Pound vs. Euro: Floor at 1.10 Seen Keeping Exchange Rate Supported

Image © Thomas Otto, Adobe Stock

- GBP/EUR unlikely to go below 1.10 near-term

- Danske's von Mehren sees sideways trade likely over coming days

- UK Parliament to vote on Brexit deal week starting Jaunary 14

- Expect potential for big moves around mid-January

Pound Sterling is expected to see volatility spike in mid-January when the UK parliament votes on the EU-UK Brexit deal now that the government has given confirmation on when the vote will take place.

Prime Minister Theresa May told parliament on Monday the vote will take place in the week commencing January 14, and foreign exchange strategists believe the Pound could experience notable volatiltiy around this period.

According to Reuters data, market participants are now snapping up insurance against a big Brexit-Inspired bout of volatility in Sterling around the time of the parliamentary vote on the Brexit deal.

May told parliament on December 17 that the vote will take place in the new year, giving a date that is just 7 days away from the January 21 deadline. The EU Withdrawal Act, which incorporates Brexit into UK law, requires the prime minister to give an update on Brexit by January 21 if her deal is rejected or if talks with the European Union break down.

Markets could well tread water until this date.

"From here, the Brexit story cannot move on to next chapter until deal rejected, or passed," says Robert Howard, an analyst with the Thomson Reuters currency desk. "This uncertainty may keep GBP relatively steady thru year-end, if not January 14."

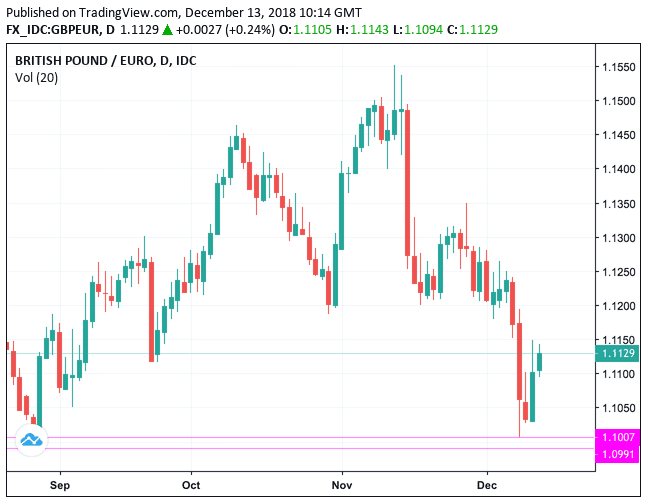

The Pound-to-Euro exchange rate is nevertheless looking more confident at the start of the new week: currently quoted at 1.1128 it a few pips away from the previous week's highs located in the early 1.1160s, and we believe a near-term floor has formed that could guard against any major drops into year-end.

The British Pound experienced notable volatility last week with the exchange rate falling to three-month lows against the Euro, only to recover in the event of Theresa May winning a vote of confidence called to determine the fate of her leadership of the Conservative party.

May's win provides some certainty in these uncertain times; something the British Pound will appreciate and this could well put a floor under the currency at around 1.10. However, the mathematics required to push her deal through parliament remains elusive, so while a solid floor appears to be building, the prospect of a strong recovery is likely to remain limited.

Above: Chart showing a potential level of solid support in GBP/EUR.

While the charts tell of a floor, analyst David Alexander Meier with Julius Baer says he has downgraded his forecast for the Pound-Euro exchange rate, "taking into account a markdown due to the increased political risks surrounding Brexit."

Julius Baer revise their forecast to 1.0870; this places them below the consensus estimate. (To see where 50 of the world's biggest institutions are forecasting GBP/EUR to go, please see this download).

Julius Baer's longterm outlook remains more constructive for Sterling however, the GBP/EUR exchange rate is forecast at "a Bullish" 1.16, "reflecting our view that a no-deal Brexit can be avoided – if Brexit happens at all."

The British Pound is currently seen extending back to last week's highs at the time of writing, but we would expect the currency's gains to ultimately be limited to tight ranges as we await the next move of the UK parliament and the European Union who could yet offer further concessions to help the Brexit deal agreed with the UK pass through parliament.

"There is no doubt that European nations will want the current proposal to succeed, yet the fact is that without any significant concessions, the UK is heading for the exit door with little in place," says Joshua Mahony, Market Analyst at IG.

Negotiators will be working at what more can be offered by the EU in Brussels this week, and we would expect some guidelines regarding new deadlines will be released at some point; the EU knows the UK parliament has until January 21 to vote on the Brexit deal therefore they viewed last week's European Council summit as being too early to offer any concessions.

Domestic opposition to the deal is entrenched with a cabal of Conservative party MPs unwilling to fall behind their leader despite her winning the just-held confidence vote. The DUP are also expected to stick to their pledge of rejecting the Brexit deal as long as the backstop clause is kept in the Withdrawal Agreement, which it will.

The opposition parties meanwhile hope the Brexit impasse will lead to the government falling; however we feel that there is the prospect of some opposition politicians falling behind the deal at the last minute when asked to choose between a deal and no deal, being unwilling to risk a no deal purely on a shaky assumption the government might collapse.

"All options still are on the table, including a second referendum and the risk of the deal not being passed in the House of Commons remains intact. Hence, we expect EUR/GBP to remain volatile and range bound in coming weeks," says Allan von Mehren, Chief Market Analyst with Danske Bank.

Advertisement

Bank-beating GBP/EUR exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here