GBP/USD Rate Recovery Extends After JOLTS Surprise Followed up by Downward Revision to GDP

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate extended recent gains to touch a high at 1.2723 after a raft of U.S. economic data undershot expectations and sapped demand for the Greenback.

The Dollar initially softened on Tuesday after a key labour market survey revealed another sharp fall in available jobs in a sign that the U.S. labour market was loosening amidst a slowing economy.

The U.S. currency then took another leg lower in midweek trade after U.S. economic growth data for the second quarter was unexpectedly lowered to 2.1% from the initial estimate of 2.4% in a sure sign of cooling economic conditions that will convince the Federal Reserve it was right to pause the rate hiking cycle.

The ADP nonfarm employment report meanwhile showed growth of 177K for August, an undershoot on the expected 195K and a sharp slowdown from the previous reading of 312K.

"The Dollar was hurt from the downside surprise in U.S. jobs and consumer confidence data," says Charu Chanana, Market Strategist at Saxo Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Dollar fell Tuesday after the Job Openings and Labor Turnover Survey (JOLTS) showed a surprise slide in job openings in the U.S. at 8.83M, the lowest reading since 2021 and the sixth decline in seven months.

"The decline is accelerating. Over the past three months, 1.49 million openings have vanished, signalling rapidly falling labour demand," says Stefan Koopman, Senior Macro Strategist at Rabobank who reckons such data can underscore the Federal Reserve's decision to pause the rate hiking cycle.

"The dollar staged a major technical reversal yesterday, in a dramatic reaction to a considerably weaker JOLTs report than expected, spurring a large drop in US interest rates," says Marc Chandler, Chief Market Strategist at Bannockburn Global Forex.

Falling job vacancies suggest demand for labour is falling, which in turn suggests the upward pressure on wages can continue to fade. For the Federal Reserve, this eases the pressure to hike rates further as they can grow in confidence that wage-led inflationary pressures are falling.

This can weigh on U.S. interest rate yields which in turn is seen by analysts to be a negative for the Dollar and explains the tick higher in both Pound-Dollar and Euro-Dollar through Tuesday and into the midweek session.

Yet, most analysts remain of the view it is too soon to call an end to the July-August Dollar rebound.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Although the Dollar fell in the wake of the JOLTS data, analysts point out that not enough damage is evident on the charts to suggest a major turnaround in fortunes for the greenback is nigh, which could keep the Pound-Dollar rate under pressure.

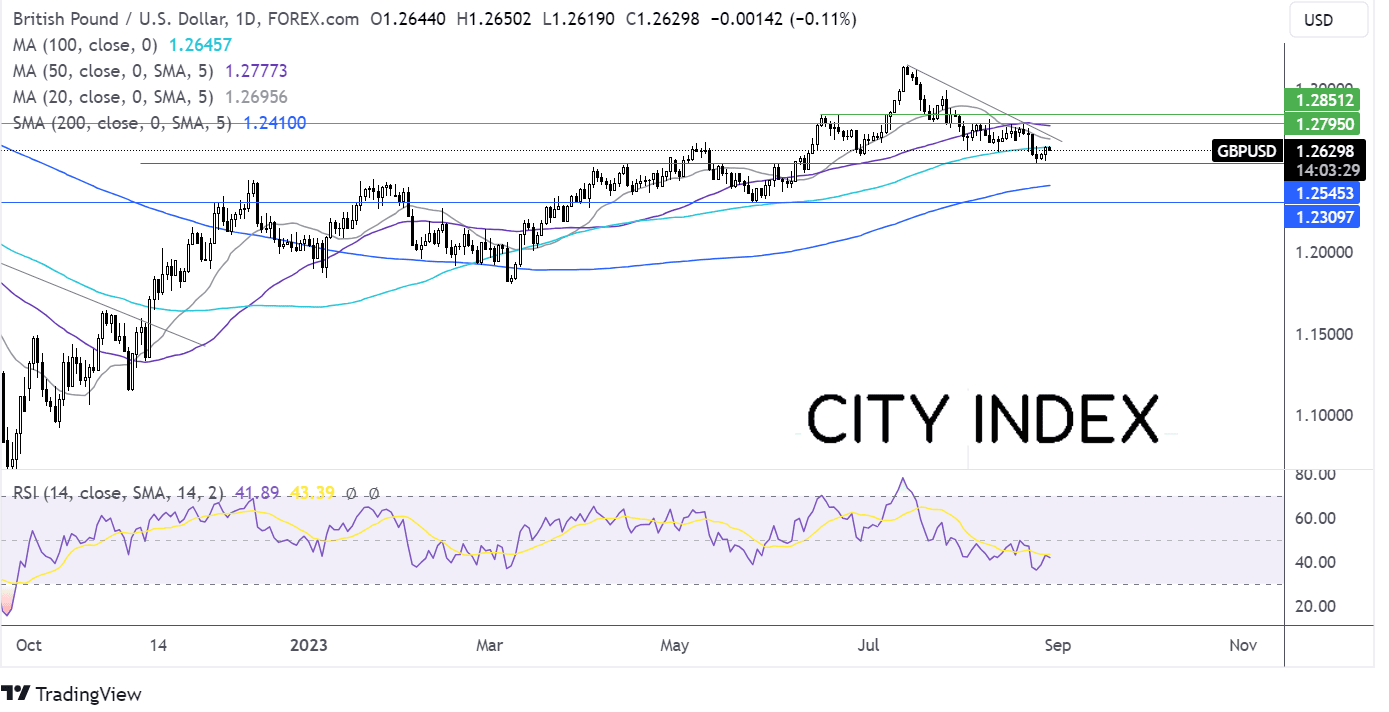

"GBP/USD has risen off its recent low of 1.2550 but remains below its falling trendline dating back to mid-July. The RSI also supports further downside while it remains out of overbought territory," says Fiona Cincotta, Financial Market Analyst at City Index.

"Sellers will look for a break below 1.2550 to extend its bearish trend towards 1.24 the 200 sma and 1.2308 the Mat low," adds Cincotta.

Above image courtesy of Martin Miller, Reuters.

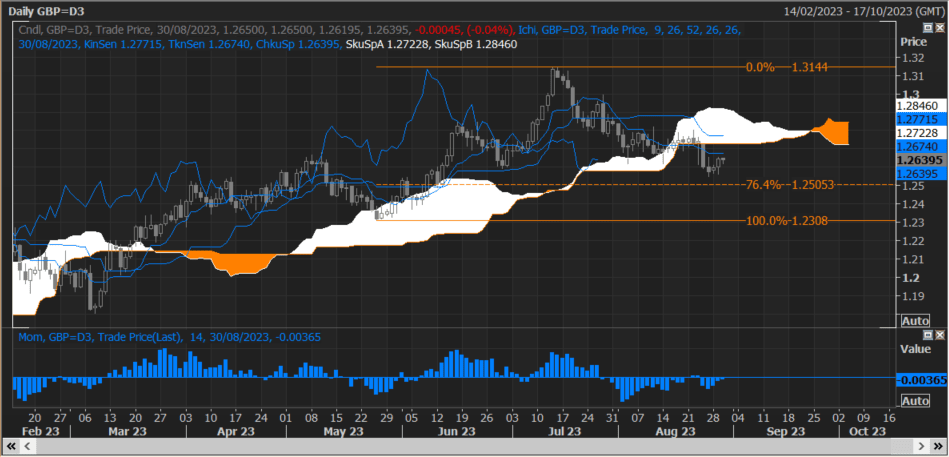

Martin Miller, a Reuters market analyst, says he would look to enter fresh bets against the British Pound on any further strength in anticipation of the downtrend ultimately resuming.

The analyst notes GBP/USD's losses have stalled ahead of the 1.2627 Fibonacci retracement level, where the 1.2627 Fibo is a 76.4% retrace of 1.2308-1.3144 (May-July) rise.

Elsewhere on the charts, Miller expects the daily cloud will likely limit recovery attempts in early September.

"Daily cloud currently spans the 1.2726-1.2919 region," says Miller, "fourteen-day momentum remains negative, reinforcing the bear market."

"We are looking to get short at 1.2670, ahead of the tenkan line at 1.2674," he adds.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks