Pound to Dollar Forecast for the Week Ahead: All Signals Green

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate can continue to advance in the coming days according to our Week Ahead Model. Fedspeak and U.S. payrolls are the fundamental risks to the positive setup.

Pound Sterling has risen for three months in sucession against the Dollar and holds positive upside momentum that can extend in the coming days.

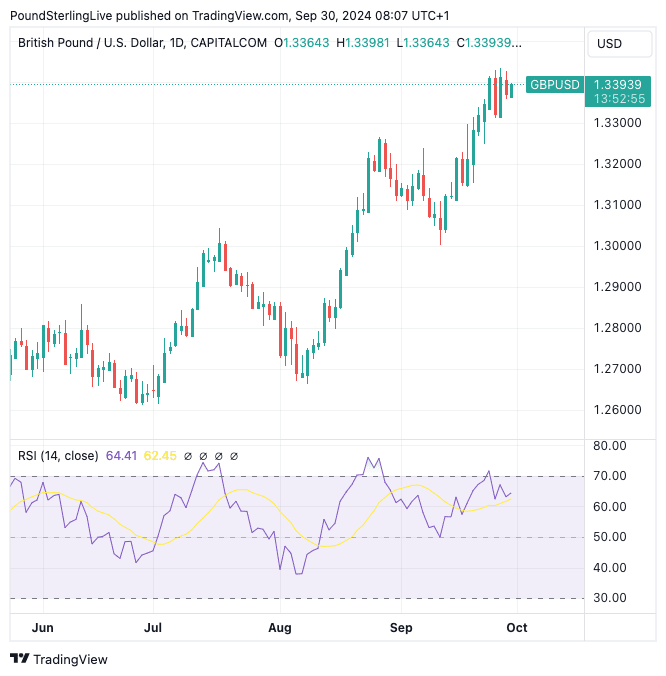

The Pound to Dollar exchange rate (GBP/USD) peaked at 1.3433 last week and has since pulled back to 1.3385, where we find it at the time of writing. It looks like the rally is consolidating around these levels ahead of a busy week.

This consolidation is needed, given the exchange rate had risen to overbought territory last week; the Relative Strength Index (RSI) broke above the 70 level, which signals overbought, requiring a pullback or consolidation to unwind.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The RSI has since fallen back to 63.69, confirming the pair is no longer overbought on the daily timeframe. Our suite of technical indicators are all flashing green and advocating for gains; for now, any weakness is viewed as likely being temporary.

The next graphical upside target is around 1.3510, representing a cluster of support and resistance going back to January 2022.

Above: GBP/USD at daily intervals.

"The broader pattern and tone of the charts remain GBP-bullish, amid steady GBP gains and strong, upward momentum on the short-, medium– and long-term oscillators," says Shaun Osborne, an analyst at Scotiabank.

"GBP dips should remain relatively shallow," he adds.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Turning to the event risk in the coming days, it is a quiet week in the UK, but the U.S. will offer important data and speeches from Federal Reserve interest rate setters.

The Pound tends to rise when stock markets are rising, which can continue as long as markets think the Federal Reserve will continue to cut interest rates.

Any strong data from the U.S. would, however, signal the pace of cuts will slow, which can deal a setback to the markets.

With this in mind, keep an eye on U.S. PMI survey data on Tuesday and speeches from Fed Open Market Committee (FOMC) members Cook, Collins, Barkin and Bostic. Bowman and Barkin speak on Wednesday.

There are more U.S. PMI figures incoming on Thursday (covering the services sector), which will keep markets entertained ahead of the week's highlight, which is Friday's non-farm payroll release.

Here, a headline of 144k is expected. The rule of thumb is that anything slightly below would signal the need for more cuts at the Fed and keep the mood music supportive of global risk and the Pound.

But any big downside miss could backfire as it would suggest maybe the economy is slipping into recession. If the figures give a significant upside surprise, markets will almost certainly fall as investors race to bet the Federal Reserve will slow down the pace of cuts.

This would deal a setback to the Pound and trigger a Dollar recovery.