GBP/EUR Rate Tipped as Buy at TD Securities with 1.2121 Target

- Written by: James Skinner

- GBP/EUR headed for corrective short-term rebound

- TD Securities suggests it could move “quite quickly”

- Cites terms-of-trade & short-term valuation factors

Image © Adobe Images

The Pound to Euro exchange rate has unwound all of the gains made since the earliest days of Russia’s invasion of Ukraine in recent weeks, leaving it trading at a discount to short-term fundamental factors and signals that led TD Securities to tip Sterling as a buy with a 1.2121 target this week.

Sterling has slipped precipitously against the Euro and other currencies in recent months, leading it lower from close to the top of the G10 league table in late February to near the bottom of the bucket by Tuesday this week.

These declines were catalysed by market concerns about the outlook for the UK economy and a cautious inflection that crept increasingly into the monetary policy stance and language of the Bank of England (BoE) from February.

But the subsequent losses for Sterling have left it trading at a discount to levels of ‘fair value’ implied by a variety of indicators while developments beyond the markets have also become suggestive of scope for a corrective rebound.

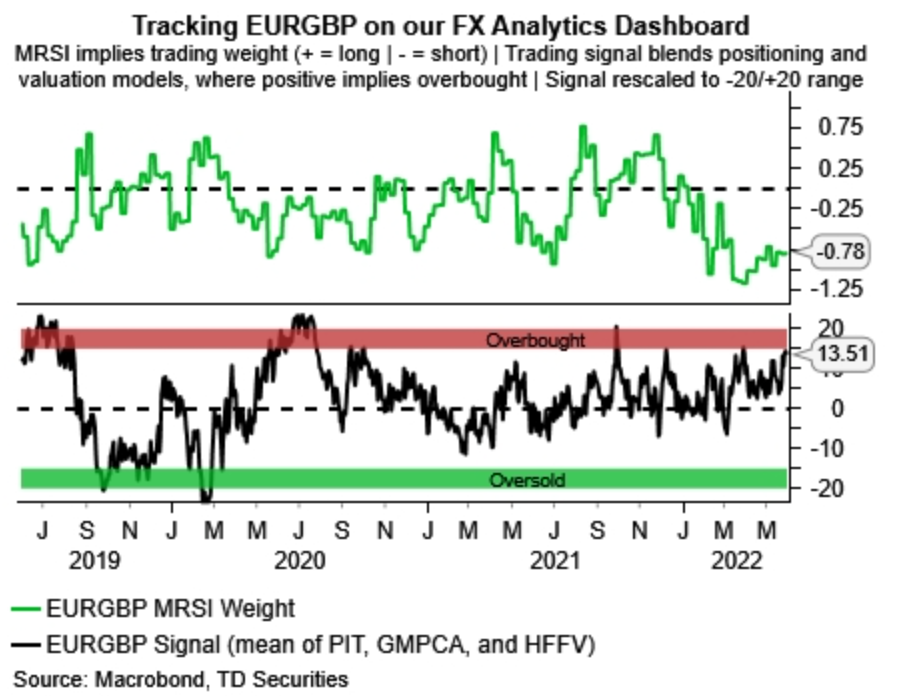

“While we are forecasting an extensive move higher in EURGBP over the quarters ahead, our tactical signals indicate that the cross is quite stretched,” says Mark McCormick, global head of FX strategy at TD Securities.

Source: TD Securities. Click image for more detailed inspection.

Source: TD Securities. Click image for more detailed inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“EURGBP has now entered the fade zone, where our signals increase the risks of a correction in the next two months,” McCormick and colleague Ray Ng said when suggesting on Monday that TD clients buy GBP/EUR and look for a move up toward 1.2121 over the next couple of months.

Most pertinently, European Union members “agreed in principle on the sixth sanctions package” in the early hours of Tuesday morning that they will “cut around 90% of oil imports from Russia to the EU by the end of the year,” buttressing an earlier rally in oil prices.

I am glad that tonight leaders agreed in principle on the sixth sanctions package. This is an important step forward.

— Ursula von der Leyen (@vonderleyen) May 30, 2022

We also agreed to work on a mechanism to provide Ukraine with a new, exceptional macro-financial assistance package of up to €9 billion. https://t.co/La3bZl6JNp

“Unless the EU is going to stop using oil --which is not the case-- it means supply-chain reshuffling as (discounted) Russian oil goes off somewhere else, and the pricier oil they had been buying heads to the EU at higher logistical cost. So that could hurt Russia – and the EU,” explains Michael Every, a global strategist at Rabobank.

The EU’s decision replicates a move taken by the UK in early March and is a catalyst for a Sterling-favourable improvement in the UK and EU’s terms-of-trade spread illustrated alongside EUR/GBP in the graph included above.

The terms-of-trade (ToT) term refers to a ratio that compares export prices against import prices, making it an important metric in attempts to value currencies, which can be combined for any two different currencies and used to paint a picture of the direction in which this one influence is travelling.

Source: TD Securities. Click image for more detailed inspection.

Source: TD Securities. Click image for more detailed inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“The cross has also overshot its implied level to our risk model [image snapshot immediately above], suggesting that it would likely move lower quite quickly if risk appetite continues to consolidate,” McCormick and Ng said in reference to another TD Securities’ model, and international market conditions.

McCormick and colleagues noted terms of trade related factors that are pointing the Pound to Euro exchange rate in the direction of 1.1976 but have selected 1.2121 as the target for their trade idea.

This higher target potentially reflects other factors as well as the common tendency for exchange rates to both undershoot as well as overshoot various measures of fair or perceived fundamental value.

The tip came ahead of the release of May inflation figures from the Eurozone, which could impact market perceptions of the pace at which the European Central Bank (ECB) is likely to eventually begin raising its interest rate.

Financial markets have speculated that it could be likely to lift the deposit rate by a large 0.50% as soon as July, which would take the benchmark rate back to zero and the era throughout which commercial banks have charged for depositing money at the safe haven that is the ECB.

Above: Pound to Euro exchange rate shown at daily intervals with selected moving-averages and Fibonacci retracements of March fall indicating possible areas of momentary technical resistance. Click image for more detailed inspection.

Above: Pound to Euro exchange rate shown at daily intervals with selected moving-averages and Fibonacci retracements of March fall indicating possible areas of momentary technical resistance. Click image for more detailed inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes