Pound in Big Dip Against Dollar After U.S. Jobs Report Punts 1st Fed Rate Cut Into September

- Written by: Gary Howes

Image © Adobe Images

The U.S. Dollar recovered sharply following the release of a stronger-than-anticipated U.S. labour market report, which has pushed back the expected first Fed rate cut to September.

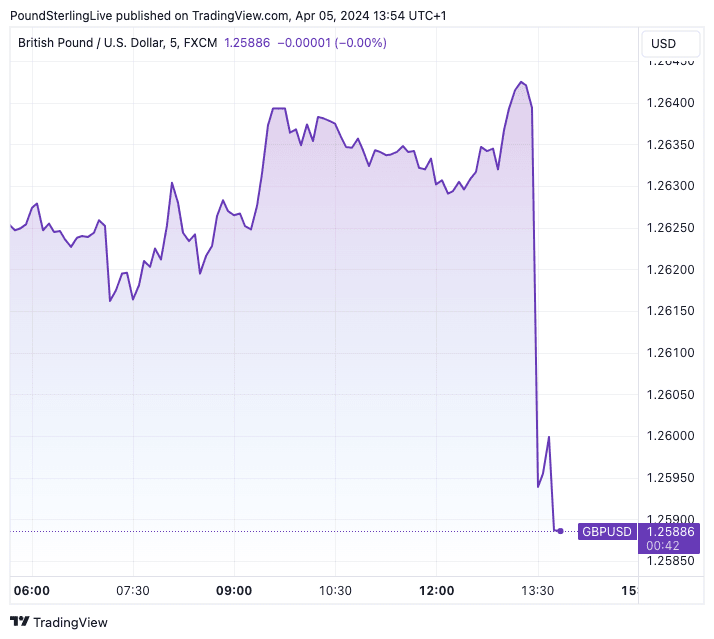

The Pound to Dollar exchange rate fell 0.40% in the five-minute window following news U.S. non-farm payrolls rose to 303K in March from 270K, exceeding expectations for 212K.

The unemployment rate unexpectedly dipped to 3.8% from 3.9%, where it was expected to stay. Average hourly earnings were steady at 4.1% in March, down on the previous month's 4.3%.

"The US job market remained hot in March with another above consensus report," says Ali Jaffery, economist at CIBC Capital Markets. "Overall, the March employment report leans against an earlier cut by the Fed."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The U.S. jobs market continues to surprise," says Catie Di Stefano at Online Gamblers. "We continue to see this reflected in discretionary spend."

The market reaction - higher bond yields, stronger USD and weaker stocks - signals the market believes these data are inconsistent with a rate cut at the Federal Reserve in June.

"There’s been a big move in treasuries on the back of this blowout jobs report: treasuries have slumped / yields risen, and the market is now fully pricing in the first rate cut from the Fed in September. This is a big move," says Kathleen Brooks, an analyst at XTB.

Above: GBP/USD at five-minute intervals showing the reaction to the post-payroll report. Track GBP with your own custom rate alerts. Set Up Here

In fact, the numbers are strong enough to diminish the odds of a July cut.

The hot print is an extension of the 2024 playbook that sees investors' expectations repeatedly flounced by perenially strong U.S. economic figures that threaten to stall the disinflation process.

The odds of rate cuts at the Fed are a mirage; always on the horizon, but on approach, it disappears. This plays into the 'stronger for longer' Dollar narrative and should keep the likes of Pound-Dollar under pressure in the coming days and weeks.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown says wages are likely to remain in an upwards trajectory.

"Not only does this make the fight against inflation more difficult, it puts a potential pin in hopes for an interest rate cut in June," she explains.

The figures show that the increase in jobs was partly because of an increase in leisure and hospitality, which has now returned to pre-pandemic levels.

"This is another indication that the economy has plenty of excess energy that may need to be tamed by continued higher rates," says Lund-Yates.