Dollar's Round Trip on PPI Inflation Surprise

- Written by: Gary Howes

Image © Adobe Stock

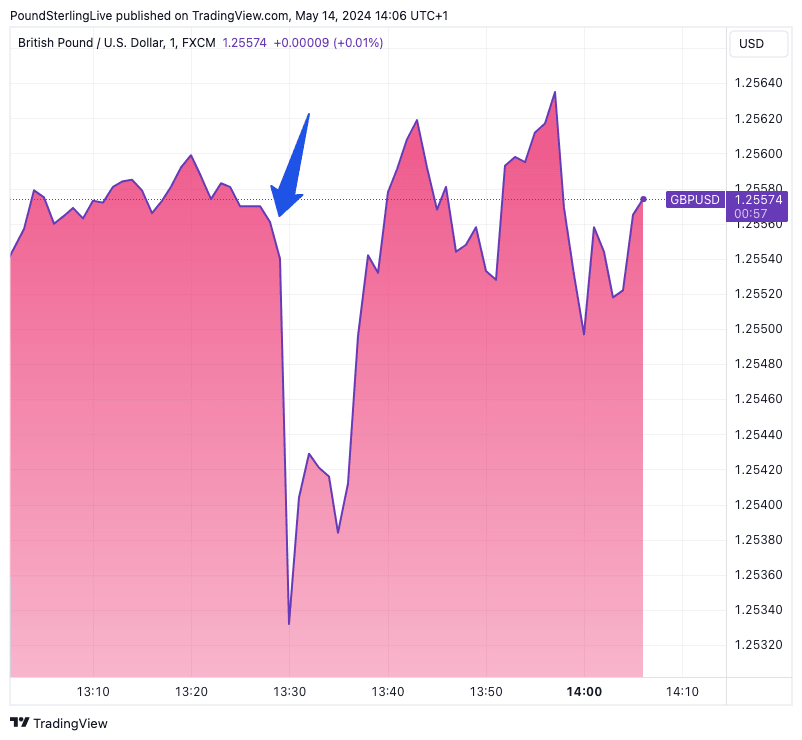

Dollar exchange rates soon recovered following news that U.S. PPI inflation rose sharply last month, as details of the report offered some comfort.

Producer Price Index (PPI) inflation - the prices domestic producers receive for their output - rose 0.5% month-on-month in April, exceeding estimates for a 0.3% outcome. The core measure also rose 0.5%, beating the consensus estimate for a 0.2% outcome.

PPI inflation can often lead CPI inflation trends, raising fears that more upside surprises from U.S. inflation lie ahead. This would leave the Federal Reserve with little option but to keep interest rates at current levels for an extended period and feed into a stronger-for-longer USD narrative.

"The dollar surged with front-end yields immediately after release but quickly retraced the move," says Kyle Chapman, FX Markets Analyst at Ballinger Group. "It is a fairly volatile measure, and markets evidently want to reserve full judgment until they receive the full set of CPI figures tomorrow."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

GBP/USD fell as low as 1.2519 before recovering to 1.2571, EUR/USD fell as low as 1.0765 but has rallied to a new high of 1.0818 at the time of writing.

"Household spending remains a contributor to consumer price inflation from the demand side, but that pressure is now joined by businesses having their own costs to pass on to consumers after an absence of such pressure throughout 2023," says Gus Faucher, an economist at PNC Bank.

The data shows the majority of the uptick in April's PPI was down to services inflation, which Chapman says casts doubt on the softening labour market narrative that has put some downside pressure on the Dollar over the past few weeks.

"The Fed must be pulling their hair out here. They were teased with some softer growth and labour market data, but the inflation data simply will not relent. This points to a sticky PCE print later this month, meaning that the Fed is rapidly running out of opportunities to see sustainable progress on disinflation by the September meeting," says Chapman.

The finer details of the PPI release, which are softer than the headline suggests, could explain the dollar's swift reversal.

"The silver lining behind the disappointing April headline is that many of the PPI components which feed into the core PCE deflator rose only modestly," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

The PCE deflator is a key measure of U.S. inflation that the Fed uses when deciding monetary policy.

For instance, Shepherdson notes, the private passenger auto insurance PPI rose by just 0.1%, the least since October, while the homeowners’ insurance PPI rose by just 0.2% and direct health and medical insurance PPI was flat.

"The continued strength in services PPI inflation is at odds with the recent deceleration in average hourly earnings in the private services sector, as well as the low level of the prices received indexes of the regional Fed services surveys, so we still expect a significant slowdown soon," adds Shepherdson.