The Pound-to-Euro Exchange Rate Forecast: 1.20 in the Cross-Hairs

Image © Rawpixel.com, Adobe Images

- GBP/EUR should continue uptrend despite volatility

- 1.2000 now in cross-hairs at 200-week MA

- Weekly charts ‘leading the way’

With a series of nail-biting votes on Brexit in the UK parliament generating exceptional volatility in Pound Sterling pairs this week, analysts are opting to take a 'wide-lens' view of the currency to get a sense of where it is going.

Concerning the Pound-to-Euro exchange rate outlook in particular, the longer-term weekly charts offer a clearer picture than the more volatile shorter-term daily charts.

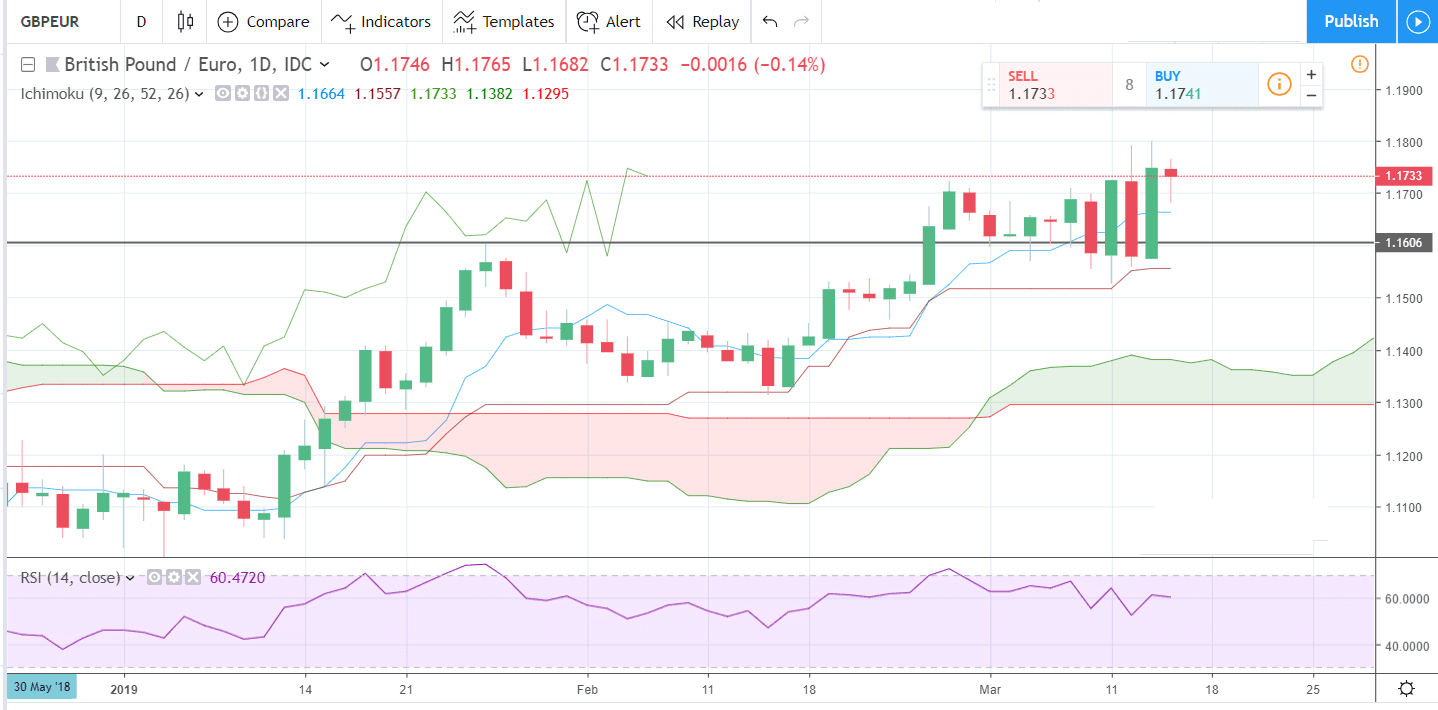

Above: The daily chart, showing high levels of volatility of late.

This should allow those wanting to know where the Pound is going next to iron out the short-term ‘noise’. We are particularly interested in knowing what the dominant trend is; and at present, the trend in GBP/EUR remains higher.

In technical analysis this is important because as the old adage goes "the trend is your friend until the bend at the end" so knowing the direction the current is moving in is the starting point of any analysis exercise.

“Significant daily swings - and worth taking the lead from the weekly chart,” says Peter Stoneham an analyst at Thomson Reuters who notes the underlying weekly bull trend in GBP/EUR is "very much alive".

Above: Taking a step back, we see a longer-term target

For Stoneham the next target is at the 200-day Moving Average (MA) at 1.2000 where significant resistance is expected due to short-term technical sellers fading the trend in anticipation of a pull-back, which eventually becomes a self-fulfilling prophecy.

1.2000 is also a major psychological level which means buyers are more likely to off-load their longs at that point, increasing supply, relatively compared to other levels.

The uptrend would only be negated by a decline beneath the cloud base at 1.1300.

We would strongly emphasise that such a target is not a near-term objective, rather a target that might be achieved on a multi-week timeframe.

Above: Location of cloud support

Stoneham also notes, however, that some indicators are flashing ‘overbought’ and this could slow down the uptrend as bulls lighten their positions.

Yet despite the bullish bias the analyst’s stance is neutral overall and, “volatility still forcing us to the sidelines for now,” he concludes.

Another analyst who is bullish GBP against the Euro, despite the short-term volatile confusion, is Christina Parthenidou, investment analyst at FX broker XM.com, who overall sees the short-term ‘risk’ as ‘neutral to bullish’.

Momentum indicators such as MACD and RSI are bullish to begin with, and the Japanese ichimoku cloud chart is also supporting a more bullish outlook.

She sees a possibility that the price could rise to the equivalent of 1.2000 and then 1.2100 in time.

A close below 1.1700 on a daily basis, however, would be a warning sign of more loses and a corrective move beginning, which might pull the pair back down to the 1.1600 range highs.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement