GBP/USD Rate Turns Green on Big U.S. Data Miss

- Written by: Gary Howes

- U.S. PMI data disappoints

- Mirroring disappointment in the Eurozone

- But the UK surprised positively

- Offering GBP support

Image © Adobe Images

On a day of PMI data releases it is the UK which has surprised positively while the Eurozone and U.S. have all delivered sizeable downside surprises.

The British Pound has in turn responded by going higher against both the Dollar and Euro.

The S&P Global U.S. Manufacturing PMI read at 52.4 in June which represents a massive slowdown on May's 57.0 and is far below the analyst community's projections for 56.0.

The U.S. Services PMI read at 51.6 in June, down sharply on May's 53.4, and is below the expected reading of 53.5.

The U.S. PMI Composite Output Index read at 51.2, down on May's 53.6, and suggests a material economic slowdown occurred in the U.S. economy during June.

S&P Global says the rise in activity was the second-softest since July 2020, with slower service sector output growth accompanied by the first contraction in manufacturing production in two years.

Business confidence was meanwhile reported to have "slumped to one of the greatest extents seen since comparable data were available in 2012", down to the lowest since September 2020.

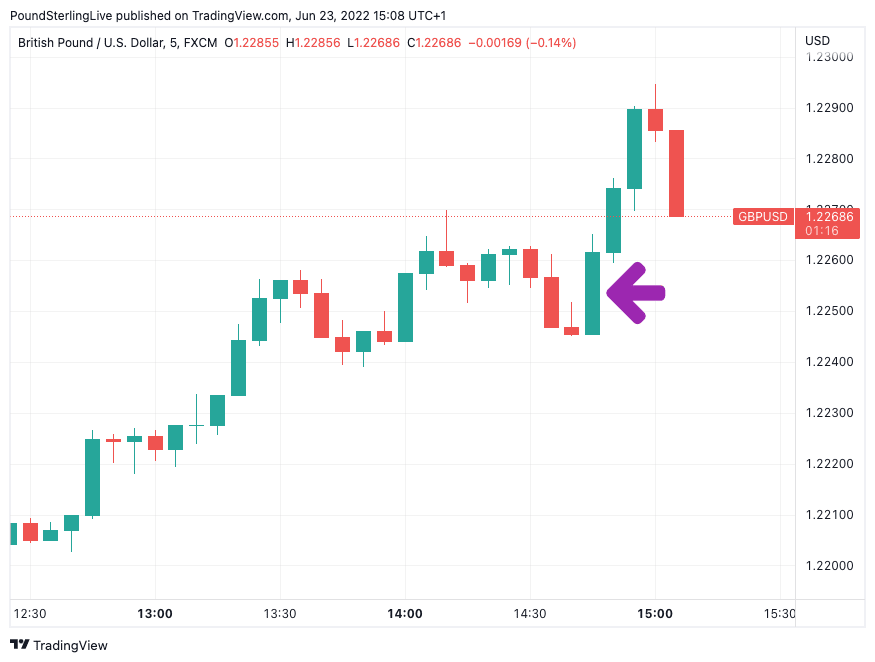

There was a noted pickup in the Pound to Dollar exchange rate on the release of the data, as per the below chart:

Above: Chart showing GBP/USD at 5-minute intervals.

The Dollar fell and stock markets rose which suggests an important market reaction is underway: investors are starting to lower their expectations for future rate hikes at the Federal Reserve.

This is understandable given that the clear downturn in activity means inflation will likely soon start falling and therefore a peak in Fed rate hike expectations might have come to pass.

As such the forward-looking nature of the market suggests investors are already looking forward to Fed rate cuts.

Indeed monetary indicators are showing the market is now pricing a terminal top at the Federal Reserve in the 3.25-3.50% range, down from +4% last week.

This is in turn supportive of equities and pro-cyclical currencies such as Sterling but is a negative for the Dollar.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The softer-than-expected U.S. PMI data mirrors that out of the Eurozone, which prompted a sharp sell-off in the Euro earlier in the day.

But it was the UK that surprised by delivering a set of PMIs that were stronger than expected.

Furthermore the UK survey suggested employment remained robust and price pressures experienced by firms might have peaked.

This has given the Pound a boost, particularly given positioning and overall sentiment has for so long been pitted against the currency.

However, for the UK, U.S. and Eurozone the forward-looking components of the PMIs are clear in signalling a sharp downturn in activity is likely ahead as new orders dry up and business confidence deteriorates.