Update: Pound-to-Euro Exchange Rate Weakness an Opportunity to Buy: Hantec Markets' Perry

Image © Adobe Images

- Breakout leads to new outlook for Sterling vs Euro

- Initially, pull-back may be opportunity to reload ‘longs’

- Pound could rise to 1.20 vs Euro or 0.83 EUR/GBP

The Pound has broken above a historic high, with technical studies suggesting the move opens a path to ‘green pastures’ beyond in which further gains will be much easier.

Initially, there may be a small pull-back from overbought extremes, but this should be used as an opportunity for traders to position themselves for the next rally, says Richard Perry, market analyst, at FX broker Hantec Markets.

Indeed, the Pound ha spared recent gains against the Euro as traders booked profit on Sterling's rally at the turn of the month with the Pound-to-Euro exchange rate paring back from a two-year high around 1.1722 to quote at 1.1668 at the time of writing.

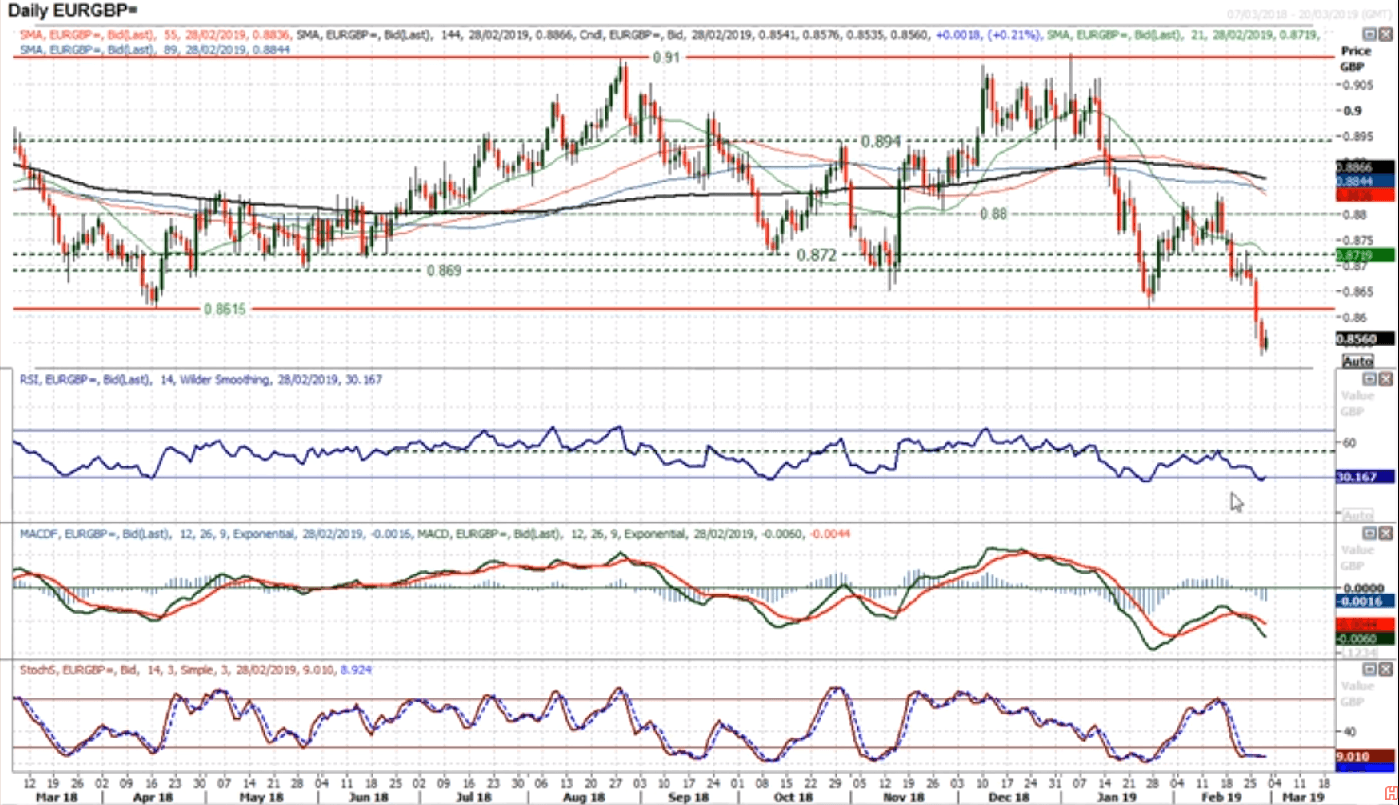

The historic level being referenced by Perry is at 1.1600-20 on GBP/EUR and 0.8600-10 on the EUR/GBP charts.

The breakout occurred after Prime Minister Theresa May offered MP’s the chance to vote for a delay to Brexit in the event of her deal being rejected in a vote due this month, it essentially removes the possibility of a ‘no-deal’ Brexit since MP’s can simply delay Brexit from happening altogether should no deal be found. The rally was further powered by talk that any delay could last up to two years.

"With Theresa May offering MPs the chance to vote on a no-deal Brexit, the pound has rallied against the US dollar over the past few days, pushing up to its highest level since July last year and riding on the growing sense of optimism that a cliff-edge departure will be avoided. Should we see a no-deal taken off the table next month, we can expect even further gains for the Pound against its trading peers," says Jake Trask, FX Research Director at OFX.

From a technical standpoint, the clearance of key resistance points is being considered by some strategists as a 'game-changing' moment.

“Massive moves on EUR/GBP. Look at this break down below 0.8615 which had been the 2018 low and became the 2019 low,” Says Perry, “that move has sort of opened up levels that we have not seen since mid-2017, and puts it on track to a new move to the downside maybe even towards 0.83 (1.20 GBP/EUR) big figure.”

Despite the strong sell-off in the Euro against the Pound, the RSI and other momentum indicators are turning higher, however, which suggests a potential for a recovery, perhaps back up to 0.86 (down to 1.1600 for GBP/EUR).

But this is nothing for Sterling bulls to fear, says Perry.

The pull-back is quite a common feature on charts following a breakout move and is known as a ‘throwback’ move. These often happen before the next surge. They present a low-risk entry point for traders wishing to ride the trend.

The original break lower looks conclusive and this adds to the bearish tone of the charts.

“It is one thing forming a huge bear candle, but to confirm it in the cold light of day in the subsequent session with another big bear candle is a really significant move,” says Perry effusively. “The breakdown of Euro/Sterling below the support at £0.8615 is a major move which has now taken Sterling to a new 21-month high and taken it into a new phase of trading.”

Intermediate targets lie at £0.8510 (1.1750 GBP/EUR) and then £0.8380 (1.1925), adds the analyst. “However, for now, the market is stretched and this could induce a near term technical rally. Rallies are now a chance to sell with the resistance at £0.8620 a key breakdown of overhead supply, whilst the hourly chart shows £0.8600 is initial resistance.”

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement