Pound-to-Euro Rate Rises after Eurozone Economic Woes Grow Larger

- Written by: James Skinner

© European Central Bank

- French, German PMI surveys sound alarm on Eurozone outlook.

- French industry hit hard in November as German activity waines.

- Casting even taller shadow over ECB and Euro outlooks for 2019.

The Pound-to-Euro rate stabilised Friday after IHS Markit PMI data for November pointed clearly toward a further loss of economic momentum for the bloc during the final quarter.

France's IHS manufacturing and services PMIs both declined beneath the crucial 50.0 level during the recent months, which marks the difference between industry expansion and contraction. That suggests French industry is now wallowing in recessionary conditions.

"While there is only a very loose association between the PMI and GDP growth in France, the index is broadly consistent with quarterly growth of about 0.1% at best," says Jack Allen, a European economist at Capital Economics.

France's manufacturing PMI fell to 49.7, from 50.8, in November when markets had been looking for a decline to only 50.7. The services PMI dropped to 49.6, from 55.1, when markets had looked for a reading of 54.8.

Meanwhile, the survey's German counterparts both also pointed toward a further loss of momentum during the final quarter.

The German manufacturing PMI declined to 51.5, from 53.4, when markets had been looking for an increase to 51.9. The services PMI fell to 52.5, from 53.3, when consensus was for an increase to 53.4.

Germany's economy already contracted in the third-quarter, for the first time since 2015. Is it now headed for a recession?

"New orders growth in the private sector has ground almost to a halt, reflecting in particular weakness in external demand. Solid employment growth is a bright spot, but this won’t last long given the soft output and new orders data," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

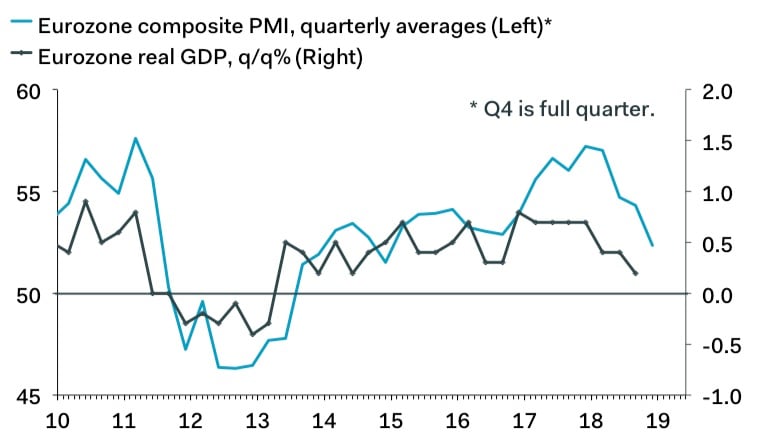

Above: PMI correlation with Eurozone GDP. Source: Pantheon Macroeconomics.

Friday's PMI data took the Eurozone composite PMI, which measures both manufacturing and services conditions across the single currency bloc overall, down to 51.3 in November from 52.7 previously.

Eurozone economic growth already fell by half during the third quarter, dropping from 0.4% to just 0.2%, and economists are saying the survey data now points to a continued downturn.

"The decline from 52.7 to 51.3 suggests the revival of GDP growth in the Eurozone may not have happened at all. While the ECB was relatively optimistic about the growth outlook yesterday, today’s PMI adds to the worries," says Bert Colijn, an economist at ING Group.

Colijn says the global economic environment, which has softened in light of President Donald Trump's 'trade war' with China, is responsible for much of the deterioration in the Eurozone outlook. But that bloc-specific factors like civil unrest in France may also have added to the gloom.

PMI surveys measure changes in industry activity by asking respondents to rate conditions for employment, production, new orders, prices, deliveries and inventories. A number above the 50.0 level indicates industry expansion while a number below is consistent with contraction.

Markets care about the data because it is an important indicator of momentum within the economy. And economic growth has direct bearing on consumer price pressures, which dictate where interest rates will go next.

"The ECB ended net asset purchases yesterday, but the question is how much policy can be normalised further in a slow economic environment," Colijn writes, to clients. "Today’s PMI confirms an already slow growth environment and with plenty of downside risks possibly materialising before summer next year, doubts about the forward guidance are likely to increase."

Above: Pound-to-Euro rate shown at hourly intervals.

The Pound-to-Euro rate was quoted 0.18% higher at 1.1154 following the release, which has stabilised the Sterling exchange rate at the end of a Brexit-heavy week that dented Sterling overall.

The Euro-to-Dollar rate was quoted -0.62% lower at 1.1291 Friday and is down -5.05% for the year, while Euro-to-Pound rate was -0.28% lower at 0.8982 and has risen 1.58% this year.

Above: Eurot-to-Dollar rate shown at hourly intervals.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Doubts about ECB Rate Hikes Grow

Mario Draghi, President of the European Central Bank (ECB), told markets Thursday that the Eurozone economic outlook has deteriorated in recent months and that risks to growth are now firmly to the downside.

For the time being at least, the ECB has stuck to its commitment to begin lifting interest rates next year, which is important because the Euro's appeal to investors is hinged on the bank raising rates once "through the summer of 2019.

However, the single currency will first need to survive the European parliamentary election in May and the ECB's latest economic forecasts will also need to be borne out in reality over coming quarters.

The ECB says the economy will grow by 1.7% next year, down from the 1.8% projection issued in October. Eurozone growth was 2.3% in 2017 and is now forecast to come in at 1.9% for the current year.

Inflation is forecast to decline to 1.8% for 2019 as a whole, down from 2% in November. It has risen above the target of "close to but below 2%" this year thanks largely to previous increases in the oil price.

However, what matters most for the ECB policy outlook is the core inflation rate, which refers to the consumer price pressures left over after energy and food items are removed from the goods basket, and has actually fallen this year.

Core Eurozone inflation fell from 1.1% to 1% in November. That is exactly the level it was at in January 2018 and is only 10 basis points, or 0.1%, above the level it was at in January 2017.

As a result, the European Central Bank has not made any real progress toward its inflation target, in underlying terms at least, over the last two years.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here