GBP/USD Rate Soars on U.S. Job Undershoot

- Written by: Gary Howes

Image © Adobe Images

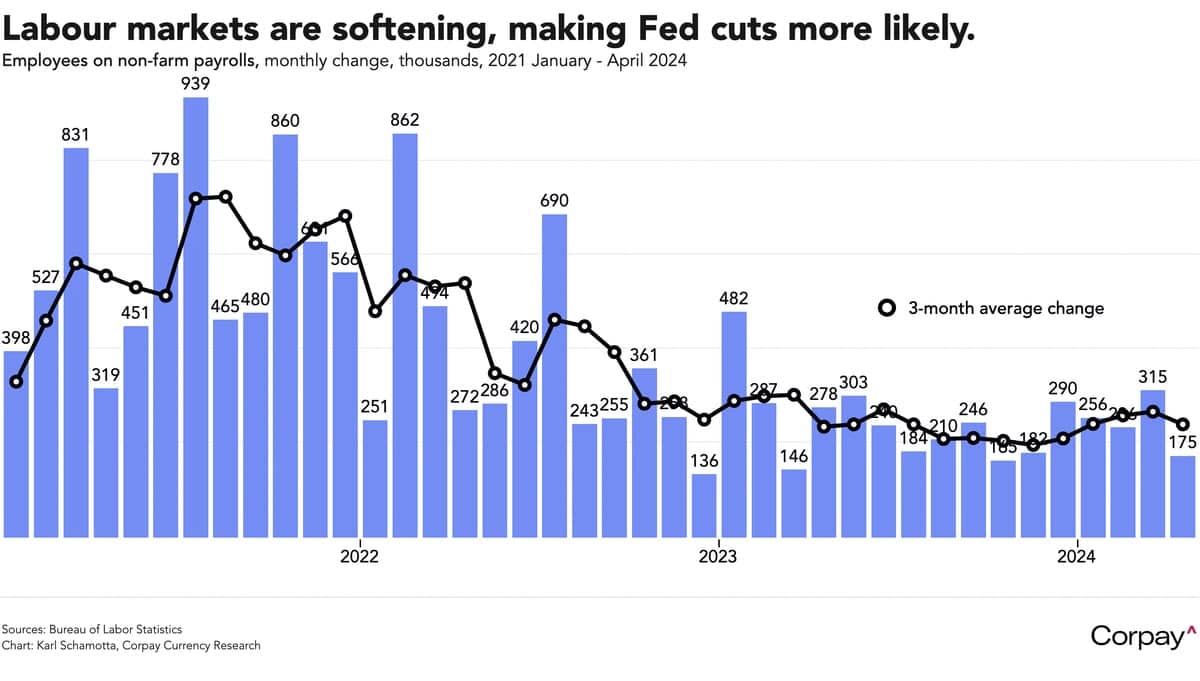

Dollar exchange rates were flattened by a decidedly soft U.S. jobs report that brings a Federal Reserve rate cut looming into sight.

The Pound to Dollar exchange rate leapt above 1.26 (+0.54%) after non-farm payrolls increased 175K in April according to the BLS, down from March's 315K and undershooting expectations for 238K.

The unemployment rate unexpectedly rose to 3.9% from 3.8% while average hourly earnings rose 0.2% month-on-month in April, down from the previous month's 0.3% and below expectations for 0.3%. The year-on-year rate fell from 4.1% to 3.9%.

"April’s employment report was weaker across the board," says Paul Ashworth, Chief North America Economist at Capital Economics. "Labour market easing puts rate cuts back on the table."

The Dollar was 0.60% down against the Euro (EUR/USD 1.0790), but suffered more sizeable losses against the 'high beta' currencies such as the Australian Dollar (AUD/USD 0.6634 +1.0) and the New Zealand Dollar (NZD/USD 0.6032 +1.20%.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The importance of the U.S. economy and Fed rate expectations reverberates right across the FX market, with these high beta currencies outperforming the likes of the Pound and Euro too. Stocks and bonds are also tearing higher, which brings down bond yields and the cost of borrowing more generally.

These figures flip the market into a Dollar-negative setup and one that favours those that benefit when investor sentiment is improving. The next major test for the Dollar will be the U.S. inflation release mid-month. Any undershoot will cement the pro-risk / USD-negative setup.

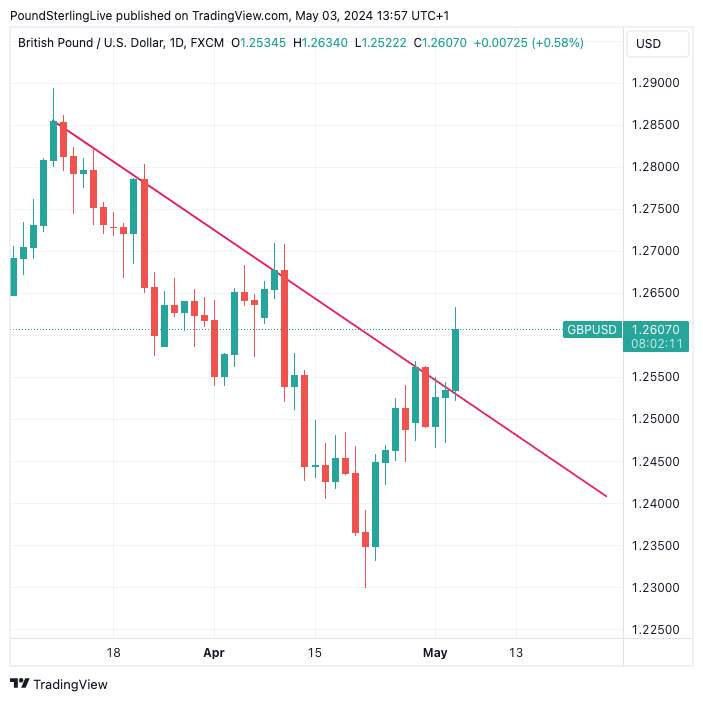

Above: The strong GBP/USD rally could mean the 2024 downtrend has come to an end. Track GBP/USD with your own custom rate alerts. Set Up Here

According to an analysis from Pantheon Macroeconomics, the U.S. employment situation will continue to weaken in the coming months.

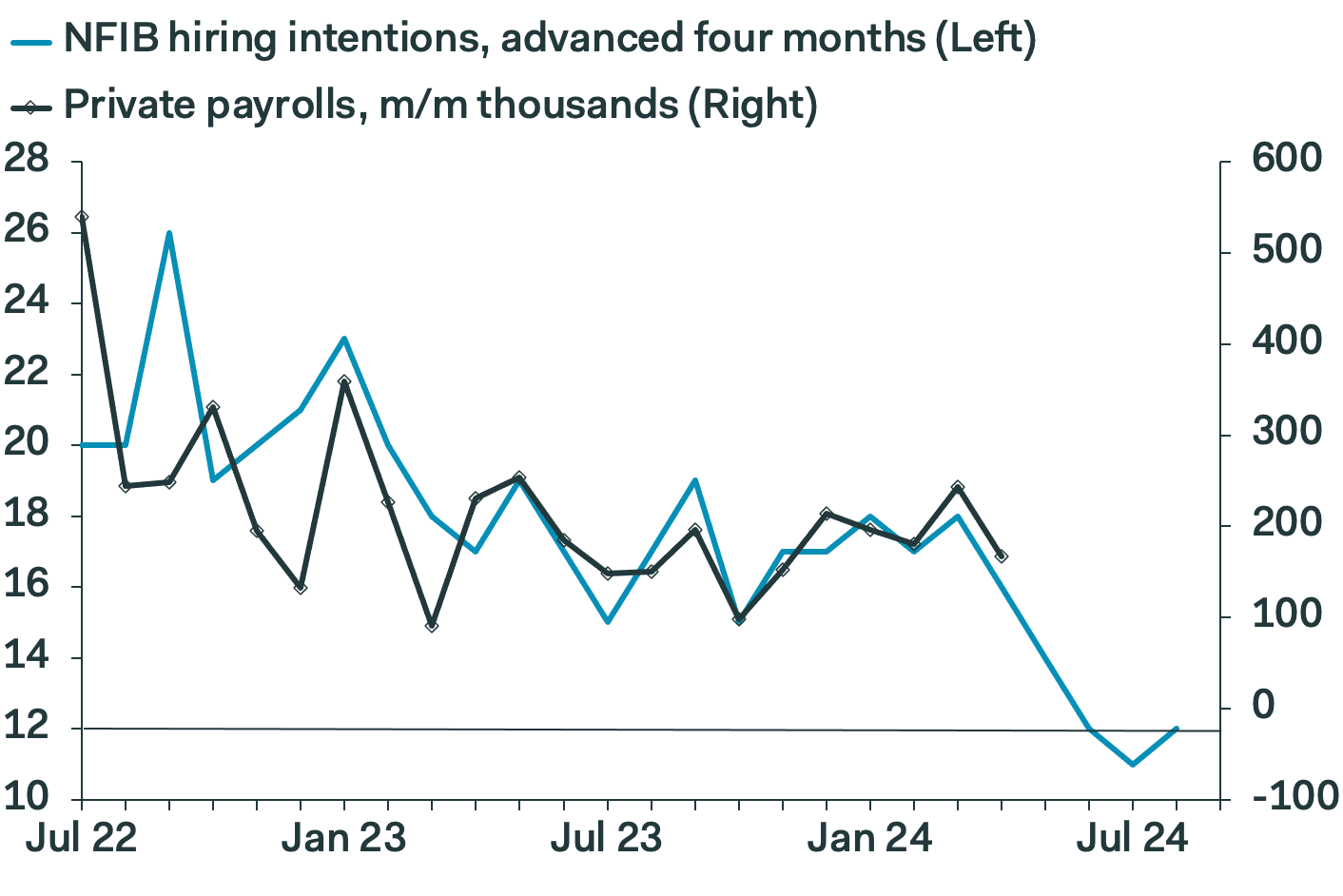

Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, says the NFIB survey of employment has proven a handy predictor for the official figures (see chart below). "The downshift in payroll growth has come exactly when the NFIB suggested it would, and the signal for the future is unambiguous... weaker numbers ahead".

Pantheon Macroeconomics forecasts 100 basis points of easing this year from the Fed, starting in September.

This is more than the market is pricing, implying further weakenss in the Dollar if fulfilled.