UOB: GBP/USD Rate's Rally Has the Momentum

- Written by: Gary Howes

Image © Adobe Images

A surge in momentum behind the Pound-Dollar exchange rate (GBPUSD) should take it higher and it is too early to expect a material pullback on a technical basis, according to a new analysis.

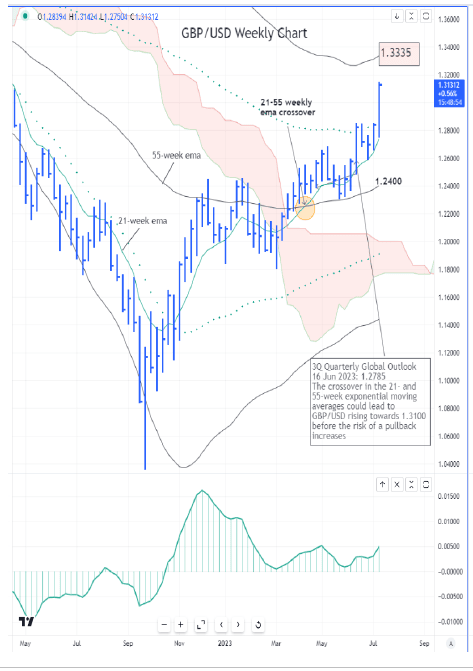

United Overseas Bank (UOB) says in a new technical analysis the exchange rate is likely to continue to head higher towards the top of the weekly exponential moving average envelope.

UOB noted in its third-quarter 2023 Quarterly Global Outlook, published on 16 June 2023, when GBP/USD was trading at 1.2785, that the crossover of the 21- and 55-week exponential moving averages in GBP/USD.

Analysts noted the development could lead to GBPUSD rising to 1.3100 before the risk of a pullback increases.

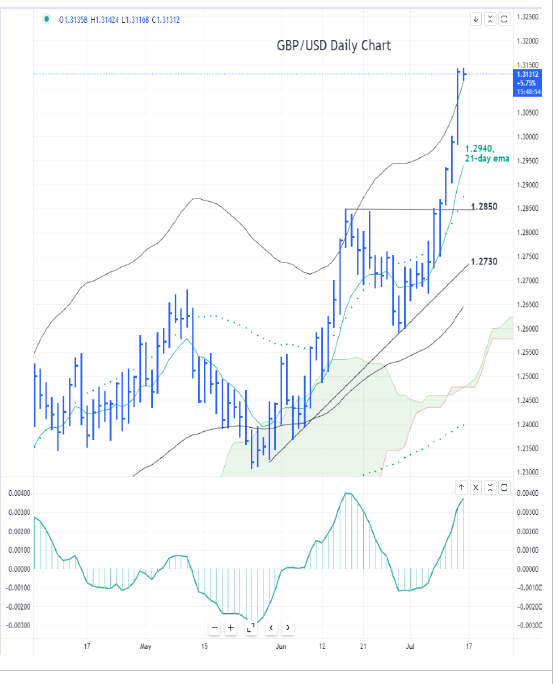

"After trading below the short-term resistance level of 1.2850 for a few weeks, GBP/USD lifted off earlier this week, and yesterday (13 July 2023), it surged past our objective of 1.3100 (high of 1.3144)," says Quek Ser Leang, Markets Strategist at UOB in Singapore.

Above image courtesy of UOB.

GBPUSD reached a fresh 2021 high and another key figure at 1.31 on Thursday as the strong rally ignited by the release of softer-than-expected U.S. inflation data midweek extended, propelled by a bonfire of short positions and a soft U.S. PPI inflation release.

"The strong boost in momentum suggests GBP/USD is unlikely to pullback," says Leang. "Instead, it is likely to continue to head higher towards the top of the weekly exponential moving average envelope."

The UOB analyst identifies this next major resistance level at 1.3335.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"In order to maintain the strong buildup in momentum, GBP/USD should not break below the ‘breakout’ level of 1.2850 in the next month or so," says Leang.

The key support level is said to be located at the rising trendline, now at 1.2730. From the perspective of several months, the 55-week exponential moving average (now at 1.2400) is unlikely to come under threat, according to the analysis.

Above image courtesy of UOB.

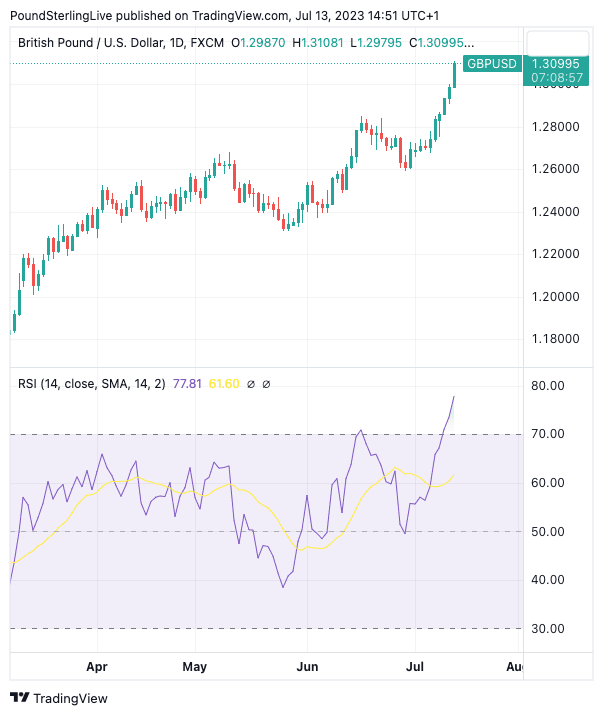

GBPUSD this week sliced through 1.30, a key level littered with speculative shorts and take-profit levels as traders bet this big figure would be where a turnaround might shape up.

Pound Sterling's ascent has therefore potentially ignited a bonfire of short positions that propelled the exchange rate in quick time through thin air to 1.31.

However, a rapid acceleration in the rally also leaves the pair looking richly priced on the daily timeframe, with the RSI screaming of overbought conditions:

Above: GBPUSD at daily intervals with the RSI in the lower panel.

The Relative Strength Indicator (RSI) is a momentum signal that can also warn when an asset is overbought (a reading above 70) or oversold (below 30). The RSI will ultimately return back to between 30 and 70, and for this to happen GBPUSD must consolidate or retreat lower.

For now, any consolidation would likely be considered short-lived given the majority of technical indicators remain positive and dips would likely be bought into.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks