U.S. Dollar Struggles after Fed Minutes Leave Market Guessing

- Written by: James Skinner

- Softer USD gets no help from Jan FOMC minutes

- Hawkish market left guessing over March move

- Little further on plans for balance sheet unwind

Image © Adobe Stock

The U.S. Dollar was left struggling this week after minutes of January’s Federal Reserve (Fed) meeting left the market none the wiser about the likely size of a possible March interest rate rise or the bank’s plans for its balance sheet.

U.S. Dollar exchange rates steadied near the week’s lows on Thursday after an earlier corrective setback appeared to be exacerbated by minutes from last month’s Federal Open Market Committee meeting, which left a hawkish market underwhelmed.

"USD briefly jumped higher against all currencies we monitor (with the exception of JPY) after Bloomberg reported that Ukrainian forces had fired shots at four Luhansk People’s Republic localities. With uncertainty elevated, the risk is that currencies remain volatile,” says Kim Mundy, a senior economist and currency strategist at Commonwealth Bank of Australia.

"The minutes largely told us what we already knew: the FOMC will stop expanding the balance and start increasing the Funds rate soon. The higher than expected CPI last week and the huge 3.8%/mth increase in US retail sales yesterday more or less guarantee an increase in the Funds rate next month,” Mundy and colleagues also said on Thursday.

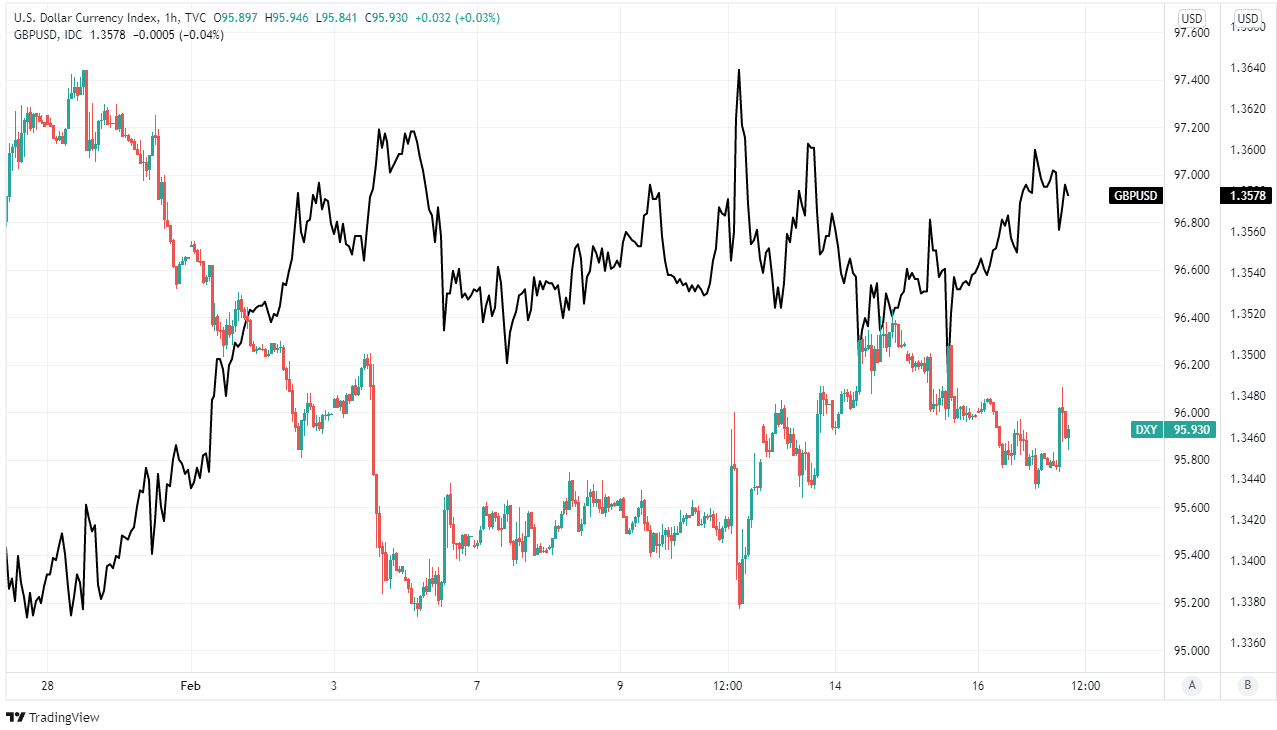

Above: U.S. Dollar Index shown at hourly intervals alongside GBP/USD.

- GBP to USD reference rates at publication:

Spot: 1.3592 - High street bank rates (indicative band): 1.3216-1.3311

- Payment specialist rates (indicative band): 1.3470-1.3524

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The Dollar benefited notably in recent weeks from widespread speculation about the prospect of a larger-than-usual interest rate rise being announced in March and there was little to encourage that assumption in January’s meeting record.

“The Dollar Index DXY is easing after the FOMC minutes gave few clues about a March 50bp hike. The Ukraine geopolitical risk premium has eased slightly too in recent days. But, the medium term DXY uptrend is solidly intact,” says Richard Fanulovich, head of FX strategy at Westpac.

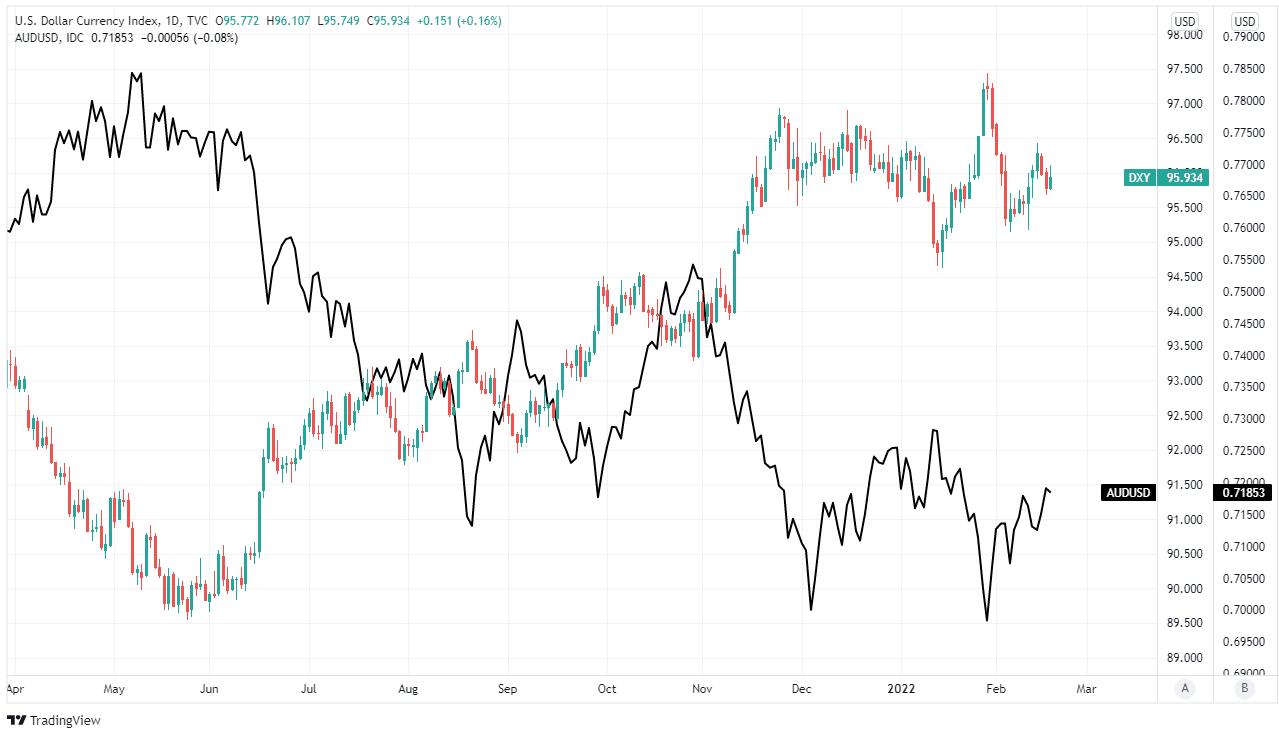

“Given the ongoing strength in metals/ energy and the risk on move post FOMC minutes, it feels like we have some further to run here. We can see AUD/USD strength continuing towards the 0.7250/60 level,” Fanulovich and colleagues said in a Thursday note.

Financial markets have anticipated a faster pace and larger scale of policy changes from the Fed since U.S. inflation was reported to have reached a four-decade high last month, and after the latest payroll figures suggested the U.S. labour market went from strength-to-strength in January.

Above: U.S. Dollar Index shown at daily intervals alongside AUD/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

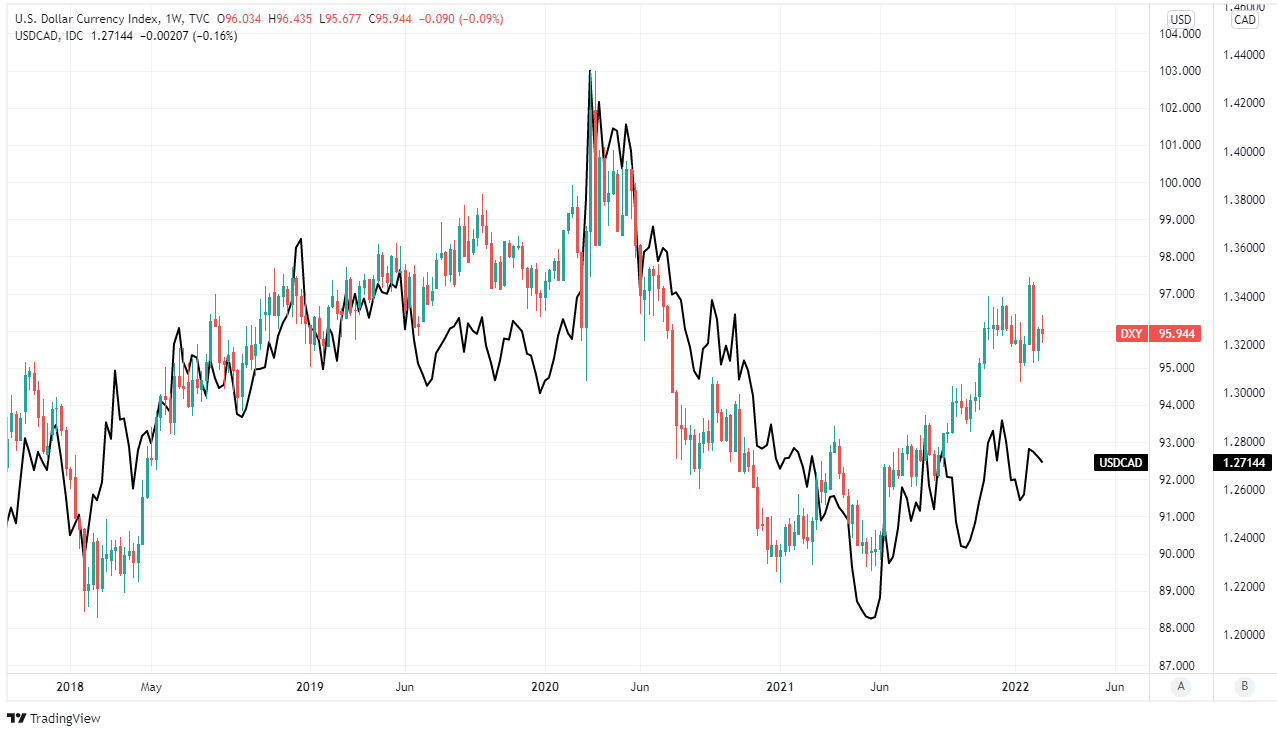

Wednesday’s minutes confirmed that “most participants” thought the Fed would need to be quicker raising borrowing costs quicker than it guided for in December if inflation remains elevated near current levels over the coming months.

Fed officials and forecasts suggested in December that inflation is likely to recede in 2022 and notably so by mid-year, leading them to anticipate around three increases of the Fed Funds interest rate in their latest quarterly dot-plot of economic projections.

This may always have been unlikely to do much for the Dollar on Thursday given that market expectations for U.S. interest rates have shifted aggressively in recent weeks to imply that as many as six rate rises could now be likely in 2022.

“With no explicit discussion of a date to begin balance sheet runoff, or of the idea of a 50bp hike in March, the minutes are on the less-hawkish side of expectations. But they aren’t the last word on anything, given the worse-than-expected inflation and wages data released since the meeting; the Fed's actions will be driven by the data,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Above: U.S. Dollar Index shown at weekly intervals alongside USD/CAD.