Dollar Surges against Pound and Euro As U.S. Services Inflation Corners The Fed into Another Hike

- Written by: Gary Howes

Image © Adobe Images

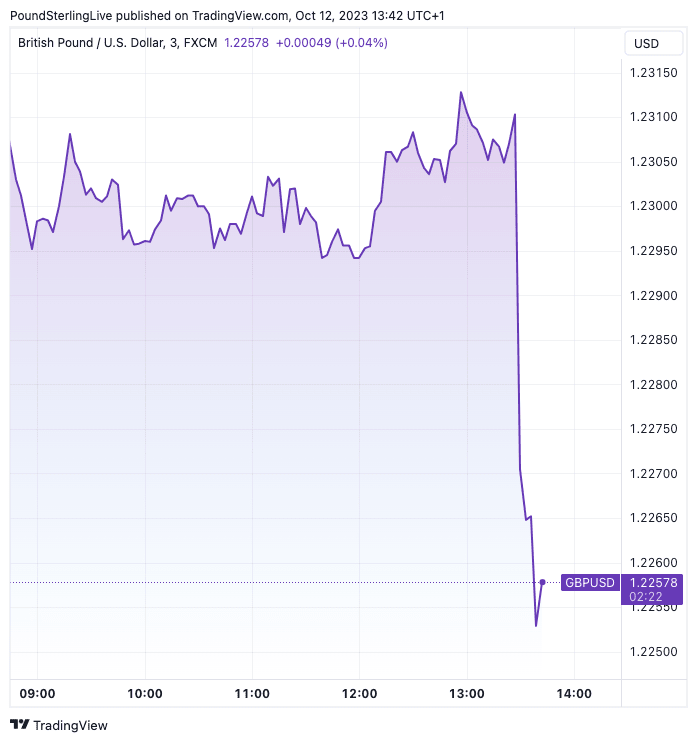

The Pound to Dollar exchange rate has fallen sharply following the release of U.S. inflation data that suggests consumer demand is picking up and the Federal Reserve will be left with few options but to raise interest rates again before year-end.

Headline and core CPI inflation readings were relatively close to the expected level, suggesting that the Dollar's initial broad-based rally following the release might have faded.

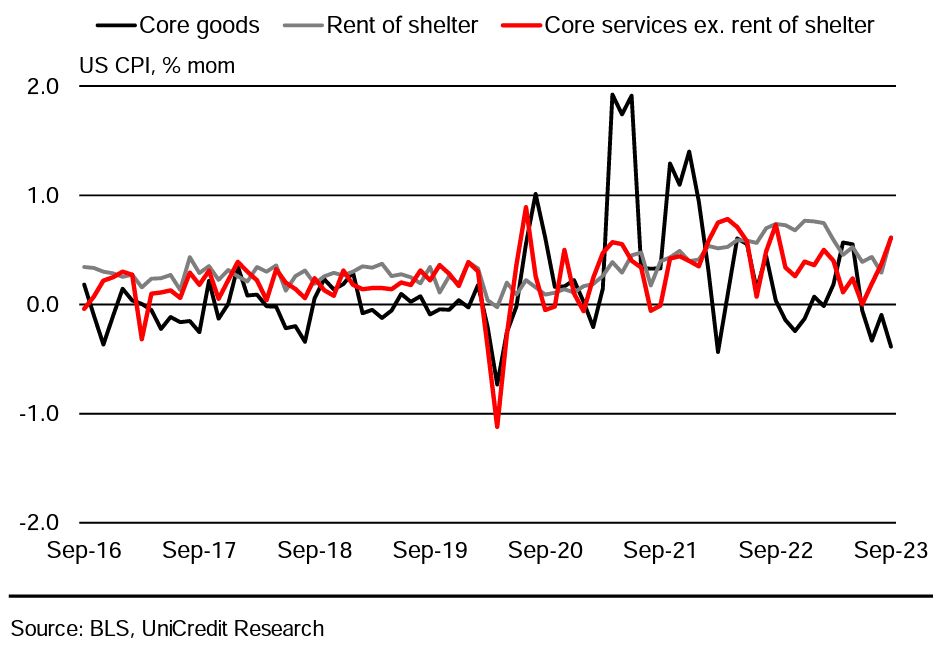

However, as the hours passed, it was clear the gains were determined to stick with a likely culprit being a strong services inflation reading. Core services (excluding shelter) registered a second consecutive month of strength, as it lifted 0.5% m/m after a 0.4% increase in the month prior.

The Fed's preferred measure of prices tied to underlying demand, non-housing services, saw another substantial increase of 0.5% in the month.

"The underlying detail in today's report suggests that demand-side price pressures are heating up and will likely require more restrictive monetary policy. As a result, we expect the Federal Reserve to raise rates in December, allowing some time for more data and to judge the durability of the tightening in the bond market," says Ali Jaffery, an economist at CIBC Capital Markets.

Above: "Non-housing core inflation jumped" - UniCredit.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

U.S. headline inflation was reported at 3.7% year-on-year in September, which is unchanged from the month prior but ahead of consensus expectations for 3.6%. The month-on-month increase in September stood at 0.4%, down on August's 0.6%, but higher than the 0.3% expected.

The Pound to Dollar exchange rate was recorded a sizeable 0.88% lower on the day at 1.2213 by the time of this update with the Euro to Dollar pair declining 0.63% to reach 1.0550. The broad USD index was 0.60% higher at 106.36 in a move that tracked a 2.0% rally in the U.S. ten-year bond yield.

The market's reaction suggests investors are again positioning for a 'higher for longer' interest rate environment as the U.S. Federal Reserve might take out another 'insurance' interest rate hike in November.

Above: GBPUSD showing the immediate reaction to the U.S. inflation release. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

"The pace of disinflation has slowed, and some of the details warrant close monitoring," says Daniel Vernazza, Chief International Economist at UniCredit Bank in London. "Taken together with last Friday’s stronger payrolls report, the CPI report means the Fed could still hike at one of the two remaining meetings this year."

But the jump in the Dollar could yet unwind given core inflation numbers met expectations at 0.3% m/m and 4.1% y/y (down on August's 4.3%).

The Federal Reserve is arguably more concerned about trends in core inflation as these are a direct result of domestic activity, whereas headline CPI inflation is prone to global factors such as fuel and food prices.

Indeed, a breakdown of the data confirms energy prices once again played a sizeable role in pushing up headline prices as the effects of the rally in crude oil prices feed through. However, this might not be a significant concern given oil prices have since fallen and suggest October's inflation reading should signal a decent cooling.

"Even if we do get an upside surprise, it is not clear that the USD will capitalise given it shrugged off last week's strong NFP print and ignored yesterday’s admittedly modest upside surprise in PPI," says Daragh Maher, Head of Research for the Americas at HSBC.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks