Standard Chartered Bullish Pound Sterling against Dollar, Upgrades Stance on UK Equities

- Written by: Gary Howes

Image © Pound Sterling Live

Standard Chartered's wealth management division are bearish on the U.S. Dollar on a six to twelve month view as they sense a major turning point for global currency markets is approaching.

The UK-based and Asia-focussed lender meanwhile upgrade their stance on UK stocks saying they now offer good value and exposure to the commodity complex, a development that supports their bullish thesis on the Pound over the medium-term.

Steve Brice, Chief Investment Officer at Standard Chartered Wealth Management's Chief Investment Office, says there are two opportunities in today's markets:

"The first is in Asia ex-Japan equities," he says, adding:

"The second opportunity is in UK equities, which we expect to benefit from its relatively larger weight towards Value and dividend-yielding sectors as well from a more attractive valuation, compared with the Euro area and the US."

The calls form part of Standard Chartered Wealth Management's midyear review which details their investment thesis for the next half year.

"We have also upgraded UK equities to 'preferred' on the back of its heavy exposure to sectors that may benefit from high inflation, such as energy, mining and financials," says Daniel Lam, Head of Equity Strategy at Standard Chartered.

The expected outperformance of UK assets will in turn likely provide the Pound with a source of added support as global investors seek out better returns.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Indeed, Manpreet Gill, Head of FICC Strategy at Standard Chartered, says he is bullish a select few currencies against the Dollar over the next six to twelve months, most notably the Euro and Pound.

This bullish stance on the Pound rests on "strong growth and employment" expectations as well as a "hawkish" Bank of England.

But Standard Chartered warns there are downside risks to their core view as the Pound could remain vulnerable to stagflation pressures and geopolitical risks.

But the big call that would ultimately send the Pound to Dollar exchange rate higher is the expectation the USD is to peak in the second half of 2022. (Set up your FX rate alert here).

This as hawkish expectations regarding Federal Reserve policy fades as inflation moderates.

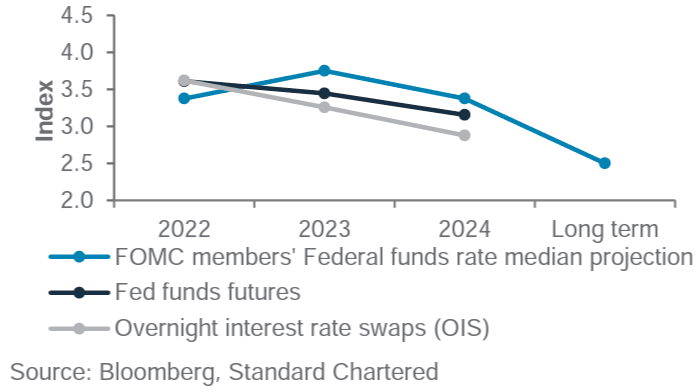

Above: Market implied Fed fund rate and Fed’s forecast. "Market expectations for Fed rates have converged below Fed’s own projections, suggesting the sharp increase in bond yields is likely behind us" - Standard Chartered.

Global central banks will meantime continue to tighten monetary policy to avert their own currency weakness as this amplifies inflation.

"Global central banks are following the Fed with tighter policy, aiming to avoid much weaker currencies and even higher inflation. This should ultimately weigh on the USD," says Gill.

He adds capital flows should also rotate away from the U.S. towards more attractively valued assets, such as UK equities.

"The USD has already priced in aggressive Fed hikes, slower global growth and considerable safe-haven risk. The timing of the USD reversal will likely be driven by the speed of policy convergence, China’s economic stimulus as it exits zero-COVID policies and some form of resolution in the Ukraine war," says Gill.

Indeed, near-term Standard Chartered stay "broadly neutral" towards the Dollar and warns sticky U.S. inflation data could keep the Fed singularly focused on policy tightening.

Furthermore a slowing global economy and financial market constraints could prevent global central banks the opportunity to raise rates and close the gap on the Fed, thereby maintaining the Dollar's yield advantage.

Another supported of the Dollar in the near-term is the increased risk-off sentiment driven by the Ukraine war and other geopolitical tensions says Gill.

So while a big turning point looms, some patience might have to be exercised in the near-term.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks