Pound Sterling / Euro Rate Forecast: 1.20 on the Cards, but Some Patience Required says Scandinavian Lender

- Written by: Gary Howes

- GBP outlook bullish

- But GBP/EUR to go sideways a while longer

- BoE to tighten before ECB

- GBP/EUR forecast to rise in gentle fashion

Image © Adobe Images

- GBP/EUR reference rates at publication:

- Spot: 1.1599

- Bank transfers (indicative guide): 1.1293-1.1373

- Money transfer specialist rates (indicative): 1.1392-1.1518

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

Foreign exchange analysts at a leading Scandinavian lender and financial services provider tell clients they are "still bullish on GBP" and expect a steady appreciation against the Euro over the coming 12 months.

The call comes following a period of stability in the Pound-to-Euro exchange rate (GBP/EUR) that has lead to questions as to whether Sterling's 2021 advance might already be running out of traction.

Danske Bank says in a new foreign exchange research briefing that their constructive view on the British Pound in the 12-month timeframe rests on an expectation that the UK economy will outperform that of the Eurozone.

"The UK is gradually reopening supported by fast vaccinations, which, combined with businesses getting used to the new EU-UK trading relationship, means that the outlook for the UK economy looks much brighter. We expect the UK economy will outperform the euro area this year," says Mikael Olai Milhøj, Chief Analyst with Danske Bank.

The UK economy shrank in the first quarter of 2021 but by less than many economists had been expecting and the latest survey of economists by Bloomberg shows widespread upgrades in growth forecasts as analysts play catch up with the economy's better-than-expected performance.

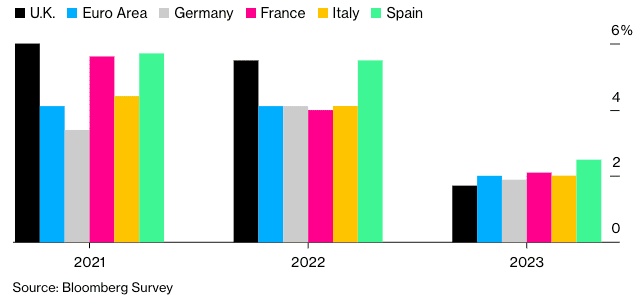

Economists regularly surveyed by Bloomberg revised up their growth forecasts for 2021 to 6.0%, which would mark the strongest annual expansion for the economy since 1973 and means it will grow ahead of Germany, France, Italy and Spain.

Above image courtesy of Bloomberg.

Calls for further gains in Sterling come following a strong start to the year for the currency that was subsequently followed by a sharp retracement in April.

However, May has seen some of that first-quarter strength return with the Pound-to-Euro exchange rate appreciating by 1.10% already this month taking it back to 1.1600.

Although further outperformance by Sterling will be required if the 2.20% fall endured during May is to be overcome.

Any further gains for the pair might reside with how sentiment regarding EU-UK trade relations progress.

Trade between the UK and the bloc recovered further in March with the exports of goods to the EU increasing by £1.0BN (8.6%), driven largely by car exports, according to the ONS.

"Good news is that disruption stemming from the abrupt arrival of the UK-EU trade deal in January appears to have eased," says James Smith, Developed Markets Economist at ING Bank.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Danske Bank think Brexit as a theme has moved into the background now, but they urge clients to keep an eye on the EU-UK negotiations on the implementation of the Northern Ireland protocol and financial services.

The UK and EU continue to work towards refining the Northern Ireland protocol with negotiations expected to continue for a number of weeks owing to rising tensions within the Unionist community over what they perceive to be a 'hard border' in the Irish Sea.

A risk to the outlook could be an inability by the EU and UK to come to an agreement on the matter.

A further impulse of potential support to the Pound identified by Danske Bank is the ongoing shift in Bank of England (BoE) policy from 'dovish' to 'hawkish'.

The BoE on May 06 said they would be reducing the scope of their quantitative easing programme which signalled to the market that the extraordinary supported to the economy would start to be gradually reduced.

"The BoE is tapering the bond buying pace, signalling that QE may not be extended further (bond buying is set to expire by year-end). The first 15bp rate hike, which would take the Bank Rate back to 0.25%, is now priced in by November 2022," says Milhøj.

The foreign exchange guide book holds a general rule of thumb that when a central bank reduces quantitative easing and raises interest rates the currency it issues appreciates in value.

More specifically, that currency is supported when a central bank does so faster than another central bank.

"Eventually, the BoE is likely to tighten monetary policy earlier than the ECB," says Milhøj.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"We remain bullish on GBP, as we are still more upbeat on the UK than on the euro area," adds Milhøj.

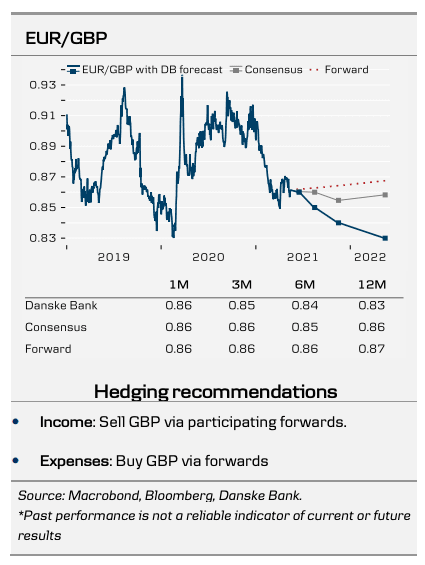

Danske Bank do however tell clients they expect the Pound-Euro exchange rate to trade around current levels for a while level before ultimately trending higher once more.

The pace of appreciation is indeed expected to be more gentle than the gains witnessed at the start of the year.

They forecast the Euro-to-Pound exchange rate to trade at 1.2050 in 12 months, with the Euro-to-Pound target set at 0.83.