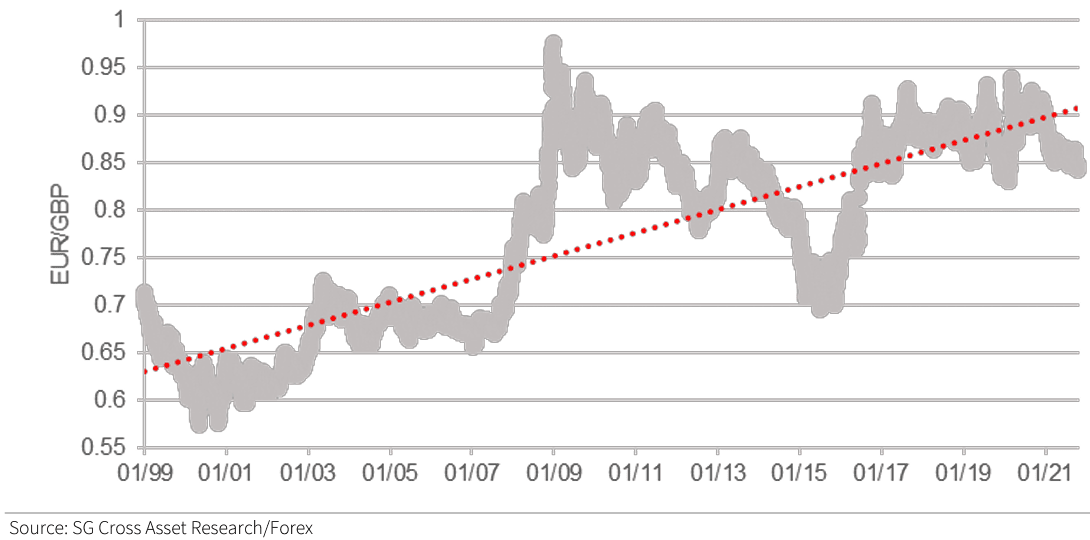

"EUR/GBP has been trending steadily higher for over 20 years and should keep going up" - Soc Gen.

Image © Adobe Images

The British Pound is on a journey that will inevitably see it fall below parity against the Euro according to one of the UK's leading foreign exchange analysts.

Kit Juckes, who heads up foreign exchange research at international investment bank Société Générale from London, says Sterling will likely continue to under-perform the Euro amidst chronic economic underperformance over coming years.

The call comes as Juckes and his team review the foreign exchange landscape at the mid-point of 2022 and issue their latest set of predictions.

"The UK is the top candidate among G7 economies to be first to slip into recession. Strikes, a prime minister under pressure and an ongoing energy crisis all make for continued pressure," says Juckes.

The Pound to Euro exchange rate had rallied back to above 1.20 earlier in 2022 as the world looked to escape the pandemic and central banks looked to raise interest rates.

But, the invasion of Ukraine by Russia and the ensuing energy shock left the UK facing higher inflation rates than elsewhere leading economists to turn bearish on the Pound's prospects.

The exchange rate has since fallen back towards the 1.16 levels where we currently find it. (Set your FX rate alert here).

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Many institutional foreign exchange strategists we follow nevertheless see the Pound recovering as the global macro economic environment turns a corner and starts to improve.

But Juckes is not convinced the UK economy will deliver the kind of fundamental turnaround required to give Pound exchange rates a sustained boost.

"We think sterling is likely to go on underperforming for the next year or two," says Juckes.

He says the UK is in danger of being the slowest-growing major advanced economy next year, with the highest inflation rate and the biggest current account deficit.

"That's quite a collection, and it represents a clear threat to the pound. Sentiment is already poor, and there are plenty of speculative shorts out there too, but further weakness is likely," he adds.

The analyst cites strikes, threats to the prime minister’s position and rows about the Northern Ireland Protocol as near-term headwinds to the economy and its currency.

"These are additional irritants that all help the international consensus to think that the UK is trying harder than most to revisit the 1970s," says Juckes.

The analyst finds over the long-term further losses by the Pound are inevitable and all-time lows beckon.

"I asked Excel to put a best-fit line through a chart of EUR/GBP, and if I’ve got my maths right, the line will reach parity in 2030. Realistically, given the nature of the underlying currency trend, EUR/GBP is likely to get to parity well before then," says Juckes.

Above: "EUR/GBP has been trending steadily higher for over 20 years and should keep going up" - Société Générale.

"This isn’t how we forecast exchange rates, but the trend helps understand that while a move to parity in the immediate aftermath of Brexit was unrealistic, a move there eventually certainty isn't," says Juckes.

For the Pound to reach the 1:1 level against the Euro would would require a significant period of UK economic underperformance that leads to easier monetary policy relative to the Eurozone.

"And that’s uncomfortably easy to imagine in the next few years," says Juckes.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes