Pound to New Zealand Dollar Week Ahead Forecast: Strong U.S. Payrolls Can Arrest the Decline

- Written by: Gary Howes

Image © Adobe Images

Of the major Sterling exchange rates, GBP/NZD is under the most pressure, but we could see some relief later in the week.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) fell 2.77% in August, and our reading of the charts hints at the potential for further weakness in the early stages of September.

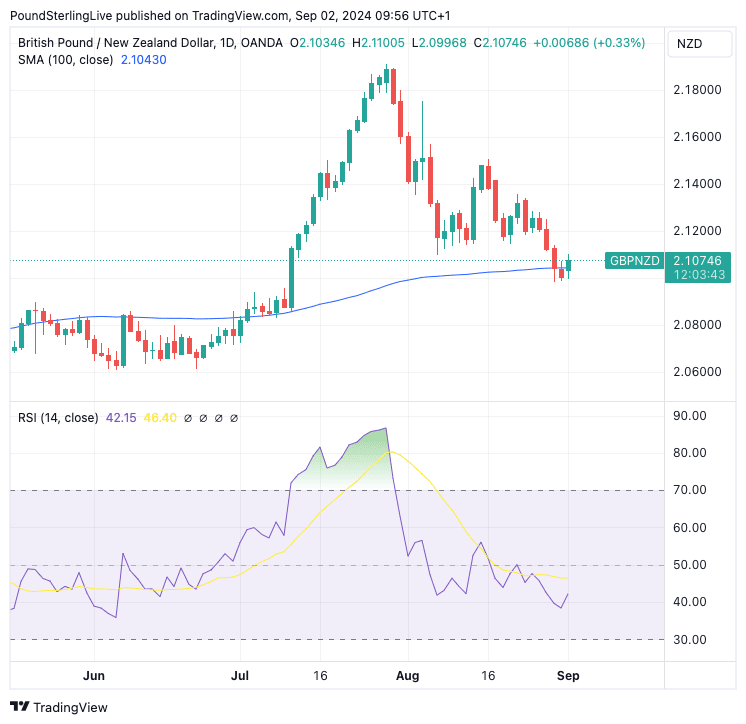

GBP/NZD trades below its 50-day moving average but is fighting to stay above the 100 DMA (2.1034), which will provide an interim support level. We note that the 100 DMA has proved itself a useful support and resistance level in the past and wonder if it can hold the exchange rate in the coming days.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

A breakdown below 2.1034 would potentially open the door to a run lower to the 200 DMA at 2.0848. Momentum is to the downside, as confirmed by the RSI, which gives a sub-50 reading at 42.

Expect a break lower in GBP/NZD if this week's U.S. data prints on the soft side, as this would have the effect of boosting the odds of a sizeable 50 basis point rate cut at the Federal Reserve later in the month.

Lower rates at the Fed are good for the global economic growth pulse, to which the NZ Dollar is particularly sensitive to. Rising global sentiment can bolster NZD and push GBP/NZD back towards the 2.08 level, where solid support will likely arise.

Above: The chart suggests GBP/NZD is unwinding an unusually strong bout of strength experienced in July. This was exemplified by the unusually high RSI reading (see the green element of the RSI in lower panel)

Risks Tilted to a Weaker NZD

We have ISM survey figures from the U.S. on Tuesday and Thursday, but the big event is Friday's non-farm payrolls report.

Market positioning shows confidence in a rapid series of Fed rate cuts, and economists we follow warn that these expectations are now running ahead of themselves and that the U.S. economy is still too strong to warrant fresh injections of 'easy' money.

We think that the odds of a 50bp cut can recede further on a stronger-than-expected U.S. non-farm payroll report on Friday, which can further bolster the Dollar and weigh on the New Zealand Dollar.

This would press the GBP/NZD exchange rate higher.

"The incoming data this week has generally supported our view that the US is on track for a soft landing, and if we are right in thinking that payrolls growth will rebound a bit from the surprise weakness in July, the odds of a 50bp cut from the FOMC at its next policy meeting will probably recede further," says Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics.

The market expects a payroll print of 163K for August, up from 114K in July.

Capital Economics forecasts a healthier 170K gain, alongside a small fall in the unemployment rate to 4.2%. Wage growth should remain at 3.6%.

"Together, that would be consistent with a 25bp rate cut by the Fed next month," says Thomas Ryan, North America Economist at Capital Economics.

Lars Mouland, an analyst at Nordea Bank, says Hurrican Beryl, which swept through Texas on July 8th, might have been the main reason the July employment numbers looked so bad.

"We expect a rebound in next week's data will remove some of the recession fears," says Mouland.

He explains that economic activity was also impacted by Beryl as the entire 140K national drop in July housing starts can be traced back to the Southern states, with no discernible changes elsewhere.