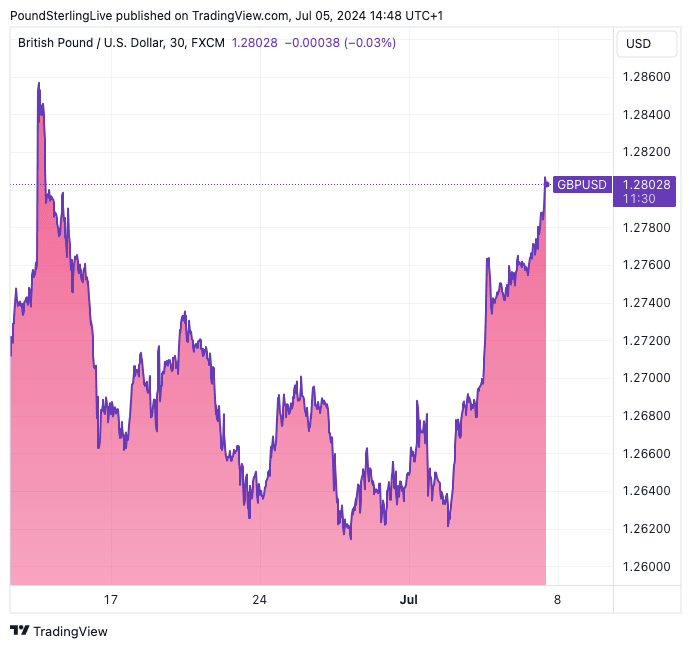

GBP/USD Breaks 1.28 on Soft U.S. Jobs Report

- Written by: Sam Coventry

Image © Adobe Images

The Dollar fell after a U.S. labour market report showed conditions continuing to cool, bolstering expectations for an interest rate cut from the Federal Reserve at the September policy meeting.

The Pound to Dollar exchange rate spiked above 1.28 after the Bureau of Labor Statistics slashed its previous estimates for U.S. job growth in April and May by 111K and said unemployment rose to 4.1% in June.

The June non-farm payroll report fell to 206K from 272K, but this beat estimates for an outcome of 190K. However, the currency and bond market reaction suggests emphasis is falling on the revision to the previous two months and the unemployment rate.

"Traders are selling the dollar and interest rates are slumping on firming prospects for a September rate cut," says Karl Schamotta, Chief Market Strategist at Corpay.

The takeaway is that the labour market is loosening, which is consistent with softening wage growth that will weigh on inflation going forward, allowing the Federal Reserve to cut interest rates, potentially as soon as September.

Indeed, the BLS also reported average hourly earnings rose 3.9% on an annual basis, which is the lowest level in three years.

"The U.S. labour market appears to be cooling," says Richard Carter, head of fixed interest research at Quilter Cheviot. "Fed policymakers raised concerns at its latest monetary policy meeting that unemployment could rise too quickly should rates be held for too long."

On Tuesday, Federal Reserve Chair Jerome Powell told a conference in Portugal that the Fed would consider cutting interest rates if the job market deteriorated.

Carter says there remains a risk that the unemployment rate could increase further from here.

"Though this is a relatively solid jobs increase, coming in slightly higher than expected, when considered alongside the downturn in earnings as well as signs of softening elsewhere in the economy, it could prove to be enough for a shift in the Federal Reserve’s stance," he says.

The U.S. job report is the latest in a series of soft economic prints. On Wednesday, the Dollar fell following the release of the ISM services sector PMI, which undershot expectations by a significant margin.

"There remains a clear desire among FOMC members to deliver a cut, likely sooner rather than later, hence the ‘Fed put’ remains forceful, and flexible, in nature. This should, in turn, continue to support risk assets, with the path of least resistance for equities continuing to point to the upside," says Michael Brown, Senior Research Strategist at Pepperstone.

Currency analysts say the Dollar could come under sustained pressure once the Federal Reserve looks to be entering a sustained period of interest rate cuts.

However, complicating factors to such an assumption include the November U.S. elections. Already, we have seen markets vote that the rising odds of a Trump presidency are USD-supportive.