Dollar Rebounds from Lows against Euro and Pound as Retail Sales Disappointment Prompts Safe Haven Bids

- Written by: Gary Howes

Image © Adobe Images

The Dollar rallied and stocks fell on the release of U.S. retail sales data that came in well below expectations.

U.S. retail sales fell 1.0% month-on-month in March, exceeding estimates for a 0.4% fall, providing further evidence the U.S. economy is headed for a growth setback.

The Dollar has typically fallen on the release of bad economic news over recent weeks with the thinking being such outcomes increase the odds of Federal Reserve rate cuts later in the year.

But the foreign exchange market is notoriously treacherous and the Dollar actually rallied after today's soft data.

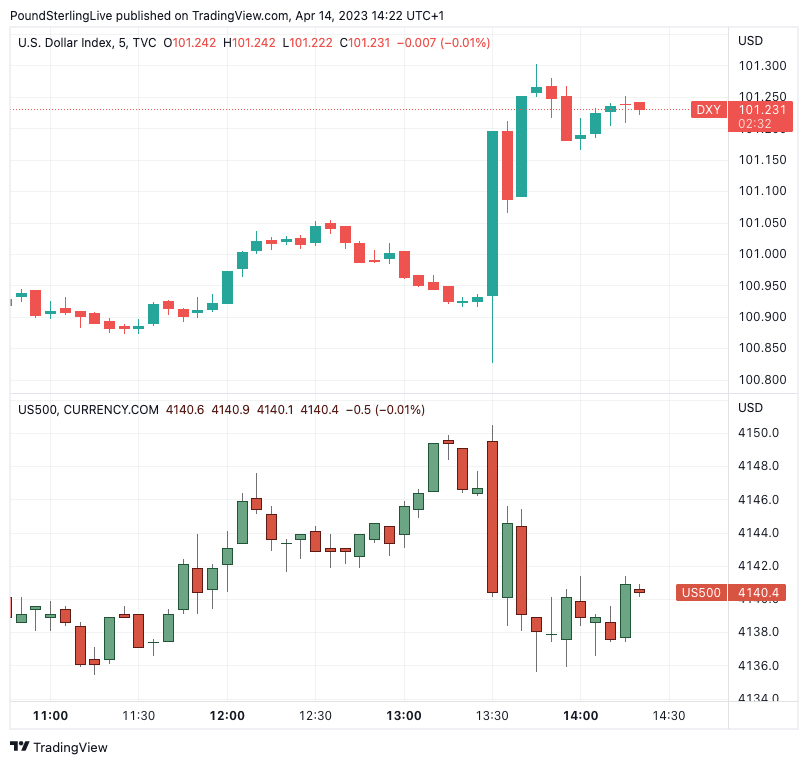

A look at the charts reveals the Dollar rose as the S&P 500 stock market fell, indicating that the currency received a safe-haven bid:

Above: The Dollar index rebounded as U.S. stocks retreated.

The thinking, therefore, is that a recession is bad for U.S. stocks which is, in turn, supportive of the Dollar.

The Pound to Dollar exchange rate retreated 0.40% on the day following the data to 1.2474. The Euro to Dollar rate fell back from one-year highs to quote at 1.1030.

"While the data adds to the souring in dollar sentiment, the greenback could catch a safe-haven lift if the numbers weigh on risk appetite and spur broader concerns about global growth," says Joe Manimbo, Senior Market Analyst at Convera.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Ryan Brandham, Head of Global Capital Markets for North America at Validus Risk Management says the Dollar could also be finding a bid as positions are squared following another torrid week for the currency.

"Excluding autos, gas and the control group, the numbers were stronger than expected, which may cloud the market reaction and potential positioning squaring into the weekend by market participants," he says.

Excluding gas and autos, retail sales fell 0.3% in the month to March while core retail sales retreated a more severe 0.8%, more than doubling the expectation for a retreat of 0.3%.

The outlook for the U.S. Dollar nevertheless looks challenging with analysts at BNP Paribas today saying the currency is now on track to experience a long-term period of decline.

BNP Paribas Securities Corp's Head of Americas Macro Strategy, Calvin Tse, says even in the case of a global risk-off event, USD strength from safe-haven demand would be limited.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Tse notes that the USD retraced in March as data started to show a slowdown in the U.S. economy, leading to a fall in US real yields and curve steepening pressures.

He believes that this coupled with positive yields outside the U.S. and a more hawkish European Central Bank (ECB) should spur the repatriation of funds by European and Japanese investors, who have been overweight US assets for much of the past decade.

"All in all, this supports our longstanding thesis that we are at the beginning of a multi-year structural USD decline," Tse added.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks