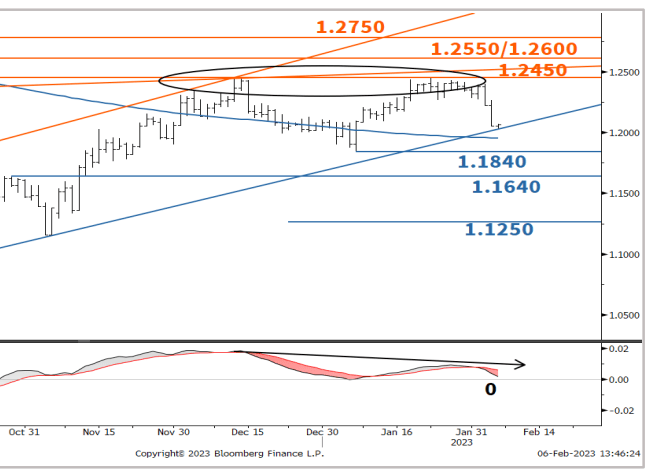

Can the GBP/USD Pullback go as Low as 1.1250?

- Written by: Gary Howes

- USD in strong comeback following jobs report

- GBP/USD failures create 'double top' pattern

- Key technical support level at 1.1840

- Break opens the door to levels as low as 1.1250

Image © Adobe Images

The Dollar has made a notable comeback following some surprisingly hot U.S. labour market data, leading market participants to query whether this is the start of a more sustained move or just a counter-trend blip.

The Dollar rose against all its major peers after it was reported the U.S. created in excess of 500K jobs in January, a figure that trebled the amount markets were expecting.

After all, the narrative of recent months is that the U.S. economy was sliding into recession and this would bring down inflation and allow the Federal Reserve to end its interest rate hiking cycle.

"That surprise 500-thousand-plus job gains we saw on Friday means the market may gravitate towards 'higher for longer' narrative which may help provide support for the dollar on the dips," says Fawad Razaqzada, Market Analyst at City Index.

In fact, ahead of the data release bets had risen that the Fed would start cutting by the middle of the year.

All these developments weighed on the Dollar against most major currencies.

But a strong payrolls figure flies in the face of these assumptions, forcing investors to backtrack on bearish-Dollar positions.

The Pound to Dollar exchange rate had probed the 1.24 level again just days ahead of Friday's data, and the capitulation lower to current levels around 1.2050 leads to questions as to whether the top is now in.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"GBP/USD has failed to reclaim December peak of 1.2450 on second attempt forming a double top. Daily MACD has started posting negative divergence denoting receding upward momentum. A short-term pullback is not ruled out," says Tanmay G Purohit, a technical analyst at Société Générale.

Purohit is particularly interested in the neckline of the formation at 1.1840, which is said to be a crucial support.

"A break can lead to an extended down move towards 1.1640 and target of the pattern at 1.1250," says Purohit.

Image courtesy of Société Générale.

The Dollar has risen alongside U.S. bond yields as investors have begun to price in a higher interest rate profile in the U.S.

Money market pricing shows the probability of another 25 basis point rate hike in March rise to almost 100%, while that of another 25bp hike in May has jumped to 67% from about 40% a week ago.

"Investors are realising that the Fed may, after all, have to maintain a contractionary monetary policy in place longer than expected in order to dampen inflationary pressures that could arise from a tighter labour market," says Razaqzada.

W. Brad Bechtel, Global Head of FX at Jefferies, says last Friday's labour market report was a bit of a watershed moment for markets.

"But it is only one data point for now and markets are wrestling with how to interpret what was revealed there. Many of the FX pairs are starting to show trend reversal patterns developing," he says in a regular daily briefing to clients.

The sharp reversal higher in the Dollar index, and the associated reversal in the likes of GBP/USD and EUR/USD, signals to Bechtel some recent trends are possibly set to reverse.

"We'll see if EUR/USD can continue to grind lower, through minor support levels like the Jan 18 low and continue or if we run out of steam, the next couple days matter in that regard. Same for DXY, USD/JPY, GBP/USD and many of the Asian pairs that have done so well this year thus far," he says.

With the Dollar being the driving force behind GBP/USD all eyes now turn to the next release of U.S. inflation, due February 14.

The Dollar would rise further should inflation come in stronger than markets are expecting as this would reinforce the message from the jobs report; namely that the economy remains strong enough to churn out uncomfortably high inflation rates.

Another below-consensus decline could however prompt Dollar weakness as investors are more inclined to view the labour market figures as a blip and that a narrative of a slowing economy and an end to Fed rate hikes remains intact.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks