Pound-Dollar Eyes 1.25 as Data Suggests the U.S. "Inflation Shock is Over"

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate defended a support level just above 1.24 following the release of U.S. inflation data that will boost confidence at the U.S. Federal Reserve that the fight with inflation has been won.

To be sure, inflation came in slightly hotter than expected at 3.7% year-on-year (consensus: 3.6%, previous: 3.2%) according to the BLS, however, the majority of the lift was due to rising prices at the fuel pump.

The more important core CPI inflation reading of 4.3% y/y for August was in line with expectations and well below the 4.7% of the previous month.

Month-on-month core inflation ticked higher 0.3% which was above the expectation for a 0.2% reading and above July's 0.2% increase.

The Dollar rose in an initial knee-jerk reaction but soon returned to pre-release levels, leaving Pound-Dollar at 1.2493 and Euro-Dollar at 1.0755.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Explaining the Dollar's inability to hold the gain is an assessment by Robin Brooks, Chief Economist at IIF, that "the U.S. inflation shock is so totally over".

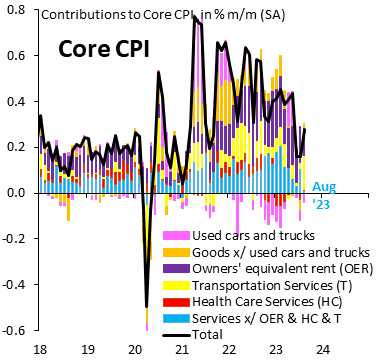

"There's lots of noise in monthly CPI data, especially via transportation and health care services. When we take those out of services inflation, the remaining "core" services inflation was ZERO inflation in August 2023. Huge!" he explains.

The data did little to convince the market to change its mind and price-in a Federal Reserve interest rate hike in September.

Above: U.S. inflation breakdown, image courtesy of @RobinBrooksIIF

"The battle against inflation is being won – but battles like this are never won in a totally straight line – they go up and down incrementally, but the trajectory is clearly favourable, and the case for stopping rate hikes is compelling," says Nigel Green, CEO of de Vere Group.

Lee Hardman, Senior Currency analyst at MUFG Ltd, says there would have needed to be a significant upside surprise in today's inflation data to alter market expectations for the Federal Reserve's upcoming September decision and of more interest is how it impacts expectations for 2024 when the Fed is expected to cut interest rates, a development that is widely tipped by analysts to weigh on the Greenback.

MUFG notes market pricing for the scale of cuts in 2024 has already been reduced owing to rising oil prices which are anticipated to rejuvenate inflationary trends.

Recent history meanwhile reveals the Dollar does tend to retreat in the immediate aftermath of inflation releases.

"Looking at price action around CPI report releases this year, the dollar index has weakened in the first 30 minutes after releases following the last six CPI reports," notes Hardman.

"While headline inflation is forecast higher, the core component, more relevant for next Wednesday’s FOMC meeting, is expected to drop. Barring upside surprises from data, the dollar should weaken," says Asmara Jamaleh, an economist at Intesa Sanpaolo Bank.

The data is unlikely to be a game changer for a market that currently favours the Dollar amidst growing concerns for growth elsewhere in the world, leaving the Pound-Dollar and Euro-Dollar at risk of further downside over the coming days.

"Inflation matters for the monetary outlook and the dollar, but appealing alternative currencies are lacking right now. Compared to US exceptionalism, the cyclical downtrend in other parts of the world like China and the Eurozone creates an environment of dollar outperformance, explaining the USD’s more than 5% gain in eight weeks. Until this narrative changes, we expect the dollar to remain firm in the short-term," says George Vessey, a currency strategist at Conve

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks