Dollar Boosted by ADP Employment and Heavy Treasury Auctions

- Written by: Gary Howes

Image © Adobe Images

"August dull? Rangebound trading? Not a chance," says Kenneth Broux, a strategist at Société Générale, referencing the shakeup in U.S. bond markets that has in turn fed into a stronger dollar.

The Pound to Dollar exchange rate (GBPUSD) has shifted back to the 1.27 defence line in response to a rise in U.S. bond yields - which has had a magnetic pull on the Greenback - and foreign exchange strategists see the potential for further declines.

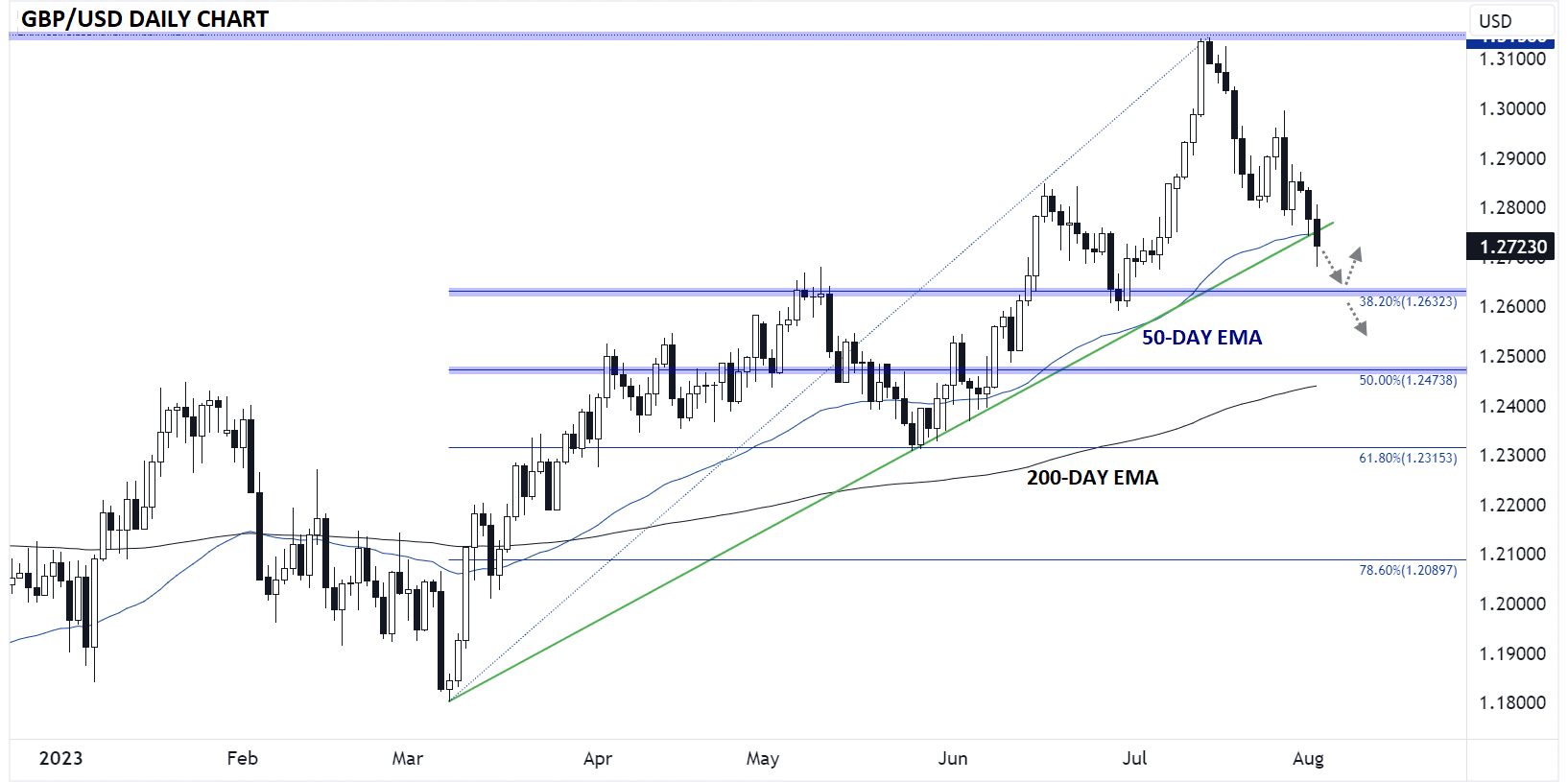

"With the greenback rising on the back of surging yields and a strong ADP report, GBP/USD is slicing through support at its 50-day EMA and bullish trend line near 1.2750. From a purely technical perspective, the pair may now have room to extend its drop toward the 38.2% Fibonacci retracement of the March-July rally at 1.2630 next," says Mathew Weller, an analyst at Forex.com.

Image courtesy of Forex.com.

The Dollar's strengthening rally has some stronger-than-forecast U.S. labour market data to thank, as well as an increase in the amount of debt being offered by the U.S. Treasury as it seeks to fund the government.

"Bond yields and the dollar stay in the ascendancy this morning after a tumultuous session yesterday which saw US 10 yields and swaps race into new ranges after above forecast ADP and modestly larger than forecast increases in Treasury refunding auction sizes," says Broux.

The ADP non-farm employment change showed a 324K increase in jobs in July, vastly outstripping the consensus expectation for a rise of 189K and pointing to underlying strength in the labour market.

With the labour market showing little signs of weakness, market participants are concerned that domestic inflation pressures will remain elevated and add to bets the Federal Reserve might have to raise interest rates again before 2023 is out.

This results in higher U.S. bond yields, which boosts the Dollar and weighs on stocks. The Dollar then finds further support as falling stocks suggest a negative investor sentiment, which makes its safe-haven status shine.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The more interesting dynamic, however, is the Treasury refunding sizes, particularly as they come in the wake of the hullaballoo caused by Fitch's downgrade of U.S. sovereign debt.

"Fitch caused tempers to flare in political and (some) economic circles and cannot be detached completely from the price action in bonds and equities yesterday," says Broux.

"In a world of deteriorating fiscal metrics, the increase in Treasury refunding auctions (bond supply) to meet long-term borrowing needs will not help in reining in bond yields if the underlying economy (labour market, inflation) keeps defying calls of recession," he explains.

Looking ahead, more of the same could be on the menu for bonds and the Dollar:

"The refunding coincides with above forecast estimates for payrolls tomorrow and US CPI next week, then logically the higher auction sizes must translate into lower prices and higher yields," says Broux.

Looking ahead, U.S. jobless claims and the services ISM are on tap Thursday and Société Générale says they could offer an opportunity for yields and the dollar to consolidate, "but adjustment of position before what could be a solid NFP print tomorrow could pile on the misery for Treasuries and give the dollar another shot in the arm."

"Looking a bit further afield, Friday’s US Non-Farm Payrolls report also has the potential to inject some volatility into GBP/USD. Traders and economists are expecting job growth to hold steady near 200K this month, with average hourly earnings anticipated to slow to 0.3% m/m from 0.4% last month," says Weller.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks