Dollar Falls against Euro and Pound after Powell Signals the Fed has Completed the Heavy Lifting

- Written by: Gary Howes

- USD lower in wake of Fed Powell's comments

- Says disinflation underway

- But Fed looks set to raise rates again

- As too soon to "take a breather"

Image © Adobe Images

The Dollar fell sharply against the Pound, Euro and other major currencies after the Chair of the Federal Reserve said the U.S. economy would not require significantly more rate hikes to bring inflation lower.

The Fed raised rates by 25 basis points, as expected, and the Dollar strengthened following guidance that further rate hikes were required, but Jerome Powell's press conference following the decision triggered significant market moves.

"For the first time, we can declare that a deflationary process has begun," said Powell in an acknowledgement that previous hikes were making an impact.

But it was after Powell was asked by a member of the press whether he was worried about easing financial conditions (the cost of money in the U.S. has been falling since October) that markets took off.

"We think that financial conditions have tightened significantly in the past year," Powell said in comments interpreted as being consistent with an acknowledgement that the Fed was close to completing its task.

"The market has seemingly decided that Powell’s press conference was more dovish than anticipated," says Matthew Weller, an analyst at Forex.com.

"Powell did his best to try and talk tough but ultimately came up short as the market smelt out and clung onto the dovish parts of his press conference," says a note from the institutional FX dealing desk at JP Morgan.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Initial Dollar Strength

The Dollar strengthened ahead of the press conference as investors digested the Fed's statement in which it said further rate hikes were needed, disappointing those market participants wanting a firmer commitment to ending the hiking cycle.

"Inflation has eased somewhat but remains elevated," the statement said, adding "the Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

The plural "increases" would imply more than one additional hike remains.

"The Fed delivered the highly anticipated quarter point rate hike, and didn’t yet opt to signal a pause or give any solace to markets that are pricing-in rate cuts for the second half of the year," says economist Avery Shenfeld at CIBC Capital Markets.

The hike now takes the target range for the federal funds rate to 4.5%-4.75%,

"Policymakers did not see this as an opportunity to take a breather," Powell said. "A pause is not something that the FOMC is on the point of deciding right now."

Press Conference Delivers the Surprise

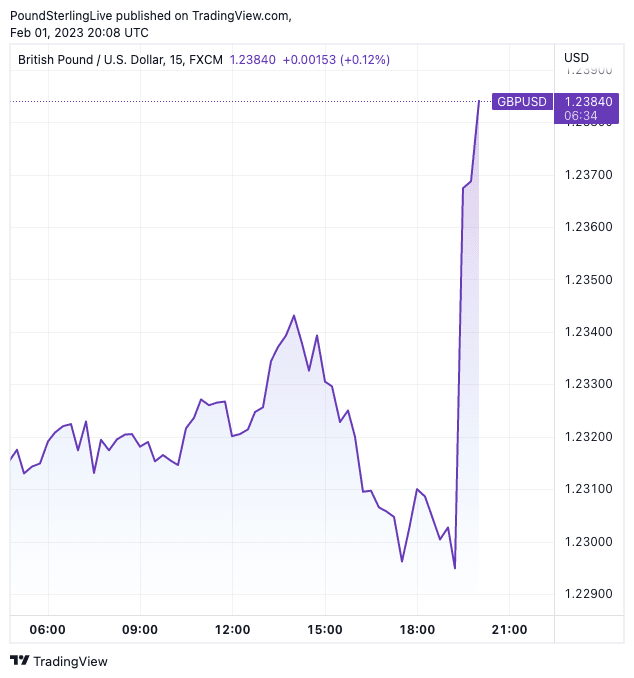

Above: The spike in GBP/USD registered as Powell delivered his press conference. Consider setting a free FX rate alert here to better time your payment requirements.

But the press conference was, on balance, more 'dovish' than expected and we did not see Powell push back against expectations for a rate cut later in the year.

"It seems the neutral FOMC statement and the news conference have seen the Fed avoiding offering much of a pushback against conviction expectations of a peak in the Fed Funds rate in March and a subsequent 50bp easing cycle through the second half of this year. Indeed, markets have priced an extra 10bp of easing this year," says James Knightley, Chief International Economist at ING.

U.S. stock markets were initially lower in the wake of the hike and associated guidance, suggesting a tinge of disappointment that the Fed was not more forthright in signalling an impending end to the hiking cycle. But Powell's verbal messaging underscored a view that the end was in fact in sight.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Dollar was particularly soft against the Euro, falling 1.20% to €1.0983, thanks to ongoing expectations for a series of 50bp rate hikes from the European Central Bank during Q1.

The Pound to Dollar exchange rate rose back to 1.2382 following Powell's comments. Bank account transfer rates are higher again at approximately 1.2130, competitive cash and holiday rates at 1.22250 and competitive transfer rates at 1.2340.

Although the Federal Reserve acknowledges inflation remains elevated it opted to remove mention of the sources of said inflation; a potential signal its concerns are easing following a succession of softer-than-forecast inflation prints.

"There's only one further 25 bp hike ahead, as the FOMC will be less willing to deliver as much economic pain as it might previously have thought would be necessary should inflation run at the more moderate pace we’ve been seeing in the last 3-6 months," says Shenfield.

The decision and statement are therefore broadly consistent with a view that the Fed's hiking cycle is now firmly in view, even if it doesn't want to signal the all-clear.

Dollar strength will therefore likely continue to be faded.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks