Pound-Dollar Week Ahead Forecast: Supported Above 1.41 with 2018 Highs in Sight

- Written by: James Skinner

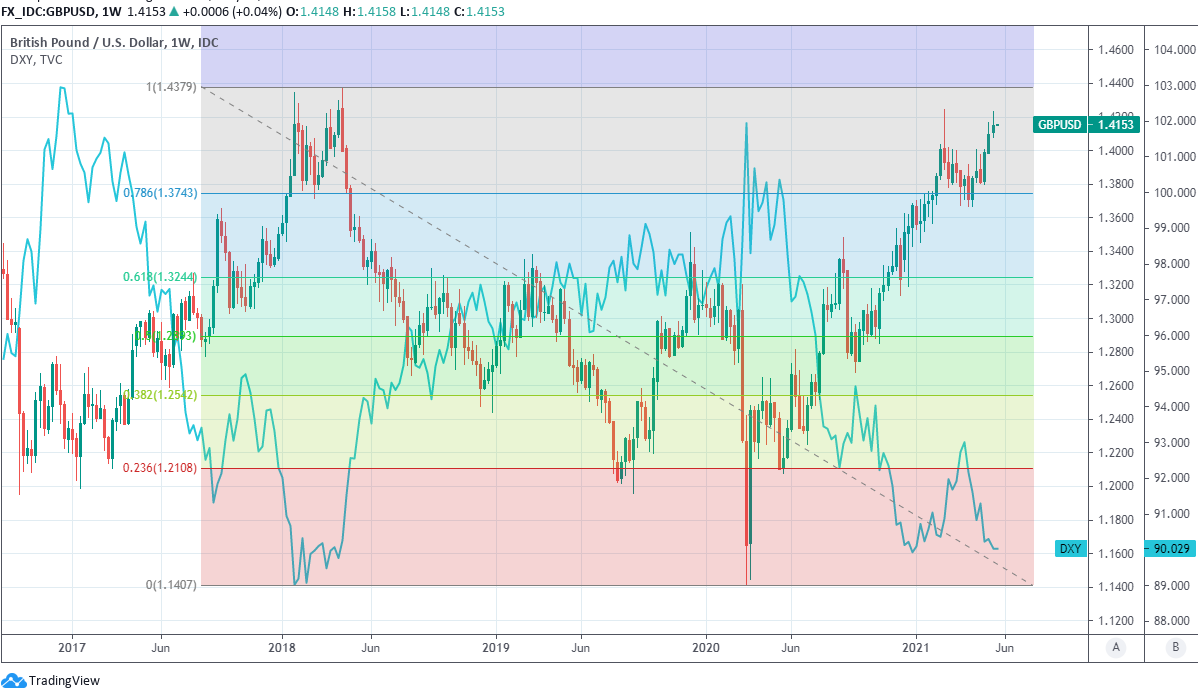

- GBP/USD supported at 1.41, with 2018 high at 1.4377 in sight

- Global factors in driving seat as UK calendar quietens

- U.S. economic data & RMB exchange rates in focus

- GBP/USD reference rates at publication:

- Spot: 1.4157

- Bank transfers (indicative guide): 1.3753-1.3850

- Money transfer specialist rates (indicative): 1.3916-1.4050

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar exchange rate enters the new week underpinned by nearby support levels and within arm’s reach of 2018 highs, although much about price action over the coming days depends on international factors like investor appetite for the greenback and developments in Renminbi exchange rates.

Sterling made a third consecutive advance against the Dollar last week, briefly climbing above 1.42 when Office for National Statistics figures showed retail sales surging in April and after IHS Markit PMI surveys indicated that Britain’s manufacturing and services sectors gathered further momentum in May.

Meanwhile, and although the Dollar rose broadly in defiance of its doubters late on Friday when U.S. PMI figures surprised on the upside for the month of May, it has otherwise put in a much more chequered performance of late while the ICE Dollar Index has entered the new week close to its lowest level since February 2018.

That last minute surge pulled the Pound-Dollar exchange rate back to 1.4150 on Friday, from where it enters the new week underpinned by a cluster of nearby support levels and tipped for further gains ahead by a range of analysts.

“GBP/USD is consolidating just below 1.4238/45, the recent high and the March 2018 high. Nearby support is 1.4100 ahead of 1.4000/18,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Above: Pound-Dollar rate at weekly intervals with Fibonacci retracements of 2018 fall and U.S. Dollar Index.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“We note the strong buy signal on the daily DMI and eventually look for gains through 1.4245 to 1.4377 the 2018 high,” Jones adds.

Jones and the Commerzbank team are looking for the Pound to advance further over the coming days and weeks, taking it up to 1.4377 and its highest since January 2018.

Expectations of the Pound remain bullish although with the UK economic calendar now falling quiet, global factors are likely to call the shots over the coming days.

"As long as the soft USD environment remains in place, GBP/USD is likely to breach the multi-year high of 1.4237 quite soon and head towards 1.44, in line with our 1-month forecast," says Petr Krpata, chief EMEA strategist for FX and interest rates at ING.

While the Dollar trend is evidently to the downside the U.S. unit has surged broadly and repeatedly in recent weeks, often seemingly in response to increases in U.S. bond yields, while being quick to deflate as the dust settles in the bond market.

Any unwinding of last Friday’s Dollar bounce would support the Pound and other currencies through the early days this week, although bond yields and their possible response to key economic figures due out from the U.S. on Thursday and Friday would pose lingering risks.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

U.S. economic data out this week includes the second estimate of first-quarter GDP, data which provide insight into business investment trends and trade balance figures for April, which are expected to show the U.S. trade deficit with the rest of the world rising to a new record last month.

Consensus looks for the U.S. trade deficit to have risen to $92bn as imports into a stimulus-pumped U.S. economy likely surged faster than exports in what would be a supportive development for other economies as well as, some say, an argument for a weaker Dollar.

However, one other potential and likely significant influence on the Dollar over the coming days or weeks could be developments in Chinese Renminbi exchange rates.

"Any signs of independent Renminbi strength could lend weight to the notion that the PBOC wants a stronger currency to insulate against imported commodity price rises. This would be bearish for the dollar in our opinion," says Chris Turner, global head of markets and regional head of research at ING.

China made headlines over the weekend when, among other things, Vice President Liu Guoqiang of the Peoples’ Bank of China (PBoC) said; “The People's Bank of China has perfected a managed floating exchange rate system based on market supply and demand and adjusted with reference to a basket of currencies. This system is suitable for China's exchange rate system arrangements at present and for a period of time in the future.”

Above: ING Group graph showing various currencies’ correlations with the Renminbi.

Vice President Guoqiang was responding to questions about the bank’s stance in relation to China’s managed exchange rate regime, questions which may have been prompted by the recent release of the transcript from an April speech given by Zhou Chengjun, director of the PBOC Finance Research Institute in which Chengjun said that “China’s central bank has to let go of exchange-rate goals in the end.”

This is not the same subject as the one taken up by Lu Jinzhong, head of research at the Shanghai branch of the PBoC, in one of the bank’s magazines last Friday.

Jinzhong suggested the PBoC “appropriately appreciate the RMB” via the USD/CNH exchange rate in order to offset rising Dollar-denominated commodity prices that have raised production costs and squeezed margins for companies, which could have broad and uplifting implications for other currencies.

Many currencies correlate positively with the Renminbi and some of them increasingly so in recent months, as can be seen in the above graph, and this means among other things that some of them at least could be likely to mimic any rally seen in the main Chinese exchange rate.

It’s not clear if the PBoC would take up the proposal, although any decision to do so would inevitably involve steep gains for the Renminbi against the Dollar and so would potentially be an upside risk for the Pound, Euro and any other currencies which tend to follow the Renminbi.

“Let’s see whether USD/CNY can break under the 6.40/41 area over coming weeks (we do in general like a soft dollar environment this summer) and in general, broad trends in USD/Asia – particularly in USD/CNY – do tend to support the overall USD trend,” ING’s Turner says.

Above: GBP/USD shown alongside CNH/USD (green), EUR/USD (blue) and USD/CNH (red).