Pound-Dollar Finds Support in Wake of U.S. PPI Inflation Data Release

- Written by: Gary Howes

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.4033

- Bank transfers (indicative guide): 1.3642-1.3740

- Money transfer specialist rates (indicative): 1.3816-1.3930

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

U.S. Producer Price Index (PPI) inflation is rising, but not by quite enough to trigger a fresh bout of Dollar buying

The Dollar pared recent gains against the Pound, Euro and other major currencies after the release of PPI inflation rose 0.6% month-on-month in April which is higher than the 0.3% expected by markets but still less than the 1.0% reading of March.

The annual increase was taken to 6.2% the U.S. Bureau of Labor Statistics said, higher than the 5.9% expected and the 4.2% print from March.

PPI measures the changes in the prices of goods brought and sold by manufacturers and as a result economists utilise the data to project where Consumer Price Inflation (CPI) might head in coming weeks and months.

The release of PPI comes a day after U.S. CPI inflation blew analysts expectations out of the water, prompting the selling of stocks and the buying of Dollars.

The market's reaction to the Thursday PPI reading suggests inflation expectations amongst investors were almost as red-hot as inflation itself, meaning a sizeable beat would have been required to keep the moves of recent days extending.

Core PPI - which strips out global variables such as fuel, food and trade services, thereby giving a more 'organic' feel to price dynamics - rose by 4.1% year-on-year in April, ahead of the expected 3.7% and the previous month's reading of 3.1%.

"The key question will be what happens once the oil hit begins to fade; will rising margins as the economy reopens then keep PPI inflation at a faster pace, alongside other inflation measures? That, in turn, would raise the risk of a sustained rise in inflation expectations, which the Fed could not tolerate indefinitely," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

This was driven by a month-on-month Core PPI reading of 0.7%, which is ahead of expectations of 0.4% but stable on the previous month's 0.7%.

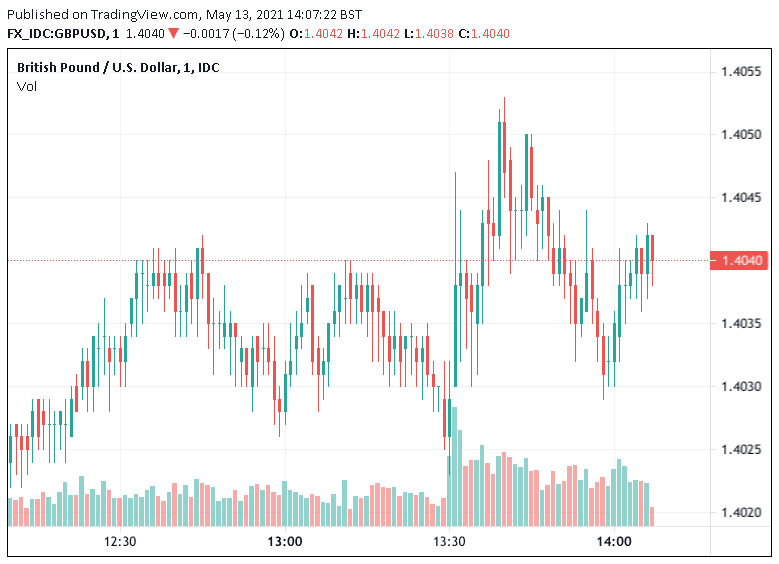

Following the data release the Pound-to-Dollar exchange rate (GBP/USD) rose back above the 1.4050 level having been as low as 1.4026 ahead of the release. The gains have pared back to 1.4040 at the time of writing.

Above: Price action in GBP/USD and a pick-up in volumes around the 13:30 release of U.S. PPI.

"USD unfortunately sees just limited follow-through to the upside overnight after yesterday's positive NY closes. Extends itself where technically possible, but runs into equity/bond dip buyers, technical resistance and some option expiry levels for today's NY cut," says Erik Bregar, Head of FX Strategy at Exchange Bank of Canada.

The Dollar has tended to find support when expectations for higher inflation rates in the future rises amongst investors, the thinking being that the Federal Reserve will ultimately have to react by raising interest rates.

The general assumption is that when U.S. interest rates are rising faster than they are elsewhere in the world the Dollar attracts a bid, as foreign investor capital finds its way into the U.S. to seek higher returns.

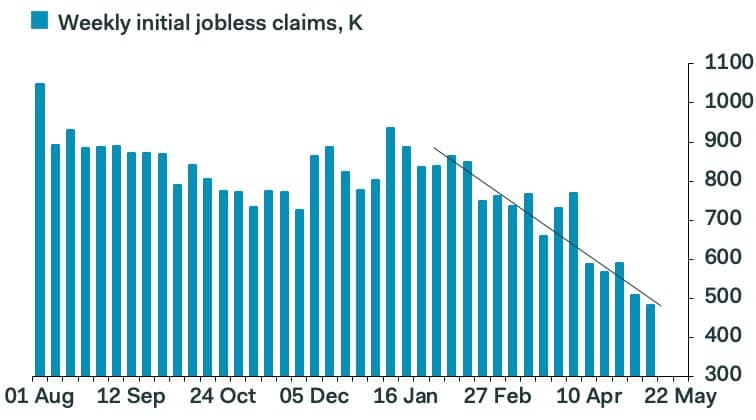

Image courtesy of Pantheon Macroeconomics

Separate data out of the U.S. meanwhile showed weekly U.S. jobless claims for the unemployed continues to fall as the re-opening continues.

Initial jobless claims printed at 473K, which is down on the 490K expected by economists and the 507K reported previously.

The four-week average now stands at 534K.

"The 34K drop in claims confirms that the previous week’s 83K drop was no fluke. The trend now is strongly downwards, as the reopening allows firms to hold on to staff who would otherwise have been laid off," says Shepherdson.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |