GBP/USD Week Ahead Forecast: Recovery to 1.27

- Written by: Gary Howes

Image © Adobe Images

What is the Pound to Dollar exchange rate forecast for the coming week? We think the Pound will rebound in the coming days, but strength could be short-lived as fundamentals continue to favour the U.S. Dollar.

Pound Sterling has entered a short-term downtrend against the Dollar, but we look for a small rebound in the coming days if support at a key moving average holds firm.

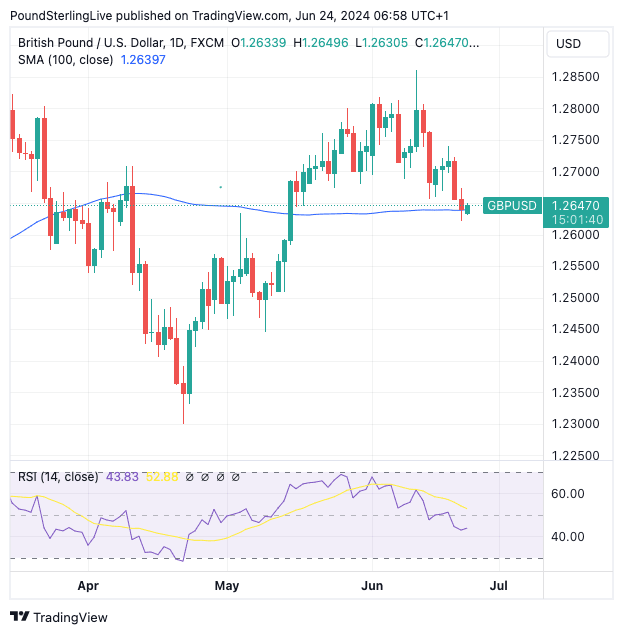

The below chart shows the GBP/USD has fallen to meet the 100-day moving average at 1.2639, which looks to have arrested last week's selloff and could offer further support in the coming days:

Track GBP/USD with your own alerts, find out more here.

The 50-day MA is also located in this vicinity, suggesting the confluence of some notable technical levels that can create the basis for a light recovery towards 1.27.

"Look for resistance on minor rebounds to the upper 1.26s from here," says Shaun Osborne, Chief FX Strategist at Scotiabank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

For the rebound story to evolve, we must see a couple of positive daily closes on Monday and Tuesday that confirm the nearby support levels have holding power.

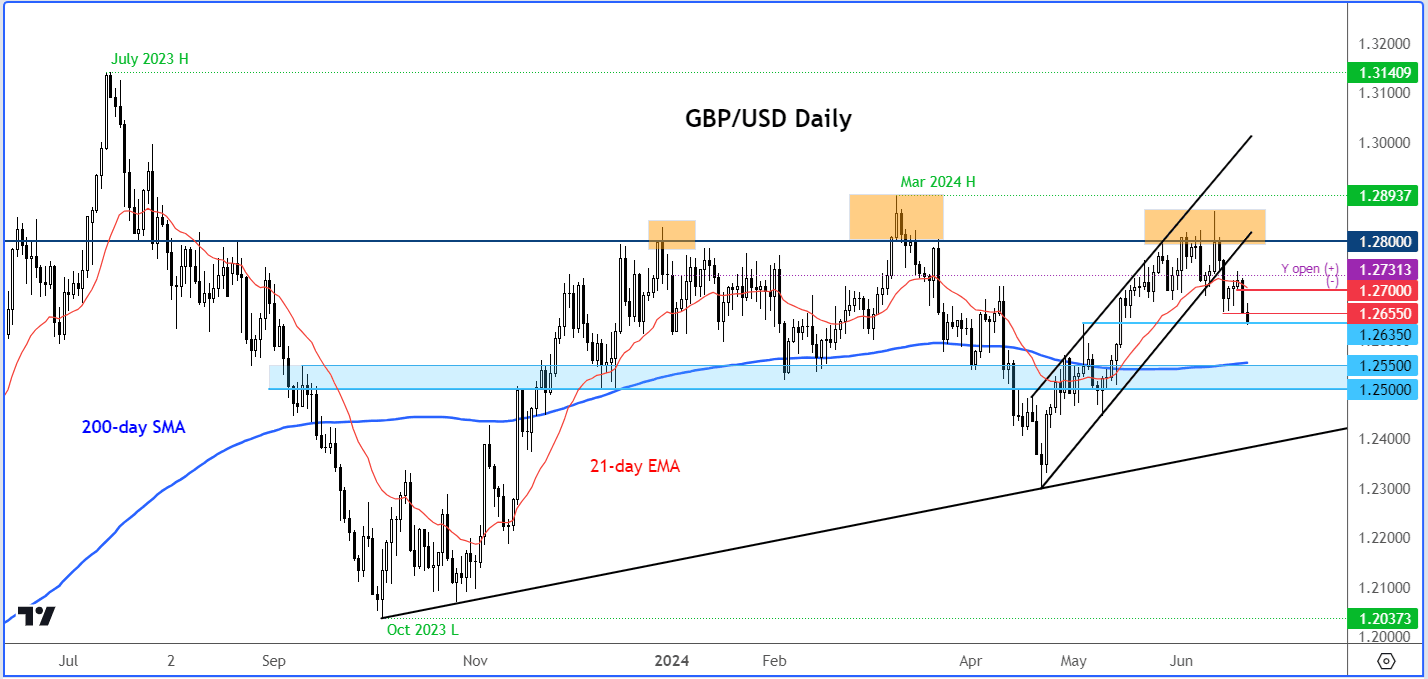

"At current levels sterling is testing possible support in the form of its 50-day moving average but, if that gives way, we could see a reversion to around 1.25, which was last month’s intermediate low," says Bill McNamara, analyst at The Technical Trader.

For now, strength will be shallow and limited with the daily RSI at 43 and pointed lower in recognition of the downside momentum that has built up recently. A break below the aforementioned 100 DMA would represent a technical deterioration and confirm a deeper downtrend is growing.

"Sterling’s technical tone has weakened in the past few sessions," says Osborne. "Loss of support in the upper 1.26s leaves the pound struggling for a foothold amid some clear deterioration in the intraday and daily trend strength oscillators."

Osborne sees support at 1.2580 (50% retracement of the April/June rebound).

"Traders seem happy to sit on the offer on the GBP/USD, keeping the short-term path of least resistance to the downside," says Fawad Razaqzada, an analyst at City Index.

"The GBP/USD has fallen to its lowest point since mid-May, testing potential support at 1.2635. A more significant support area to watch is at around 1.2550 where the 200-day average meets a prior support and resistance zone," he explains.

Image courtesy of City Index.

"In terms of resistance levels to watch, they include 1.2655, 1.2700 and 1.2735 – all prior support/resistance levels," says Razaqzada.

Turning to the calendar, it is a quiet week in the UK, but there should be some interest from the U.S.

All eyes are on Friday's core PCE release, which is seen as important for the Federal Reserve when considering the outlook for interest rates.

Core PCE is expected to read at 0.1% month-on-month and 2.6% year-on-year. Should it beat expectations, expect the Dollar to end the week on a high, with Pound-Dollar potentially ending the week at lows not seen since mid-May.

But should the data undershoot, we could see a decent relief rally in the Pound-Dollar that stabilises the near-term outlook. That said, strength will likely be limited in nature as the Dollar looks to be benefiting from the ongoing U.S. stock market outperformance.

"We think that the relative outperformance of US stocks could prove a strong enough support that could prop up the USD in the coming weeks," says Valentin Marinov, head of FX strategy at Crédit Agricole.

Crédit Agricole thinks outperforming U.S. stocks could continue to attract unhedged inflows of international capital into U.S. equity markets, "in a boost to the USD".