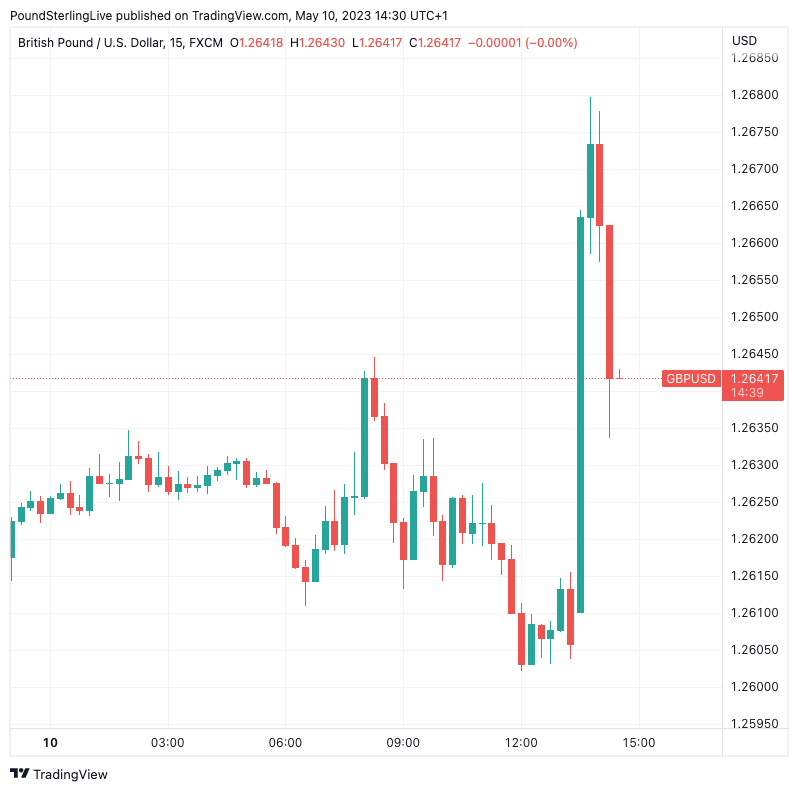

GBP/USD Rate Paints Fresh Highs in Wake of U.S. Inflation Release

- Written by: Gary Howes

Image © Adobe Images

The Dollar fell to fresh multi-month lows against Pound Sterling after new data showed inflation in the world's largest economy continued to cool, raising expectations the Federal Reserve has ended its interest rate hiking cycle.

The Pound to Dollar exchange rate (GBPUSD) hit 1.2680 - its highest since April 2022 - after headline CPI inflation rose 4.9% year-on-year, down from 5.0% in March and undershooting expectations for 5.0%.

The monthly increase stood at 0.4%, in line with expectations but up on March's 0.1% gain.

The all-important core CPI inflation figure read at 0.4% month-on-month in April, in line with expectations and unchanged on March, taking the year-on-year reading to 5.5%.

"US CPI came in mostly as expected – although a touch softer at the margin. This should be supportive of equities and a slightly bearish USD for the trading session today as the market breathes a sight of relief for now," says Ryan Brandham, Head of Global Capital Markets for North America at Validus Risk Management.

GBPUSD has risen 4.6% in 2023 amidst expectations that falling inflation in the U.S. will put the Federal Reserve on pause while also raising speculation that rate cuts will be delivered before the year is done.

The data is supportive of the trend of Dollar weakness which could allow Pound Sterling - 2023's top-performing major currency - to extend its uptrend.

"We are now taking an outright constructive stance," says Kamakshya Trivedi, Head of Global FX at Goldman Sachs, regarding his bank's decision this week to hike its forecasts for the Pound.

The Federal Reserve raised interest rates by 25 basis points again last week but the guidance ratified market expectations for a pause at upcoming meetings.

With inflation trending lower such expectations will be further cemented.

"Today’s data was in line with expectations and does not change our view that the Fed has now paused its interest rate hikes," says Karyne Charbonneau, an economist at CIBC Capital Markets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

FX market focus now falls on the scale of rate cuts to come from the Federal Reserve, with markets priced for up to 66 basis points of cuts by year-end.

The Fed will have to ratify such expectations at coming meetings in order for the Dollar's downtrend to extend, but this would require inflation to trend lower in a more convincing fashion.

CIBC Capital Markets warn the market is wrong to expect interest rate cuts in 2023.

"The still hot pace in core inflation also reaffirms that rate cuts are not in the cards for this year," says Charbonneau.

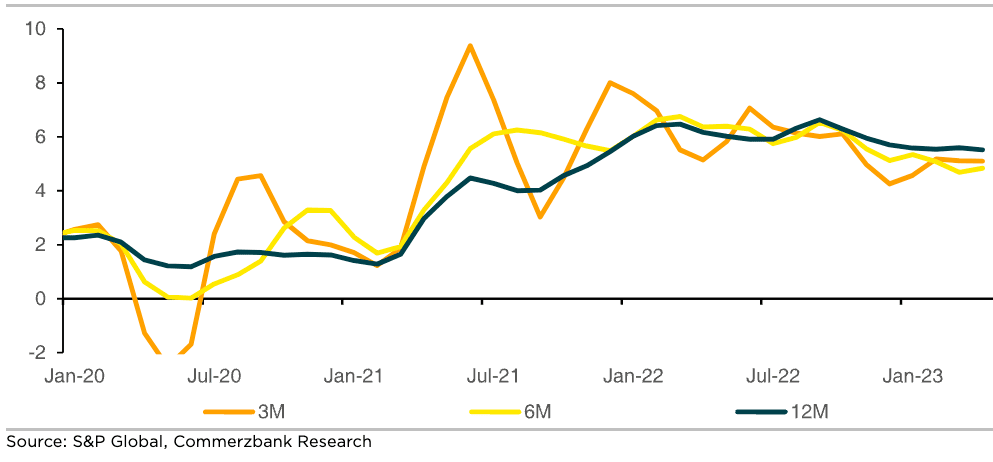

"Although inflation has passed its peak, it is declining only very slowly. We see our view confirmed that the underlying inflation problem has not been solved and that market speculation about near-term interest rate cuts by the Fed is misplaced," says Dr. Christoph Balz, Senior Economist at Commerzbank.

Above: "Underlying inflation hardly slowing down" - Commerzbank. Chart shows consumer price index excluding food and energy, 3-/6-/12-month changes, annual rate in %.

Balz says the Fed has a stubborn inflation problem to fight and a rapid decline in inflation toward its target is not yet on the horizon.

"However, it is apparently worried that it might overdo it with rate hikes and then risk a hard landing for the economy," he explains.

The U.S. economy is slowing with 500 basis points of Fed rate hikes impacting business, consumers and - most recently - the banking sector. Raising interest rates further could deepen issues experienced by mid-tier U.S. banks and create a serious financial crisis that would trigger a deep economic downturn.

"Thus the peak in the funds rate has probably been reached. However, stubborn inflation confirms our forecast that the Fed will not cut rates this year," says Balz.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks