Dollar Rallies against Pound and Euro Following U.S. Labour Market Beat

- Written by: Gary Howes

Image © Adobe Stock

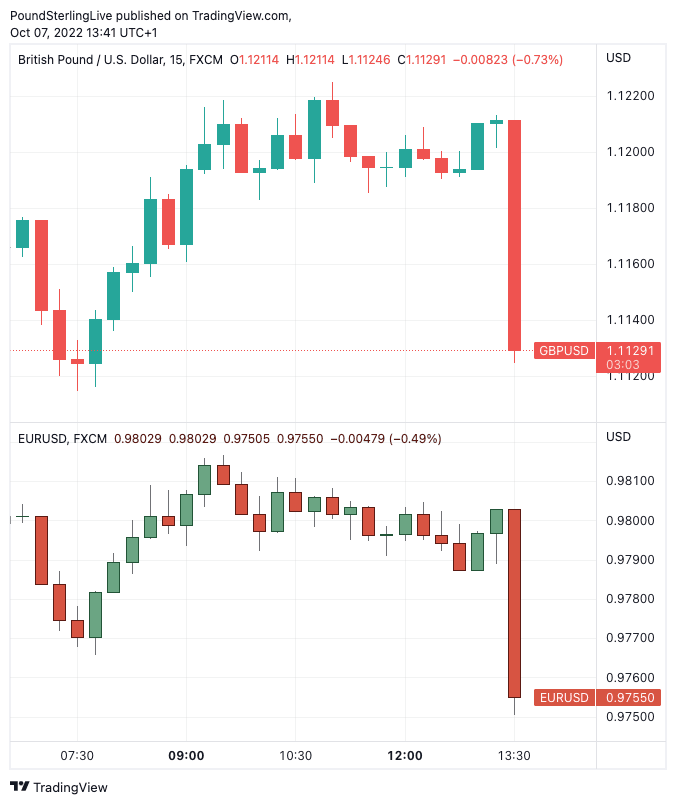

The Dollar went sharply higher against the Euro, Pound Sterling and most other currencies following the release of U.S. labour market data that betrayed a healthy economy and invited the Federal Reserve to maintain a policy of aggressive interest rate hikes.

The Pound to Dollar exchange rate fell 0.70% in the 15-minute period following non-farm payroll data that showed 263K jobs were added in September, defying expectations for a rise of 250K.

The outcome was entirely consistent with a stronger Dollar, with the Euro-Dollar exchange rate falling half a percent.

"Once more we are back to buying the dollar and selling stocks," says Chris Beauchamp, chief market analyst at IG. "Those hoping for a Fed pivot have been sorely disappointed with today’s job numbers, which have confirmed the U.S. economy continues to rumble along quite well. The latest bear market bounce has now begun to wilt as investors wearily return to expectations of at least 125bps of tightening by the end of the year, with more to come in 2023."

Above: GBP/USD (top) and EUR/USD (bottom) at 15-minute intervals. To better time your payment requirements, consider setting a free FX rate alert here.

"A strong payrolls report will serve as a reminder of why the USD remains the best in class," says Mazen Isa, Senior FX Strategist at TD Securities.

The figure represents a slowdown on August's 315K, but the unemployment rate nevertheless fell to 3.5% from 3.7%, defying consensus expectations for the rate to remain unchanged.

"Hiring remained brisk in the US in September, showing that the Fed has more work to do to meet its goal of taming an overheated economy," says Katherine Judge, an economist at CIBC Bank.

"Wage growth continued at 0.3% m/m pace, leaving wages up by 5.0% over the past year, which remains too high to be consistent with 2% inflation," she adds.

Falling unemployment and rising wages are consistent with firmer domestically generated inflation, something the Fed is keen to bring down.

Higher interest rates are meanwhile negative for global markets while making U.S. assets more attractive to foreign investors, thereby offering the Dollar support.

GBP/USD is quoted at 1.1111 at the time of writing, driving down the rates offered at banks for money transfers to around 1.0888 and the rate offered by independent payment providers to approximately 1.1077.

The employment data confirm the Federal Reserve will likely raise the Fed Funds rate by a further 75 basis points in November, heaping further pain on global markets.

"Fed policymakers have been out in droves this week, all reiterating the same message that rate hikes will keep coming until the 'job is done'," says Raffi Boyadjian, Lead Investment Analyst at XM.com.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

He says the Fed's newest governors Lisa Cook and Philip Jefferson have shown themselves to be 'hawkish'.

Loretta Mester, the Cleveland Fed chief gave the strongest indication yet that a rate cut in 2023 will not be happening while Charles Evans, chief of the Chicago Fed, suggested rates will need to rise another 150 basis points by next spring.

Governor Christopher Waller meanwhile said were upcoming October data releases to come in softer than expected, consistent with a sign that maybe the Fed could slow down, his views on the need for tighter rates would not alter.

That the labour market report was stronger than expected will only reinforce his determination to get rates higher.

This would be entirely consistent with ongoing strength in the Dollar and weakness in the higher beta currencies such as the British Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes