Dollar Back on the Front-foot this Week: Jefferies

- Written by: Sam Coventry

Image © Adobe Images

In a significant week for monetary policy, the U.S. dollar is poised to regain strength, with market analysts anticipating a positive trajectory. W. Brad Bechtel, Global Head of FX at Jefferies LLC, highlights the key events on the horizon, including policy meetings by the Federal Reserve, the European Central Bank (ECB), and the Bank of Japan (BoJ).

The first major catalyst is the release of U.S. inflation data, which will set the stage for the Federal Reserve's decision and potentially determine whether a pause or a rate hike lies ahead. Bechtel suggests, "The Fed is expected to remain on hold and most now expect the BoJ to remain on hold as well, although there is still a small contingent that is looking for a YCC adjustment. The ECB is expected to hike, and many expect one more hike after this."

Acknowledging the uncertainties surrounding the Federal Reserve's decision, Bechtel notes that recent data has supported both a rate hike and a pause. He emphasizes the importance of the Consumer Price Index (CPI) in influencing market sentiment, with a predicted 0.4% month-on-month core reading and a year-on-year headline drop to 4.1%.

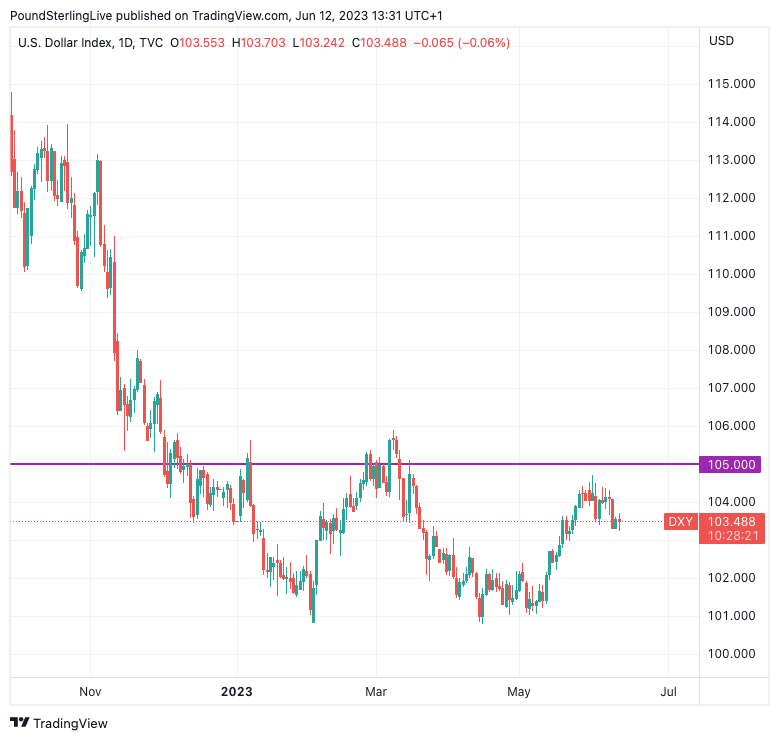

Above: The Dollar index - a broad measure of USD performance - and a potential target set out by Jefferies' Bechtel.

Considering the overall market outlook, Bechtel underscores the impact of U.S. growth and persistent inflation on the dollar's performance. He states, "For the USD, the decision by the Fed matters, but with US growth still holding in well and inflation proving to be stubbornly sticky, the market is forced to consider the Fed's base case, which is higher for longer, and that is USD positive."

Currently, the U.S. Dollar Index (DXY) has retraced slightly, settling around the 100-day moving average at an opening level of approximately 103.39, following its recent ascent towards 105. Bechtel projects that unless a dovish pause materializes, which remains a possibility, the U.S. dollar is expected to regain strength throughout the week, potentially targeting and surpassing the 105 level.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks