Pound up on May's Brexit Shift

- Written by: Gary Howes

Above: File photograph of Prime Minister Theresa May. Image (C) Number 10, Gov.uk.

- Prime Minister announces shift in Brexit direction

- Offers to engage in talks with opposition parties

- Parliament tipped to have another shot at foisting 'soft' Brexit on government

- 4th vote on May's deal being considered

- GBP/EUR to move higher on any long Brexit extension

- Snap General Election remains a key downside risk

Pound Sterling was seen trading higher against key rivals following a statement to the public on Brexit by Prime Minister Theresa May following a marathon cabinet meeting.

May says she has offered to engage in cross-party talks with opposition parties to reach a consensus for a Brexit deal.

The Prime Minister adds she will ask the EU for a second extension to delay Brexit, and that it must be as short as possible.

The basis of the talks are maintaining the existing Withdrawal Agreement reached with the EU.

Furthermore, May says the government "will abide" by what's agreed by Parliament.

The Pound has risen on what looks to be a decisive shift towards a softer Brexit, as we know the Labour Party favours a customs union agreement with the EU.

The Pound had been rising steadily higher through the afternoon trading session in London as rumours of a statement by the Prime Minister were leaked.

The Cabinet talks lasted hours with commentators suggesting this to be indicative of a big shift in Brexit strategy by the government.

Sterling had fallen overnight after the UK parliament failed for a second time to unite behind any preferred 'softer' Brexit scenario following a series of unsuccessful votes in the House of Commons on Monday, April 01.

The shift in the government's Brexit policy suggests the realisation that the Brexit deal, in its current state, has run its course, and that reaching a deal will now rely on reaching compromise with opposition MPs as opposed to hardliner Brexiteers in her own party.

Concerning the Pound's outook, these developments are supportive as the currency tends to favour moves towards any tighter post-Brexit relationship between the EU and UK.

The Pound-to-Euro exchange rate is quoted at 1.1689, having been as low as 1.1616 earlier in the day.

The Pound-to-Dollar exchange rate is quoted at 1.3091, having been as low as 1.3012 earlier in the day.

"Sterling remains above the key $1.30 and €1.16 levels despite Parliament failing to find a majority for an alternative way forward on Brexit last night. Despite political headwinds facing the Pound intensifying and the stalemate in Westminster continuing, Sterling is likely to remain within its current range," says Michael Brown, Senior Analyst at Caxton FX.

May's decision to engage the Labour party are likely to be in response to the realisation that the government had lost control of the Brexit process.On Tuesday it emerged that Parliamentarians were once again to take control of the Brexit process with the publication of a piece of legislation which would force the government to seek a delay to Brexit, to prevent a no-deal exit on April 12.

"We are now in a really dangerous situation with a serious and growing risk of No Deal in 10 days’ time," says Labour MP Yvette Cooper, who has proposed the legislation alongside Conservative Oliver Letwin.

"The Prime Minister has a responsibility to prevent that happening, If the government won’t act urgently, then parliament has a responsibility to try to ensure that happens even though we are right up against the deadline," added Cooper.

If Cooper and Letwin are succesful we would expect Sterling to rally higher, and test the Monday highs, at the very least.

According to ITV's political editor Robert Peston a raft of 'soft Brexit' options will be put to parliament again:

"Customs union, Common Market 2.0, confirmatory referendum, revocation - with a promise this time of proper cross party cooperation. And with the aim of forcing the winner on the government on Monday."

The latest attempt at thwarting a 'no deal' Brexit and foisting a 'soft' Brexit on the government comes just hours after three 'soft' Brexit options were voted on by parliament - a customs union, "Common Market 2.0" and a confirmatory public vote. All were rejected by smaller margins than May's deal on Friday, but they notably also got fewer 'ayes' due to MPs abstaining suggesting May's deal still commands the greatest support.

Brexit Secretary Stephen Barclay told the House of Commons following Monday's round of votes that the only option for the country is to find a way forward that allows the UK to leave with a deal.

Above: Brexit Secretary Stephen Barclay says the legal default in place means the UK leaves the EU without a deal unless parliament can unite behind a deal.

"The government continues to believe that the best course of action is to do so as soon as possible. If the House were to agree a deal this week it may still be possible to avoid holding European parliamentary elections," says Barclay.

Speculation in the UK press - and Barclay's talk of a deal 'this week' - suggests the Prime Minister might indeed bring back her deal for a fourth vote attempt this week.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Should a deal pass, we would expect Pound Sterling to move sharply higher and break out of its March-April trading range against the Euro and U.S. Dollar.

According to Danske Bank, if a deal were to be passed, the Pound-to-Euro exchange rate would rally to 1.2050.

The BBC's Laura Kuenssberg says there are however "whispers" that clerks in the House of Commons have made it clear to the government that John Bercow - the Speaker who dictates parliamentary business - would not allow them to bring back the deal for another vote.

Kuenssberg does however caution that the speaker's office has not decided on the matter just yet.

Even if the government succeeded and the deal was presented for a fourth vote, at this juncture there is scant indication that those dedicated opponents to the Brexit deal are ready to yield and the prospect of a timely delay to Brexit is increasing.

Those watching the Pound should not fear an extension: analysts at Danske Bank - the Scandinavian lender - say the Pound-to-Euro exchange rate would benefit on a long extension to Brexit, with a break of 1.1765 taking place and a range of 1.19-1.16 being adopted by the pair.

Today sees the Prime Minister Theresa May's Cabinet meet to discuss the way forward in light of parliament's inability to back any alternative course to her deal.

Importantly, it appears that May's Brexit deal remains the most popular option with Conservative party MPs at this point in time, and she will feel she has more leverage on the process than she did ahead of the rcent indicative votes.

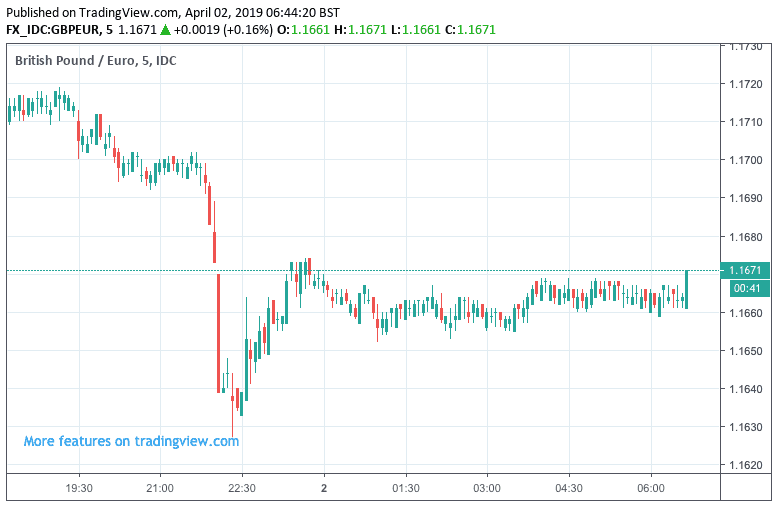

We believe that on balance the government regaining the initiative will protect Sterling against substantial downside near-term: the currency fell in the immediate aftermath of parliament's inability to unite behind a 'softer' Brexit but we are seeing consolidation taking place in Tuesday trade:

Above: Sterling drops on outcome of series of indicative votes, but ultimately looks to be well supported.

Looking ahead, we feel readers should beware the prospect of a General Election taking place in order to break the deadlock: an outcome we believe would be negative for the Pound which tends to fall in times of political uncertainty.

According to the Times, May intends to "confront the cabinet with the reality of an election today as they weigh up various dramatic options to break the deadlock". Cabinet will apparently be shown internal Conservative polling on the impact of a general election on the party at the session’s start.

For now we believe May will use the threat of an election to merely pressure her party into backing her deal. But, should it become apparent to markets that the threats might actually be delivered on, the Pound would likely sink. We must also be wary that dedicated opponents to the deal in the Conservative party have indicated they would in fact welcome an election as they believe they represent the mood of a frustrated electorate.

Steve Baker, a prominent opponent of May’s Brexit deal, has warned the possibility of a general election was now “coming on to the table,” suggesting he would welcome a new vote ahead of signing up for the deal.

Speaking on BBC’s Politics Live, Baker castigated those Conservative MPs who support the deal as “fools and knaves and cowards” with an “addiction to power.”

He suggested he may resign as a Conservative MP:

“At this point I can see no circumstances while as a Conservative MP, I voted against the Government in a confidence motion. “But we are approaching a point where the stakes are so very high and so transcend party politics and what this country is about and the fundamental British value that political power rests on consent that I think these things are coming on to the table.”

"We cannot rule out a general election if the Conservative Party implodes," says Arne Lohmann Rasmussen, an analyst with Danske Bank. "With only 10 days left to Brexit, our base case remains a long extension but it may require EU leaders accepting there is no plan at the moment."

An extraordinary EU summit on Brexit takes place on April 10.

"We think the probability of a no deal Brexit is low but not negligible," says Rasmussen, adding:

"We believe EUR/GBP will stay in the 0.85-0.87 range until we get more clarification, which we should get soon given Brexit day is 12 April. If the UK leaves without a deal, we should see EUR/GBP move towards parity."

The 0.85-0.87 range in EUR/GBP highlighted by Rasmussen gives a GBP/EUR range of 1.1760-1.15.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement