Sell the Pound against the Euro say Nordea, Citing Conservative Party Conference Dangers

Above: Theresa May is expected to sink Sterling at this year's Conservative party conference. Image © Number 10 Downing Street

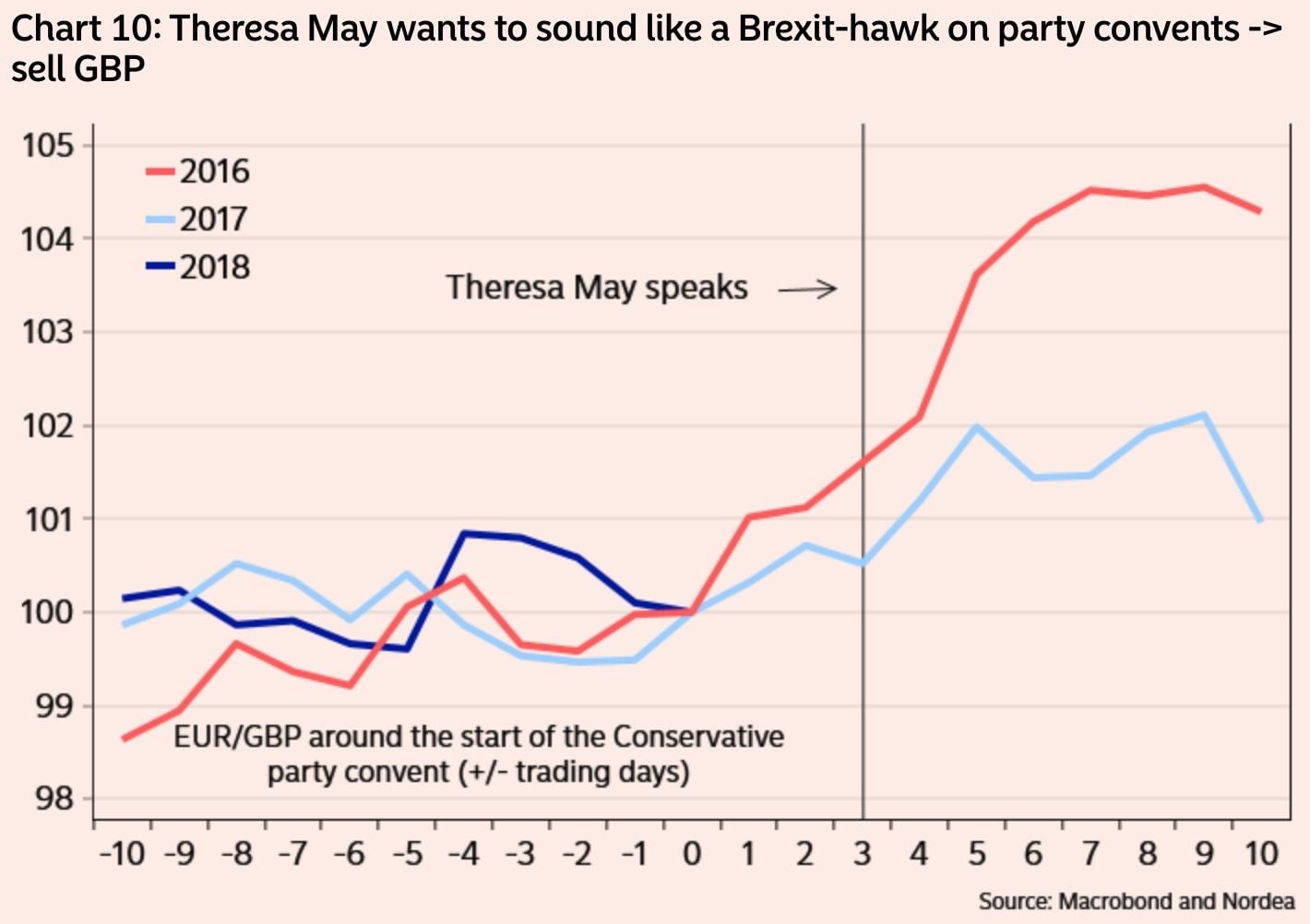

- British Pound has fallen sharply on previous two conferences

- Expect GBP/EUR lower over course of next two weeks

- P.M. May to deliver key speech mid-week

Pound Sterling is forecast to decline against the Euro over the course of the next two weeks, with the underway Conservative party conference being the trigger.

Andreas Steno Larsen of Nordea Markets tells clients "you want to be short GBP in to a Conservative party conference."

The Conservative party conference enters its second day Monday with delegates gathered in Birmingham, England, and is due to run until Wednesday and close off with an address from party leader Theresa May.

The suggestion to sell Sterling is actually something of a change in tune from the Nordea strategy desk. Previously, Nordea Markets had been "long GBP versus EUR" since late August; i.e. betting on a move higher in the Pound.

The bet was based on the assumption that the Bank of England’s low tolerance for a weaker GBP would ensure the Pound-to-Euro exchange rate remains supported above 1.1050.

"We now decide to take profit on that short EUR/GBP bet and subsequently reverse it to a long EUR/GBP position ahead of Theresa May’s scheduled appearance at the Conservative party conference this week," says Larsen.

Image courtesy of Nordea Markets.

The analyst notes that in the last two years in a row EUR/GBP moved swiftly upwards on the day of Theresa Mays speech at the Conservative party conference, "and we bet that this year will be no different, as Theresa May has every incentive to sound like a Brexit-hawk at the conference to gather internal support," adds Larsen.

The analyst is targeting EUR/GBP levels around 0.9050 on a 1-2 week timeframe. This gives a target of 1.1050 in GBP/EUR exchange rate terms.

Traders will be wary that the Pound has suffered at previous conferences.

Data shows the Pound fell 3.75 cents in the first week of October last year, after a disastrous keynote conference speech by PM Theresa May.

"Sterling suffered from May's misfortune, amid perceptions that her hold on power had never looked weaker. A year earlier, the Pound fared even worse after May's conference message was perceived as signalling that Britain was heading for a hard Brexit," says Robert Howard, who sits on the foreign exchange desk at Thomson Reuters.

That first week of October 2016 ended with a "flash crash" for GBP, which saw cable plummet to 1.1491 – its lowest for 31 years.

"Brexit developments can buck the market at any moment, either way," says Howard. "Fortune may favour the brave, but speculators holding or mulling Sterling longs must be wondering about just how bold they should be as the annual UK Conservative Party conference looms."

Immediate market attention lies with Chancellor Philip Hammond and Brexit Secretary Dominic Raab who have both delivered addresses defending the government's current proposals known as the 'Chequers plan', hinting that no major change in course will be delivered by May mid-week.

Brexit Secretary Dominic Raab told the conference the European Union needs to "get serious" on Brexit and "they need to do it now".

"Our prime minister has been constructive and respectful. In return we heard jibes from senior leaders. And we saw a starkly one-sided approach to negotiation, where the EU’s theological approach allows no room for serious compromise," said the Brexit secretary. "And yet we are expected to cast aside the territorial integrity of our own country. If the EU want a deal, they need to get serious. And they need to do it now."

Chancellor Philp Hammond meanwhile told delegates that the Chequers plan was the only plan in town that delivers on a full exit while addressing the difficult question of the Irish border.

That both senior Conservatives towed the existing line suggests we might not hear anything revolutionary from Prime Minister May mid-week.

Therefore we would be wary that expectations for a fall in the British Pound might be overblown.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here