GBP/USD Rate Hits 1.31, Now Screams Overbought

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate (GBPUSD) reached a fresh 2021 high and another key figure at 1.31 on Thursday as the strong rally ignited by the release of softer-than-expected U.S. inflation data midweek extended, driven by a bonfire of short positions and a soft U.S. PPI inflation release.

Core and headline PPI inflation were up 0.1% m/m vs 0.2% forecast, "underpinning USD-negative belief that Fed is nearly done with hiking," says Robert Howard, a Reuters market analyst.

GBPUSD sliced through 1.30, a key level littered with speculative shorts and take-profit levels as traders bet this big figure would be where a turnaround might shape up.

Pound Sterling's ascent has therefore potentially ignited a bonfire of short positions that propelled the exchange rate in quick time through thin air to 1.31.

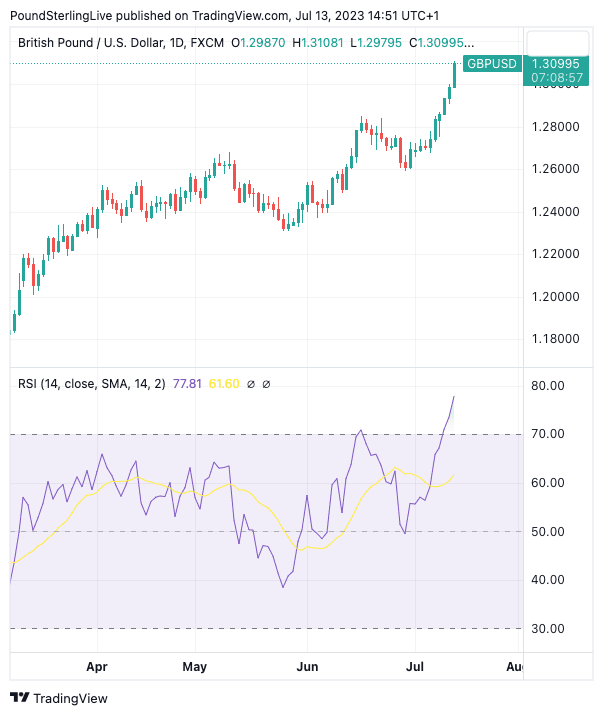

However, a rapid acceleration in the rally now leaves the pair looking richly priced on the daily timeframe, with the RSI screaming of overbought conditions:

Above: GBPUSD at daily intervals with the RSI in the lower panel.

The Relative Strength Indicator (RSI) is a momentum signal that can also warn when an asset is overbought (a reading above 70) or oversold (below 30). The RSI will ultimately return back to between 30 and 70, and for this to happen GBPUSD must consolidate or retreat lower.

For now, any consolidation would likely be considered short-lived given the majority of technical indicators remain positive and dips would likely be bought into.

From a fundamental perspective, the Pound is tipped by some analysts to remain supported as the Bank of England drives through further rate hikes in August and September. This will cement UK yields above those of the U.S. and Eurozone, offering support for the Pound via the carry channel.

The Dollar is meanwhile finding little support as analysts bet the Fed has completed its rate hiking cycle, while the strong demand for stocks and other 'risk on' assets is also typically a negative for the currency.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks