Pound / Dollar Week Ahead Forecast: Supported at 1.3612 as Upside Risks Linger

- Written by: James Skinner

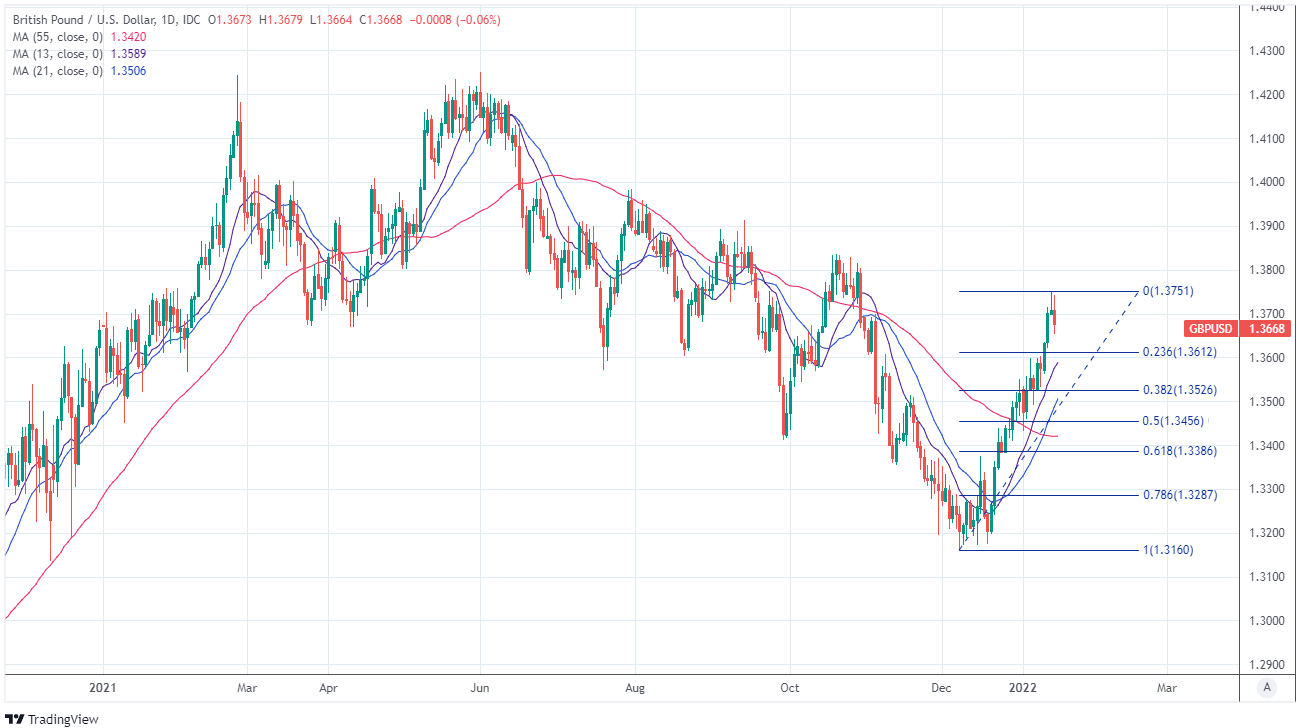

- GBP/USD consolidates rally above 1.3612

- Supported near 1.3612, 1.3589 & 1.3550

- After stalling USD squeezes GBP's sellers

- Further softness could support GBP/USD

- UK CPI in focus as USD eyes CFTC data

Image © Adobe Images

The Pound to Dollar rate notched up its fourth consecutive advance last week but could be likely to consolidate its rally above the recently reclaimed 1.36 handle as Sterling navigates a minefield of economic data over the coming days and as the market contemplates the outlook for the greenback.

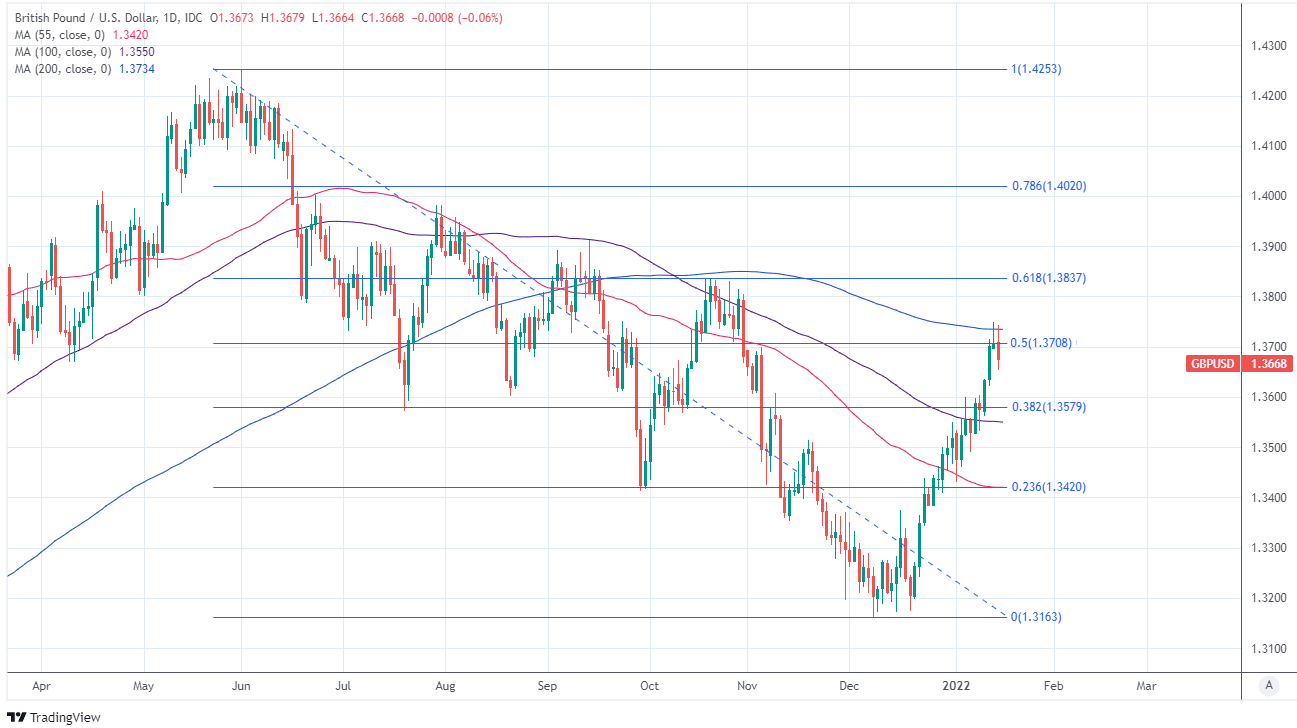

Pound Sterling further extended its recent recovery when rising around three quarters of a percent against the greenback last week, making for a fourth consecutive advance and a one month rally that reversed half of the decline that pulled GBP/USD lower from 1.4250 in June 2021.

GBP/USD traded as high as 1.3749 last Thursday after rallying from just beneath 1.36 at the Monday open in price action that came alongside widespread declines in U.S. exchange rates that took the market by surprise.

“Our foremost explanation is that global investors were extremely long US stocks and bonds relative to their benchmarks and the Fed's tightening has driven them toward a more neutral weight of US assets. That could create a wave of USD selling, even if the outlook for the currency itself has become more bullish based on accelerated Fed tightening,” says Greg Anderson, global head of FX strategy at BMO Capital Markets.

Dollar exchange rates fell broadly from Tuesday with the sell-off accelerating in the wake of congressional testimony from Federal Reserve Chairman Jerome Powell and official figures confirming that U.S. inflation reached a multi-decade high of 7% in December.

Above: GBP/USD shown at daily intervals with selected moving-averages and Fibonacci retracements of December rally indicating possible areas of technical support for Sterling.

- GBP/USD reference rates at publication:

Spot: 1.3675 - High street bank rates (indicative band): 1.3296-1.3392

- Payment specialist rates (indicative band): 1.3550-1.3607

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Many analysts and other observers perceived the Dollar’s declines as likely reflecting profit-taking by speculative traders who’d bid the currency higher over a six month period heading into the new year only to see its momentum wane during the month from mid-December to mid-January.

“The best explanation is that the hawkish Fed tilt, which commenced in earnest at the November FOMC meeting, has largely been factored into market expectations and positioning. With market pricing and Fed rhetoric coalescing around four full rate hikes for 2022, the bulk of the Fed adjustment story could well be in the price now,” says John Bromhead, an FX strategist at ANZ.

The surprise with which the Dollar’s declines took many in the market likely means that analysts and investors will be keen to see the latest instalment of Chicago Futures Trading Commission data covering the commitments of traders during the week to January 18, which is due to be published on Friday and could provide an indication of the extent to which any reduction of speculative “long positions” played a role in last week’s price action.

That would be the highlight in what is an otherwise quiet week ahead for U.S. economic and financial data, which likely leaves the Pound to Dollar rate to trade according to the market’s appetite for the greenback as well as outcomes from the raft of UK economic figures due over the coming days.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“GBP’s multi-week bullish trend remains relatively intact but a consolidation phase may be forming in the 1.3700-50 range where it has sat since midday on Wednesday, with the figure zone acting as key support followed by the mid-1.36s,” says Juan Manuel Herrera, a strategist at Scotiabank.

“Resistance after the mid-figure zone (and the 200-day MA on a closing basis, which would be a first since mid-Sep) stands at 1.38 followed by 1.3830/35,” Herrera and colleagues wrote in a Friday market commentary.

For Sterling the highlight of the week ahead is Wednesday’s release of UK inflation figures for December, which economists widely expect will see the annual rate of inflation climbing from 5.1% in November to a new decade high of 5.2%.

This could potentially support the Pound to Dollar rate if it leads the market to view February as more likely than March for any next step by the Bank of England (BoE) in the recently commenced process to withdraw the interest rate cuts announced to support the economy at the onset of the pandemic.

Above: GBP/USD shown at daily intervals with selected moving-averages and Fibonacci retracements of June 2021 corrective decline indicating possible areas of technical resistance for Sterling.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Wednesday’s inflation data is the main event for the Pound but will come in the wake of employment figures out on Tuesday and a short time ahead of appearances by BoE Governor Andrew Bailey and Deputy Governor Jon Cunliffe before parliament’s Treasury Select Committee.

Pricing in the overnight-indexed-swap market suggested on Friday that investors saw the March decision as the most likely for an increase in Bank Rate from 0.25% to 0.50%, with the market implied rate for the February 03 decision sitting at 0.42% last week.

“One of the factors that could trigger further corrective activity in the USD relates to expectations about other G10 central banks. The GBP has found some support on the back of the BoE’s 15 bps rate rise last month and on market expectations of further tightening this year (which we consider to be overdone)," says Jane Foley, head of FX strategy at Rabobank.

"The level of long dollar index positions held by CFTC speculators last week was the highest since October 2019. In recent days, however, price activity is highlighting that investors are reluctant to add to their long USD positions, suggesting that this trade is crowded and that further position adjustment may be forthcoming in the weeks ahead,” Foley also said in a Friday review of last week’s CFTC positioning data.

GBP/USD had been sold heavily throughout the second half of 2021 as the Federal Reserve prepped the market for a now underway normalisation of its monetary policy, leading many to wager that this would more than offset the actions of the BoE and ultimately undermine Sterling, although these wagers have been squeezed since the BoE lifted Bank Rate from 0.10% to 0.25% in mid-December.

For GBP/USD much now depends on whether the market will bid afresh for the greenback over the coming days, or if the apparent profit-taking seen last week will continue.