Pound-to-Euro Exchange Rate in the Week Ahead: Pushing Up Against Range Ceiling As Momentous Vote Approaches

Above: Prime Minister Theresa May's Brexit deal faces a first vote in parliament this week. Image © Number 10 Downing Street.

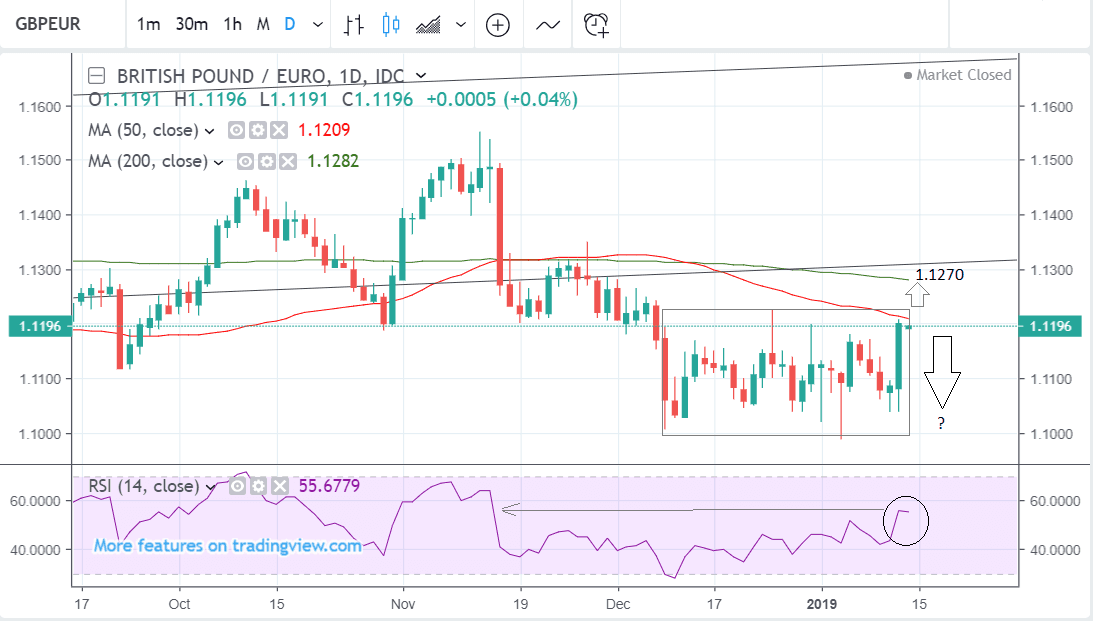

- GBP/EUR is at top of December range

- Strong upside momentum supports bullish breakout

- Pound to be driven by Brexit vote; Euro by industrial data

Pound Sterling is positively aligned against the Euro on a technical basis and gains could therefore extend short-term, but we are wary of the potential for a notable spike in volatility over coming days as the EU-UK Brexit deal is put in front of the UK parliament.

The Pound-to-Euro exchange rate starts the new week at 1.1196 after a gain of 0.34% over the previous week.

The Pound gained after the government lost a key Brexit finance bill in the commons, which reduced the likelihood of a ‘no-deal’; it then made further gains after rumours the Brexit deadline itself might be delayed if May's deal is rejected by parliament, thus further diminishing the prospect of a 'no deal' outcome.

The Euro meanwhile lost ground as fresh Italian banking sector fears and poor economic data clouded the region’s outlook, although it recovered a bit at the end of the week on easing global trade war concerns.

From a technical standpoint, the charts show the pair continuing in a sideways range between 1.10 and 1.12 as it has done ever since the start of December. There is a strong chance it could breakout higher in the week ahead because of the key meaningful vote on the government’s Brexit withdrawal deal scheduled for Tuesday, January 15.

Given this key event, there is a stronger-than-average chance of an increase in volatility.

The very strong, long, green 'upday' on January 11 favours the possibility of a breakout higher in the week ahead. It certainly looks unlikely the pair will fall back down after posting such a strong day on the chart.

The RSI momentum indicator in the bottom panel is showing strong bullish conviction. It is trading at the same level as it did when the exchange rate was between the 1.13s and 1.15s back in November. This may suggest ‘pent-up’ unexpressed upside which could come out in the week ahead.

A break above the 1.1227 December 25 highs would be critical and confirm a continuation higher, up to a target at just below the level of the 200-day moving average (MA) at 1.1270, at least initially.

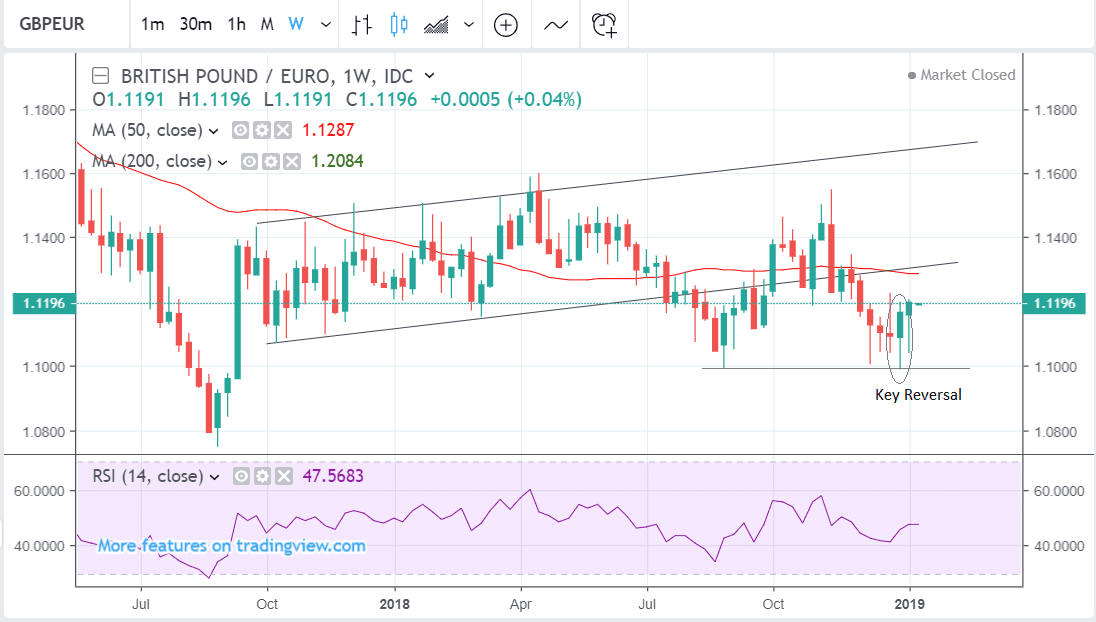

The weekly chart backs up the bullishness of the daily after forming a key reversal bar two weeks ago followed by a strong green up bar in the previous week. When they occur at the end of trends key reversal bars are often reliable ‘punctuation marks’ signalling an end to the dominant trend and reversal - in this case higher.

Clearly much depends on the outcome of the meaningful vote on Tuesday and the decisions made in its aftermath. The diagnosis from the charts suggests a slight bias for the Pound to strengthen, which might be commensurate with a no-vote, as this could increase the chances of a second referendum, and increases chances of a reversal of Brexit and ‘remain’ scenario.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get you closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Pound: A Big Week for Brexit Politics

By far the most important event in the week ahead is the vote on Theresa May’s Brexit deal, scheduled for Tuesday 15, at 19.00 GMT. The outlook definitely favours the government to lose, and it is more a question of ‘by how much’ rather than ‘whether’.

The Pound's reaction will therefore likely depend on the size of the loss, and what comes next. If the loss is large - defined by a 100 or more MPs - as some analysts believe, it might signal the death of the government’s deal and could prompt a knee-jerk move lower in Sterling.

"Very few commentators expect the deal to pass, so the move in GBP would likely be limited on that news alone," says Jordan Rochester, analyst with Nomura. "But we would be looking at the size of the defeat to understand whether a repeated vote could get over the line."

The expected defeat would probably lead to a vote of no-confidence in the government, called by the Labour Party with Labour leader Jeremy Corbyn telling the BBC's Andrew Marr on Sunday that he would call the vote soon. But we don't see the government losing such a vote as the DUP and Conservative party would unite to defend their hold on power.

"We’d expect the government to win a vote of no confidence as turkeys rarely vote for Christmas," says Nomura's Rochester.

We think the government will ultimately rework the Brexit deal and bring it back to parliament for a second airing, and there is talk of some EU concessions being made available to help the deal cross the line on a second vote.

While there is a majority in Parliament who are committed to avoiding a 'no deal' Brexit, as proven by last week’s finance bill vote, there is not necessarily a majority to command an alternative plan. That said, a report in the Sunday Times reports Downing Street uncovered a bombshell plot by senior MPs to seize control of Brexit negotiations and sideline the prime minister. At least two groups of rebel MPs are plotting to change Commons rules so motions proposed by backbenchers take precedence over government business, upending the centuries-old relationship between executive and legislature.

This in effect could see Brexit delayed, cancelled or another Norway-style Brexit delivered. All scenarios lead to a softer Brexit which is good for Sterling. However we would be seriously worried for the long-term stability of UK politics if such a coup were to take place.

Last week's reports that a large portion of Labour Party MPs are open to supporting the deal if they can secure their own changes is a significant shift in the debate we believe: if these MPs secure some changes to the deal, a softer Brexit is in sight, which represents an all-out positive for Sterling.

Labour MP John Mann says that it is "likely" that he will support Theresa May's Brexit deal, and says a number of Labour MPs will likely do the same #Ridge pic.twitter.com/sEOeoEn84x

— Ridge on Sunday (@RidgeOnSunday) January 13, 2019

Last week's report the government is considering a delay to the Article 50 process is also notable in that it suggests government ministers are aware that all alternative Brexit scenarios that would follow the failure of May's deal, would need more time to formulate and execute. While the reports were officially denied by 10 Downing Street we believe this a case of where there is smoke, there is fire.

“Perhaps the best-case scenario for the Pound, barring the deal passing in parliament, would be a delay to the article 50 process. This decision would have to be agreed by the EU, however they are likely to do so, with the Pound set to appreciate due to the removal of the pressure of hitting the 29th March deadline for exiting the EU,” says Michael Brown, Senior Analyst at Caxton FX.

Brexit aside, the two main economic releases in the week ahead are inflation out on Wednesday and retail sales on Friday. Of the two, analysts think the latter is most likely to have the greater impact on Sterling.

“With the Bank of England not expected to raise interest rates unless Parliament approves a smooth Brexit, the inflation data is unlikely to have much impact in currency markets. Retail sales on the other hand could see a stronger response by traders as it’s a better gauge of UK growth momentum,” says Raffi Boyadjian, an analyst at broker XM.com.

Retail sales are forecast to show a -0.7% fall in December according to consensus estimates. If so the Pound could fall due to a drop in expected Q4 growth.

Wednesday’s inflation data, meanwhile, is expected to show a rise of 0.2% month-on-month (Mom) and 2.2% compared to a year ago, when it is released at 9.30, with little changed from the previous print. The higher the result the better for the Pound and vice-versa.

The Euro: What to Watch

Be aware that the Euro appears to have been tracking the fortunes of China's Renminbi of late. The single-currency rallied in the week prior on news that the U.S. and China were making progress towards settling their ongoing trade dispute.

Should markets maintain optimism on the matter the Euro could well appreciate further.

The rise in the Euro however comes despite some dire data which suggests Italy and Germany both sunk into recession in the final quarter of 2018.

We wonder if the Euro is defying gravity, and are wary of a bigger move lower if data remains resolutely poor.

One of the most important releases for the Euro in the week ahead is industrial production out on Monday at 10.00 GMT, as this will provide another up-to-date assessment of the state of the Eurozone economy.

The consensus expectation is for industrial production to have fallen by -1.3% in November compared to October when it rose 0.2%. Compared to a year ago it is expected to have fallen by -2.1%.

“Data in the coming days will probably continue to paint a bleak picture, with investors eyeing Monday’s industrial production numbers for the euro bloc and Tuesday’s 2018 GDP estimate for Germany,” says Raffi Boyadjian, an analyst at broker XM.com. “Industrial output is forecast to have contracted by 1.0% month-on-month in November, more than reversing the prior 0.2% gain.”

Germany is expected to show a slower 1.5% growth in 2018 - down from the 2.2% in 2017, when it is released at 7.00 on Tuesday, according to consensus expectations.

Mario Draghi, the president of the European Central Bank (ECB) is set to give a speech on Monday at 15.00, which could also impact on the Euro given mixed data recently. Data out last week showed that although retail sales showed a resilient 0.6% rise in November and Unemployment fell to 8.0%, “other economic figures were mostly consistent with a generally subdued Eurozone growth trend” and the Eurozone is “flirting with recession.” Says Wells Fargo, which cited German data as particularly poor.

“The decline in German output in particular raised the specter of whether the Eurozone economy is on the verge of falling into recession. In our view there appears to be enough solidity in the consumer sector, and momentum in the overall economy, to avoid a recession at this time. That said, we do expect the period of subdued Eurozone economic activity to persist further and, as a result, see a slower return to zero interest rates than previously expected by the European Central Bank,” says a note from investment bank Wells Fargo.

Their analysis suggests a weaker or flatlining Euro in the short-term.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here