Pound to New Zealand Dollar Week Ahead Forecast: Upside Preferred

- Written by: Gary Howes

Image © Pound Sterling Live, Still Courtesy of RBNZ

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is trending higher, and we see little reason to stand in the way of a setup that favours modest gains in the coming days.

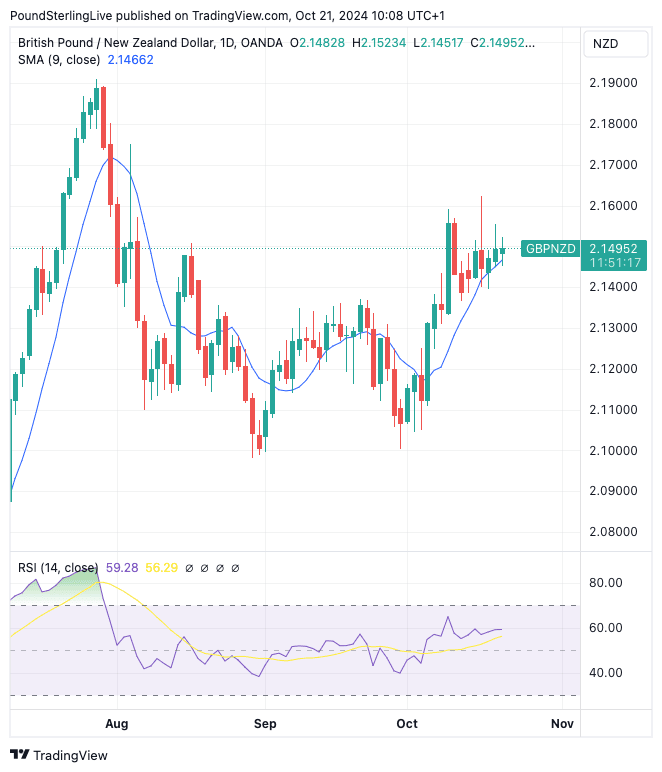

GBP/NZD rose as high as 2.16 last week, but the spike quickly faded, bringing the exchange rate back in touch with its nine-day moving average.

If we look at the chart below, we can see this technical level (the blue line) has provided support since early-October.

The 9-day MA line is moving higher, which means a series of 'higher lows' are in order amidst a gentle drift higher.

The Week Ahead Forecast model suggests that 2.16 is achievable again in the coming days. However, the odds of a daily close above here in the next five days are relatively subdued.

The coming week will be dominated by central bank chatter, with the heads of both the New Zealand and British central banks due to address the question of interest rates.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr is set to deliver comments on Wednesday, with Bank of England Governor Andrew Bailey due to speak on Tuesday and Wednesday.

The RBNZ has stepped up the speed at which it cuts interest rates and last week's Kiwi inflation data has raised the odds that the central bank will cut rates by a further 50 basis points on November 27.

New Zealand's headline inflation dipped to 2.2% y/y from 3.3% y/y in Q3 and is within the RBNZ’s 1-3% target band for the first time in over three years.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Orr will address the Petersen Institute in Washington, however, with the market already generously priced for further rate cuts, it is hard to see how he can materially trigger further NZD weakness.

Bailey could be more interesting. He caused a sizeable slump in GBP exchange rates at the start of October when he said the Bank could be more "activist" in cutting rates if the inflation data warranted.

Last week's inflation data certainly had a feeling of vindication for Bailey, undershooting expectations handsomely.

"We will also be listening closely to comments from BoE officials in the week ahead, including Governor Bailey, for any further encouragement that they are becoming more willing to speed up rate cuts in light of the weaker inflation and wage data in September," says Lee Hardman, an analyst at MUFG Bank Ltd.

But, the UK economy remains firm and the government is due to announce its budget next week, which would suggest Bailey would like to retain an air of caution.

As such, any post-Bailey moves in GBP/NZD should be faded.