Trump's Right: The Strong Dollar is a Growing Problem for the U.S. Economy

- Written by: Gary Howes

File image of Donald Trump. Official White House Photo by D. Myles Cullen.

Donald Trump is onto something: the strong Dollar is seeing U.S. consumption increasingly turn to foreign providers for sustenance. But the politicisation of the Dollar could limit its upside says one analyst.

This week's official U.S. growth figures were far weaker than economists were expecting, with the details of the first quarter GDP print showing international trade dynamics to be the culprit.

U.S. economic growth came in at a 1.6 % annualised quarter-on-quarter rate during the first quarter of 2024 after rising 3.4% in the final quarter of 2023; analysts had expected a 2.5% figure. "U.S. growth slowed sharply in the first quarter," says Felix Schmidt, an economist at Berenberg Bank. "Net exports dragged overall growth down by 0.9 ppt".

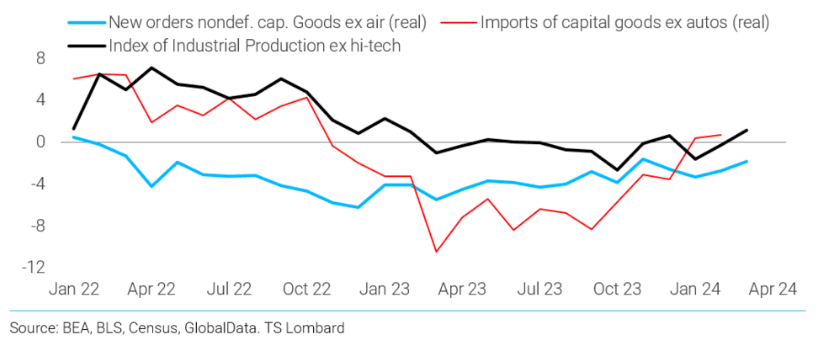

"What is problematic is the strong dollar shifting purchases of capital equipment from domestic to foreign producers – contrary to the best efforts of government policy (taxes, tariffs, and spending)," says Steven Blitz, Chief US Economist at TS Lombard.

Above: "Imports increasingly supply domestic needs for capital goods" - TS Lombard.

Presidential candidate Donald Trump said this week the Dollar was too strong and was proving "a disaster for our manufacturers and others". He said companies would be "forced to either lose lots of business or build plants... in other smart countries".

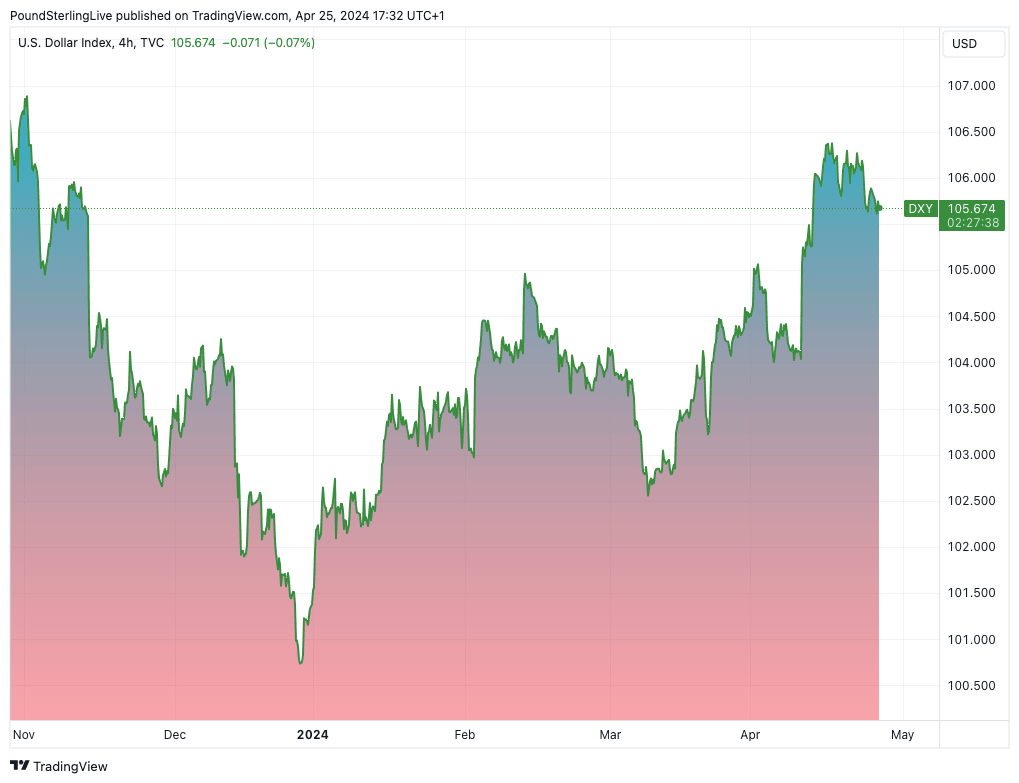

The broad Dollar is 4.25% stronger than it was at the start of 2024, making foreign goods and services cheaper for U.S. businesses and consumers and incentivising them to switch away from domestic providers. It is 18% stronger than it was in 2021.

"The weak gain in exports can be attributed to weaker global demand and the strong dollar. Even abstracting from the quarterly volatility in the data, import growth looks robust," says Felix Schmidt, an economist at Berenberg Bank.

The data indicates that although exports rose, new consumption increasingly benefits foreign suppliers, depriving domestic providers of demand.

"Why was the headline number so weak? Partly because there was a significant drag from trade. Net exports exerted a drag of 0.86 percentage points on the headline number. Without that drag, the headline number would have come in precisely in line with consensus estimates," says Tim Quinlan, Senior Economist at Wells Fargo Economics.

Above: Dollar strength. USD index shown at four-hour intervals.

The Dollar is 2024's top-performing currency, spurred higher by fading expectations for Federal Reserve rate cuts. Higher for longer interest rates maintain the attractiveness of interest-paying U.S. debt to foreign investors, whose injection of capital boosts the currency's value.

Fading hopes for rate cuts have prompted a selloff in stock markets, which only adds to the demand for the Dollar, which is favoured for its 'safe-haven' qualities.

Fundamentals are clearly in charge of the Dollar's rising valuation, but Trump sees the issue of the Dollar's strength as political.

"Of course there is an element (very large?) of playing politics here and Trump’s objective is to criticise Biden’s policies and to blame Biden for the level of the dollar and if Trump were President perhaps he would be using it as an example of US strength," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank.

Halpenny says there are other reports that suggest Trump’s political advisers are considering alternatives to increasing tariffs further on other countries.

Politico quotes some of Trump’s economic advisers as seriously studying ways to encourage other key countries to strengthen their own currencies or to face tariffs instead.

"Currency revaluation is likely to be a priority for some members of a potential second Trump administration, mainly because of the viewpoint that [an overvalued dollar] contributes to the trade deficit," a former Trump administration official told Politico.

According to Halpenny, politics is entering the Dollar debate, and this could limit its upside. "Increased politicisation of the US dollar with the dollar at these more elevated levels will certainly act to reduce speculative dollar buying at stronger and stronger levels."