Strong Employment Data to Keep Dollar Bid

- Written by: Gary Howes

Image © Adobe Images

Stronger than expected labour market data released out of the U.S. on Friday will keep the Dollar.

The U.S. non-farm payroll grew 315k in August, beating expectations for 298k, but the increase was lower than July's 528k.

The U.S. unemployment rate rose to 3.7% from 3.5% previously as the participation rate rose from 62.4% from 62.1%.

This suggests more workers are returning to the workforce and in the process raising the unemployment rate.

There were some points for the 'doves' to take home: the payrolls report confirmed wages were softer than expected, with a 0.3% monthly gain.

Meanwhile, the previous two monthly readings were revised lower.

"In an overheated U.S. economy, slightly bad news should be good news for markets, and today’s jobs data had a small taste of that," says Avery Shenfeld, Economist at CIBC Capital Markets. "The bond market has been selling off in the days leading up to the data and will see a bit of relief today, and even equities might be happier with a somewhat cooler temperature reading on what has been a too tight labor market."

The initial reaction by the Dollar was to go lower, a function of the stock market's positive reaction.

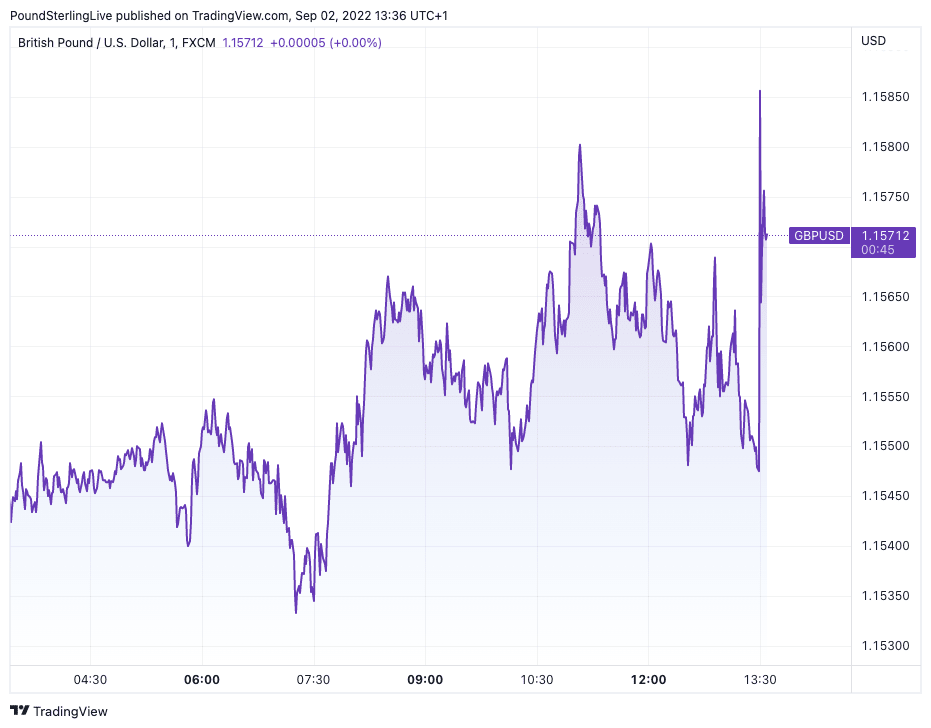

The Pound to Dollar exchange rate is quoted at 1.1566 in the minutes following the payrolls report, high-street banks are offering dollar payment rates at around 1.1336, payment specialists are however offering closer to the market towards 1.1532.

Above: GBP/USD at one-minute intervals.

"The U.S. dollar slipped after mixed jobs data catalyzed some profit-taking after its surge to 20-year peaks, particularly ahead of the long holiday weekend," says Joe Manimbo, Senior Market Analyst at Convera. "Today’s data makes for somewhat of a closer call as to whether the Fed raises rates by 50 or 75 basis points on Sept 21."

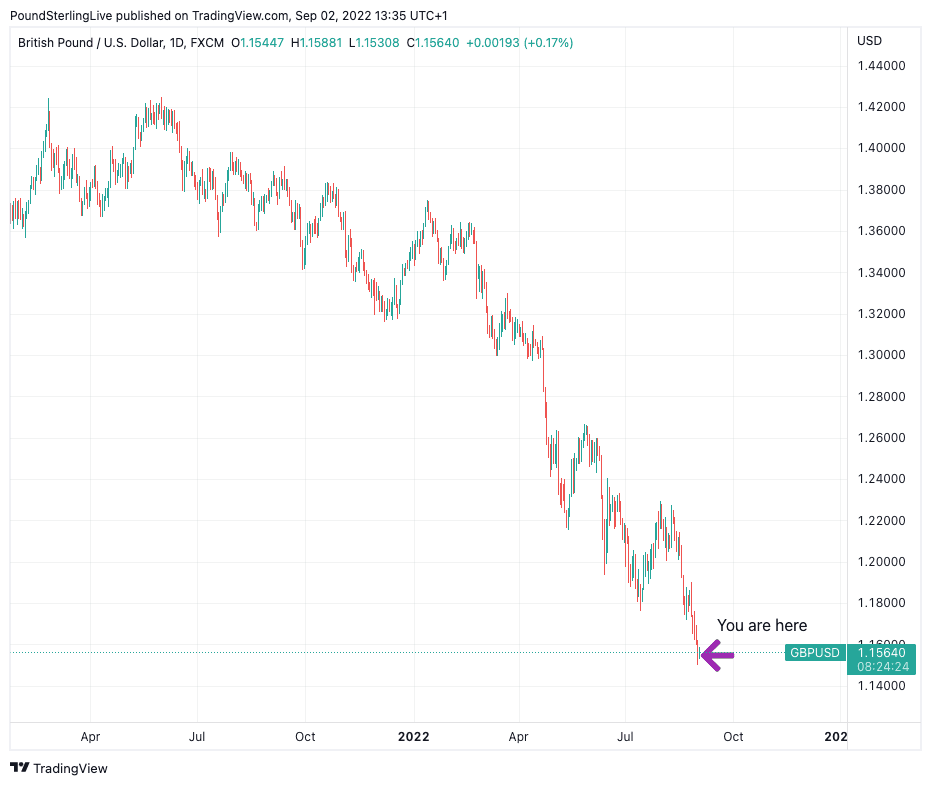

But any Dollar weakness will prove to be noise: the trend remains firmly in favour of further gains by the Greenback.

The Dollar remains bid on expectations for higher Federal Reserve interest rates amidst ongoing robust economic growth, with the Bloomberg Dollar index on Thursday reaching an all-time high.

The jobs report suggests there is little reason for the Federal Reserve to question its current stance of aggressive tightening of monetary policy and it will continue to hike rates until such a time it sees inflation falling, but this will only likely happen when the economy starts cooling.

This robust labour market figures suggest this is yet to happen.

Above: GBP/USD at daily intervals.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks